The world’s second largest market capitalization, Ethereum (ETH), has started turbulently through 2025, surpassing 52% year-on-year to trade for $1,574 at press.

The assets have acquired nearly 4.5% in the last 24 hours, but remained at sustained sales pressure, marked by a series of low highs and short-lived gatherings that failed to establish a meaningful trend reversal.

The latest blow comes after President Donald Trump announced a swept fee measure, including a 10% blanket tariff on all imports into the United States, which is due to take effect on April 9.

The announcement sparked widespread divestment across the global market, wiping out roughly $300 billion from the cryptocurrency market over the weekend. Ethereum, which is performing in a wider market, was no exception.

The market is performing modest rebounds, but emotions remain fragile. Ethereum continues to fight weak momentum and certainly leaves its short-term direction behind.

Finbold AI forecasts its Ethereum price target for April 30th

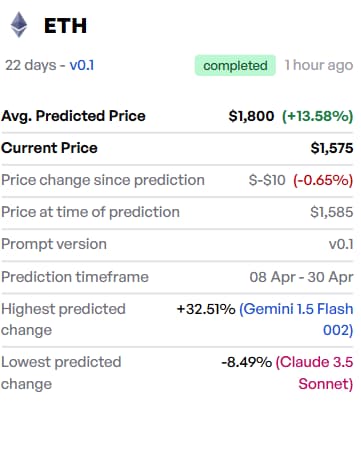

Against this background, Finbold’s AI-powered forecasting tool provided the latest outlook for Ethereum’s price trajectory by April 30, 2025.

Based on technical indicators, macroeconomic signals, and market sentiment, the model points to an average ETH price of $1,800 by the end of the month, suggesting a 13.58% reflux from current levels.

Despite the generally bullish average, the three AI models offer significantly different views on Ethereum’s short-term outlook.

The most optimistic prediction comes from Gemini 1.5 Flash 002, with ETH ranging from 32.51% to $2,300. The AI model points out slowing downward momentum on the 50- and 200-day moving averages, suggesting a potential bottom stage.

Additionally, large-scale linguistic models point to a cautious but improved outlook, taking into account the wider sentiment and the possibility of interest rate adjustments.

Meanwhile, the GPT-4o has risen by 16.37% to $1,850, citing the recent cross of death, showing a short-term bearish with 50-day SMA below the 200-day SMA.

However, it should be noted that macroeconomic conditions such as potential interest rate hikes could put further downward pressure on prices.

In contrast, Claude 3.5 Sonnet draws a bearish scenario, predicting an 8.49% decline to $1,450. This model demonstrates sustained weaknesses below the main technology level and growing caution regarding interest rate hikes.

Taken together, the harsh contrast between AI predictions speaks to the uncertainty that clouds Ethereum’s short-term direction.

Featured Images via ShutterStock