Americans are feeling pressured by the rising cost of living, but they are not retreating from cryptocurrencies.

A new holiday spending survey from Visa shows an increased appetite for digital assets as gifts, even as inflation limits disposable income and consumers remain cautious. This contrast highlights a deeper shift in how households adapt when money is tight.

Inflation is cooling, but budgets still feel tight

Inflation has eased from its post-pandemic peak, but prices for essentials such as housing, food, insurance and utilities are still rising.

Wages have generally kept pace with inflation, avoiding a sharp decline in purchasing power. Still, profit margins are thin.

After covering basic necessities, many households have less flexibility for investments and discretionary spending than they did before 2022.

US energy inflation is accelerating:

CPI energy prices rose +4.2% year-on-year in November, the fastest pace since February 2023.

This is the second consecutive year of acceleration, following the +2.8% YoY increase in September.

The causes of the soaring prices are heavy oil, electricity, and city gas… pic.twitter.com/nXS30Km6fI

— Kobeissi Letter (@KobeissiLetter) December 23, 2025

This environment hasn’t completely halted spending. Instead, the behavior has changed. Consumers rely on technology to shop faster, compare prices more aggressively, and get more out of every dollar.

Economic participation continues, although financial confidence remains fragile. That wariness is evident in how people spend their money and what they buy.

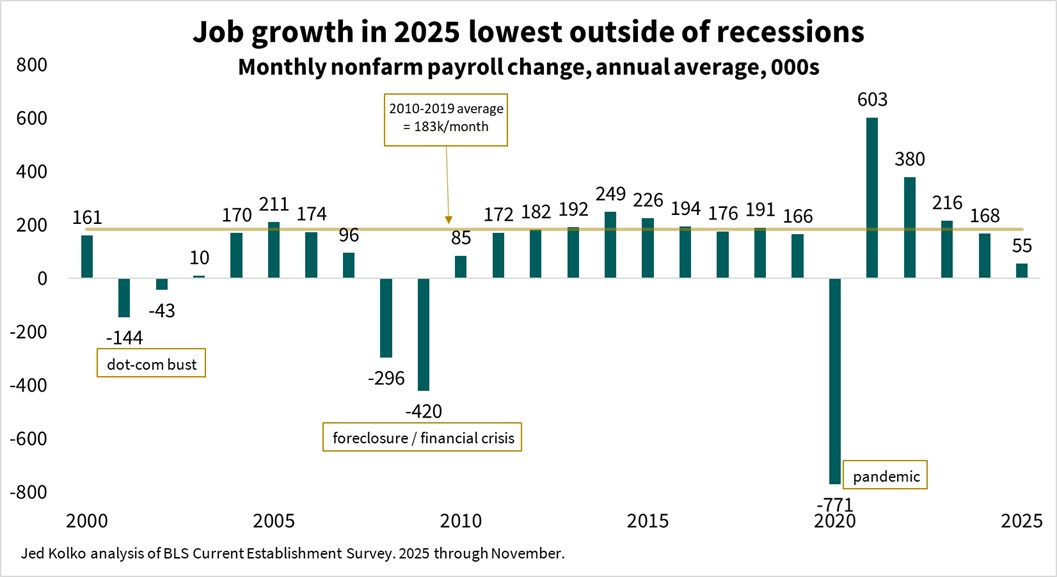

Employment growth in the United States over the years. Source: X/Jed Kolko

Virtual currency emerges as a “zero waste” gift

Visa’s December survey revealed that 28% of Americans think they would be excited to receive cryptocurrency for a holiday or vacation. christmas presentfigure to jump to 45% for Gen Z.

Charm is not about luxury. This reflects a preference for assets that are felt to be flexible, digital-first and have potential long-term value.

at the same time, 47% of US shoppers report using AI tools We help you with your holiday purchases, mainly by finding gift ideas and comparing prices. This shows a consumer mindset focused on optimization rather than excess.

Could cryptocurrencies replace cash this holiday season? More than one in four U.S. adults and nearly half of Gen Z adults say they would be excited to receive a cryptocurrency as a gift, according to research from Visa and Morning Consult https://t.co/xhU2SfJpch https://t.co/xhU2SfJpch pic.twitter.com/RUtS7aKSMP

— Reuters (@Reuters) December 5, 2025

Young shoppers are leading that change. Gen Z respondents show higher usage of cryptocurrency payments, digital wallets, biometrics, and cross-border shopping than any other age group.

For them, cryptocurrencies are a natural fit into a broader digital financial identity.

Data suggests that crypto gifts are not crowding out necessities. Instead, they replace traditional discretionary goods when consumers are still selective.

What this says about the US economy

The combination of easing inflation and sustained fiscal pressure points to a cautious but stable economy.

Americans are not retreating, they are adapting. Spending continues, but it leans toward tools and assets that promise efficiency, optionality, or future benefits.

The growing acceptance of cryptocurrencies as gifts despite tight disposable incomes indicates cultural normalization rather than a speculative frenzy.

This also helps explain why digital assets are still gaining interest even during periods of economic constraints.

For the market, the message is clear. Inflation may be cooling, but confidence has not fully returned.

In that gap, technology and alternative assets are playing a role that traditional consumption can no longer play.

Americans may feel limited, but they are still making cautious bets on the future.

The post “Americans want crypto for Christmas — even as inflation squeezes budgets” originally appeared on BeInCrypto.