Bitcoin (BTC) is witnessing a sustained outbreak of volatility in line with broader market sentiment, with artificial intelligence (AI) models predicting that the asset is likely to trade below $110,000 by November 1st.

Indeed, the market is weighed down by ongoing trade tensions, dampening hopes for a quick recovery for Bitcoin.

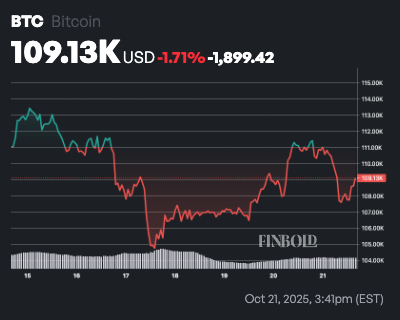

At the time of writing, BTC is trading at $109,066, having corrected almost 2% in the past 24 hours, while the asset is down 1.7% on the weekly timeline.

Bitcoin price prediction

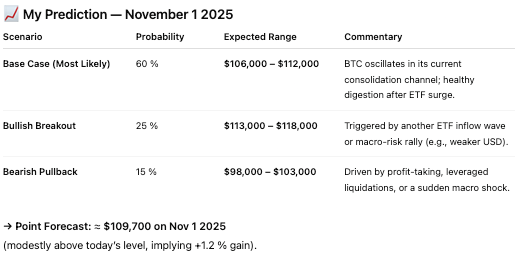

To predict the November 1 price, Finvold turned to OpenAI’s ChatGPT and noted that Bitcoin will likely trade at $109,700 on November 1, 2025, suggesting a phase of security rather than a new rally.

ChatGPT analysis highlights that while institutional demand remains strong, the pace of inflows into Bitcoin exchange-traded funds (ETFs), which have reached nearly $6 billion since the start of the year, is likely to slow, potentially slowing the upward momentum. The model pointed out that this easing could lead to mild consolidation pressure as the market digests previous gains.

Technically speaking, Bitcoin’s Relative Strength Index of around 65 indicates that the asset remains bullish, but not overbought. The moving averages (MA) support this view, with the 20-day average near $106,000 and the 50-day average near $99,000, reflecting a solid upward trend.

However, ChatGPT predicts that in the absence of a new catalyst, Bitcoin may briefly retest its 20-day average before returning to the next rally.

On the macroeconomic front, we expect a weaker dollar and stable inflation expectations to continue to support Bitcoin’s positive correlation with gold and stocks. A sudden change in tone from the Fed, especially its hawkish stance in late October, could temporarily push Bitcoin toward the $100,000 level.

Bitcoin price levels to watch

The model also notes that derivative funding rates are high, suggesting that excessive leverage could cause a short-term correction of 3% to 6% before recovery.

Regarding specific price levels, ChatGPT outlined a base scenario in which Bitcoin trades between $106,000 and $112,000 with a 60% probability. The probability of a bullish breakout from $113,000 to $118,000 is 25%, while the probability of a bearish decline from $98,000 to $103,000 is 15%.

If these levels are achieved, it would indicate that Bitcoin is likely to remain in a healthy consolidation period and maintain its broader uptrend while pausing before the next significant move.

Featured image via Shutterstock