So far, this year’s “Uptober” hasn’t lived up to its name, with Finvold’s AI prediction agent suggesting Bitcoin (BTC) is likely to fall further by Halloween.

The cryptocurrency is currently trading at around $111,280, down 1.48% on a monthly basis due to increased selling pressure and weaker institutional capital flows.

However, it is worth mentioning that Bitcoin has seen some gains in the 24-hour period, gaining 1.47% following the news that President Donald Trump will meet with Chinese President Xi Jinping next week.

Markets are seeing this meeting as a sign that tense U.S.-China relations may ease slightly toward the end of the month. Additionally, the timing coincides with ongoing trade talks in Malaysia, where U.S. Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are meeting with Chinese Vice Premier He Lifeng.

Bitcoin market trends

Beyond macro trends, JPMorgan has reportedly announced plans to allow institutional investors to use Bitcoin and Ethereum (ETH) as loan collateral globally by late 2025. bloomberg.

The move could free up billions of dollars in liquidity and ease selling pressure by allowing holders to borrow against their positions.

Furthermore, the US inflation rate showed that the Consumer Price Index (CPI) rose 3% year-on-year in September, lower than the expected 3.1%, raising speculation that the Federal Reserve would delay raising interest rates.

However, Bitcoin holders are now turning their attention to the October 30th Federal Open Market Committee (FOMC) meeting, as Fed Chairman Jerome Powell’s “meeting-by-meeting” guiding approach leaves room for a lot of uncertainty in the short term.

BTC technical analysis

From a technical perspective, Bitcoin is somewhat complex. It has managed to reclaim the 200-day simple moving average (MA) of $108,303 and is testing the 23.6% Fibonacci retracement at $120,864, but the resistance near $120,000 could trigger profit-taking if it is not supported by strong volume.

At the same time, the Ichimoku reference line, which measures stable support and resistance levels, remains neutral at $114,901, indicating trader indecision, while the 20-day volume-weighted moving average of $113,107 reflects selling sentiment.

Overall, Bitcoin is caught between short-term bullish momentum and medium-term resistance, with a break above $114,000 likely leading to another rally, and failing which the price is likely to remain at current levels.

BTC price prediction by AI 2025 Halloween

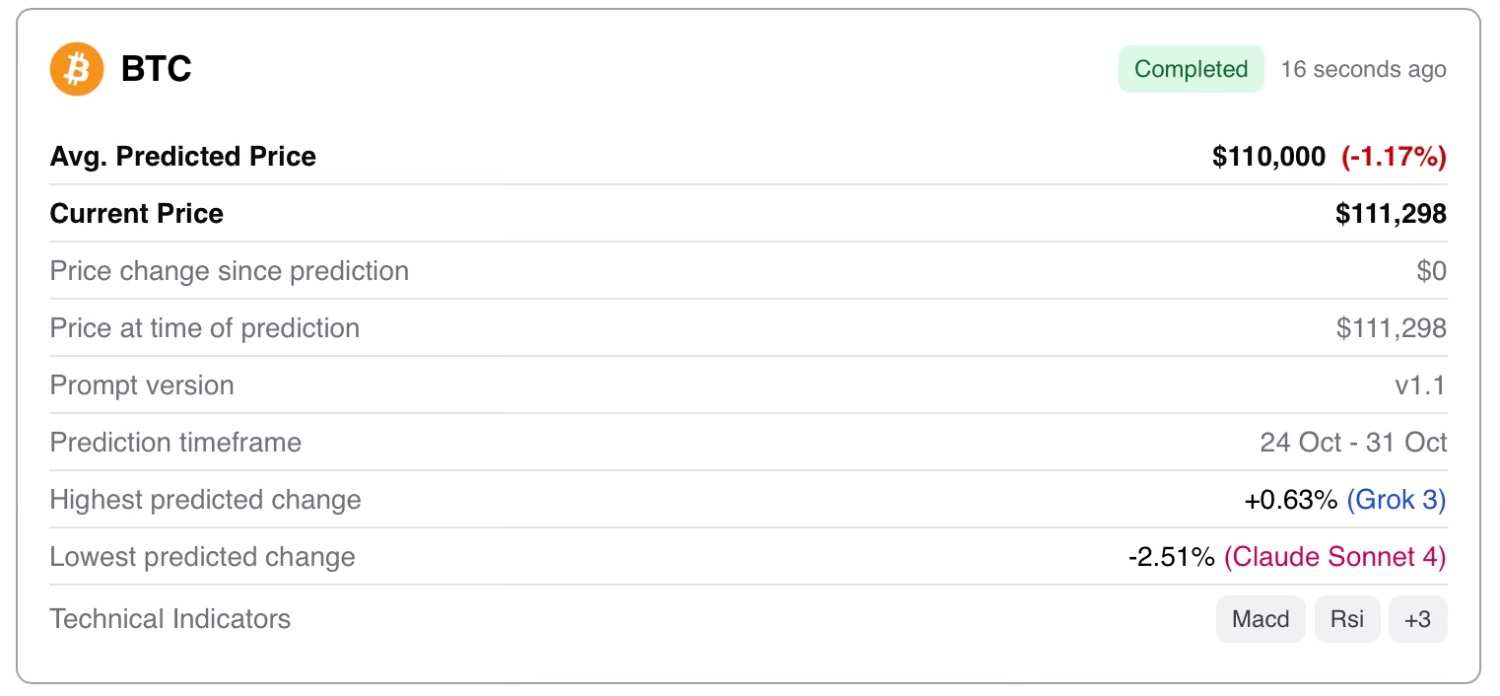

Making the outcome of this tug-of-war even more uncertain, Finvold’s AI prediction agent sees further declines in the world’s largest cryptocurrency over the Halloween period (October 24-31). In other words, a machine learning algorithm that combined the output from three large-scale learning models (Claude Sonnet 4, GPT-4o, and Grok 3) predicted the average price of BTC to be exactly $110,000. This represents a decline of 1.17% from the current price.

The predictions of the three LLMs were not in agreement. Grok 3 was actually bullish and believed the price could increase by 0.63% to $112,001.

Claude Sonnet 4, on the other hand, was the most bearish, expecting a 2.51% decline towards $108,500. In the middle, but still pessimistic, is GPT-4o, with the cryptocurrency expected to fall by 1.62% to $109,500.

Overall, the outlook for Bitcoin remains uncertain heading into Halloween 2025, with sentiment split between modest optimism and deep caution. Although institutional implementation and an improving macro environment could provide a price floor, mixed technicals and resistance around $120,000 continue to weigh on momentum.

Featured image via Shutterstock