A recent CryptoQuant analysis reveals one of the factors behind the recent collapse in Bitcoin prices, which appears to have stabilized.

Notably, Bitcoin reached a peak of $126,000 in early October 2025, before briefly stabilizing around $124,000 after an initial decline. However, this stability did not last long.

From this level, Bitcoin It steadily declined, eventually bottoming out at $84,000 in December, a decline of more than 32% year-over-year. 3 months. BTC has since rebounded slightly from the lows of $84,000, but remains nearly 30% below the $124,000 level and is currently trading around $87,000.

This prolonged economic downturn comes amid a broader bearish phase that weighed on crypto markets from early October to December.

Whale capitulation contributes to Bitcoin decline

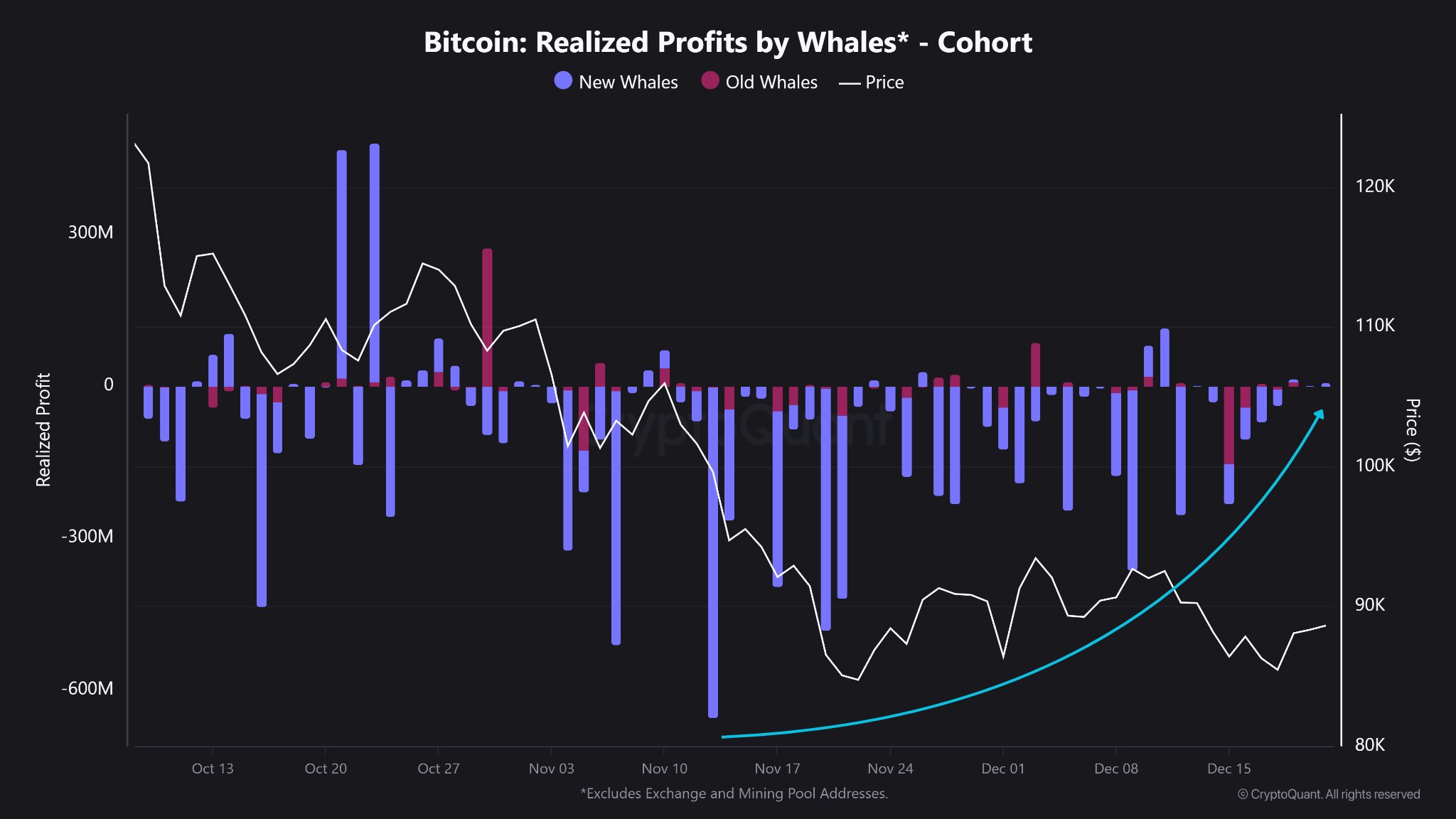

Interestingly, new on-chain data reveals one of the factors behind the decline. Recently, market analysis platform CryptoQuant identified Whale actions as a key factor in Bitcoin’s fall from $124,000 to $84,000.

According to CryptoQuant analysis, realized losses by newly active large holders played a decisive role in the price decline.

As Bitcoin fell from $124,000 to $84,000, losses from these new whale species increased, putting sustained pressure on the market. Continue Recent low is $84,000these realized losses declined sharply and then leveled off, indicating a pause in aggressive selling from this cohort.

Chart data shared by CryptoQuant revealed that the whales began showing signs of surrender in early October, but remain relatively calm. During this period, total profits and losses varied between $200 million and $100 million.

However, as Bitcoin prices fell further in late October, selling activity accelerated significantly. These dips were dominated by new whale species, with realized profits soaring up to $400 million on some days.

