Bitcoin has entered a side-to-side correction phase, with investors making profits and turning capital into the Altcoin market. Once BTC cools down, potential Altcoin Rally could be staged in the coming days.

Technical Analysis

Shayan Market

Daily Charts

After facing strong resistance at the $123,000 level, Bitcoin has entered a correction phase, which is likely to be driven by profits and distribution among investors. Historically, when BTC cools at the highest price ever, capital often spins into Altcoins, causing rallying across the wider market.

A pullback to the key 0.5-0.618 Fibonacci retracement zone currently between $107,000 and $111,000 can appear before the next major bullish impulse. Until then, a period of integration is expected and may potentially involve a significant intensity of Altcoins.

4-hour chart

In the lower time frame, Bitcoin integration usually forms a downward wedge pattern, a structure that indicates bullish continuity. Prices are currently approaching a critical support zone between $113,000 and $1.16 million, consistent with retracement levels of 0.5-0.618 Fibonacci.

If this zone successfully holds a breakout on top of the wedge and triggers it will allow you to return to $123,000 resistance. However, if support fails, deeper fixes for the $111K level may be deployed.

On-Chain Analysis

Shayan Market

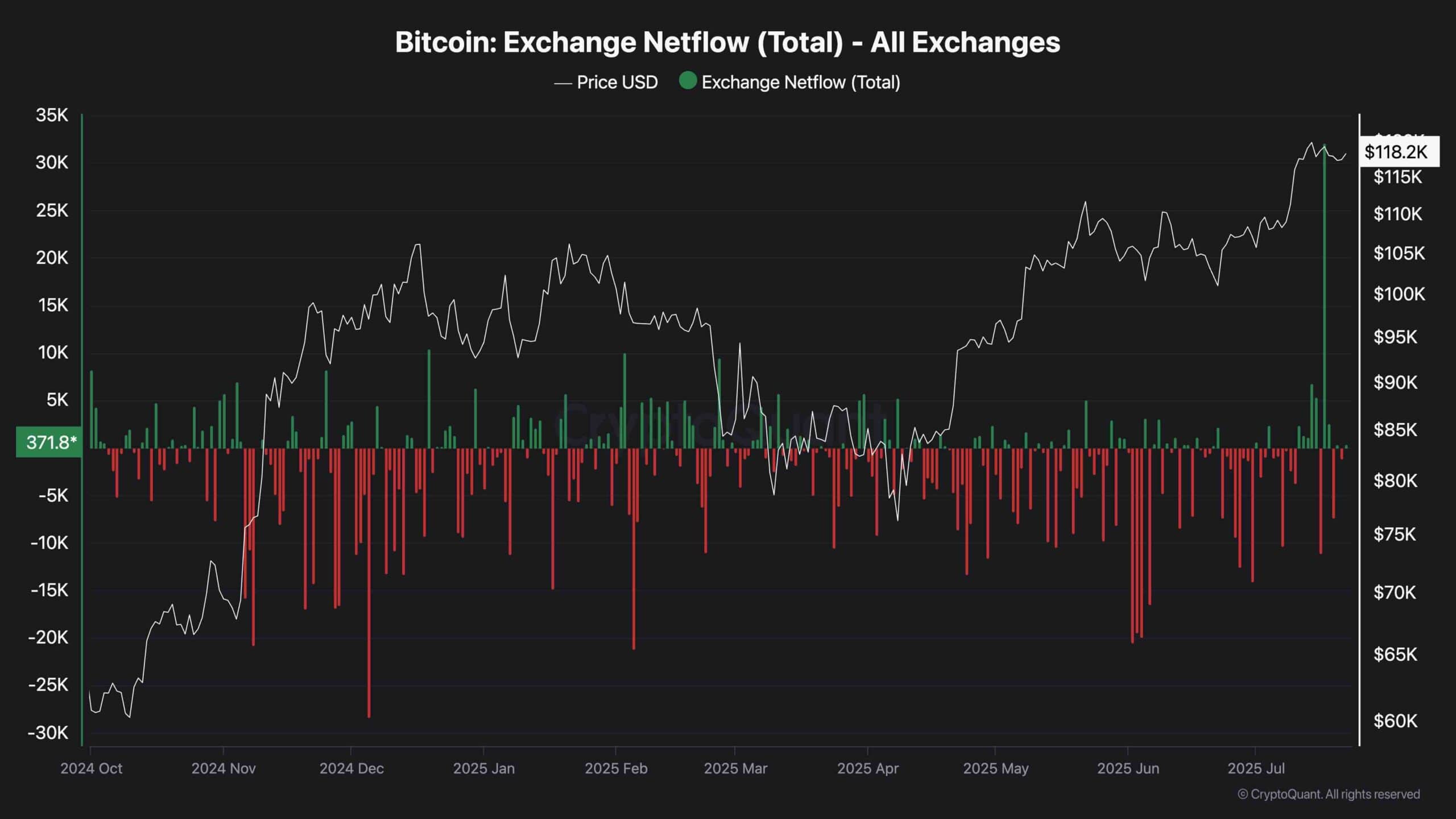

Bitcoin has seen its largest net inflow on exchanges since July 2024, indicating a significant change in dynamics on the chain. Such inflows suggest an increase in distribution and profits as more BTC will be available for trading.

Historically, similar exchange inflow spikes often precede deeper corrections. This week’s data suggests that key players, potentially funds or institutions, are offloading BTC nearest all-time, managing risk exposures.

However, this capital rotation could drive demand into alternative assets and drive Altcoin Rally. A rise in exchange supply could potentially increase market volatility, especially during a surge in demand. Traders should pay attention to this indicator as they can foreshadow the next major move.