Number of whales caught remains flat: Will recovery be next?

In November, the situation changed again. as Bitcoin falls below $100,000profits fell despite increased selling pressure. Instead of making profits, the new whales began absorbing mounting losses.

This change led to a noticeable capitulation phenomenon, with realized losses peaking at up to $600 million on some days during November. CryptoQuant directly linked these large losses to the sharp price decline during that period.

By December, data showed that drops by these whales had decreased markedly. As the capitulation eased, Bitcoin entered a phase of relative stability, with the price settling between roughly $87,000 and $90,000.

Now that selling pressure from new whales has eased significantly, the market has room to stabilize further and could recover if large holders return as buyers.

Analysts remain divided on what’s next

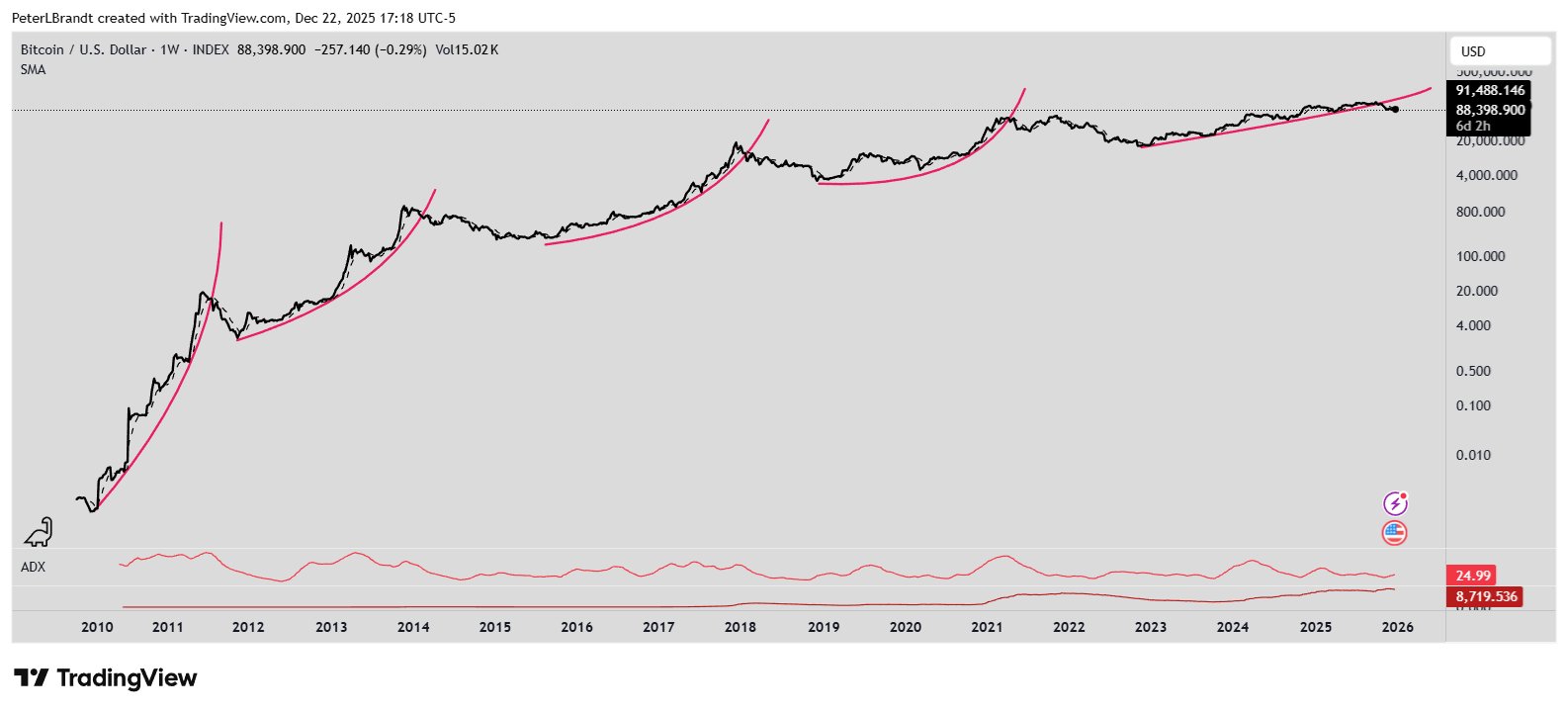

But despite this improvement, not all analysts expect a reversal anytime soon. Specifically, veteran trader Peter Brandt. warned Bitcoin could still face further decline.

He cited historical patterns, noting that Bitcoin has experienced five major parabolic rallies in its 15-year history, followed by declines of at least 80% when those rallies break. He believes this break suggests that the current correction may not be fully realized yet.

Bitcoin 1W Chart | Peter Brandt

On the other hand, Poppe analyst Michael said, observed Bitcoin has recently rejected a key resistance area around $90,000 and continues to move sideways. Although this rejection disappointed some traders, he noted that the shorter time frame still shows signs of an uptrend developing.

He called attention to $86,000 as a key support level, suggesting that holding in this area could strengthen Bitcoin’s case for breaking out of a key resistance zone.

Bitcoin 12 hour chart | Michael van de Poppe

Van de Poppe also highlighted the unusual market situation, noting that while many traditional markets are rising, cryptocurrencies are lagging behind. behind. Nevertheless, he believes this situation could change over time.