A popular crypto strategist says the confluence of macroeconomic factors is bullish for Bitcoin (BTC).

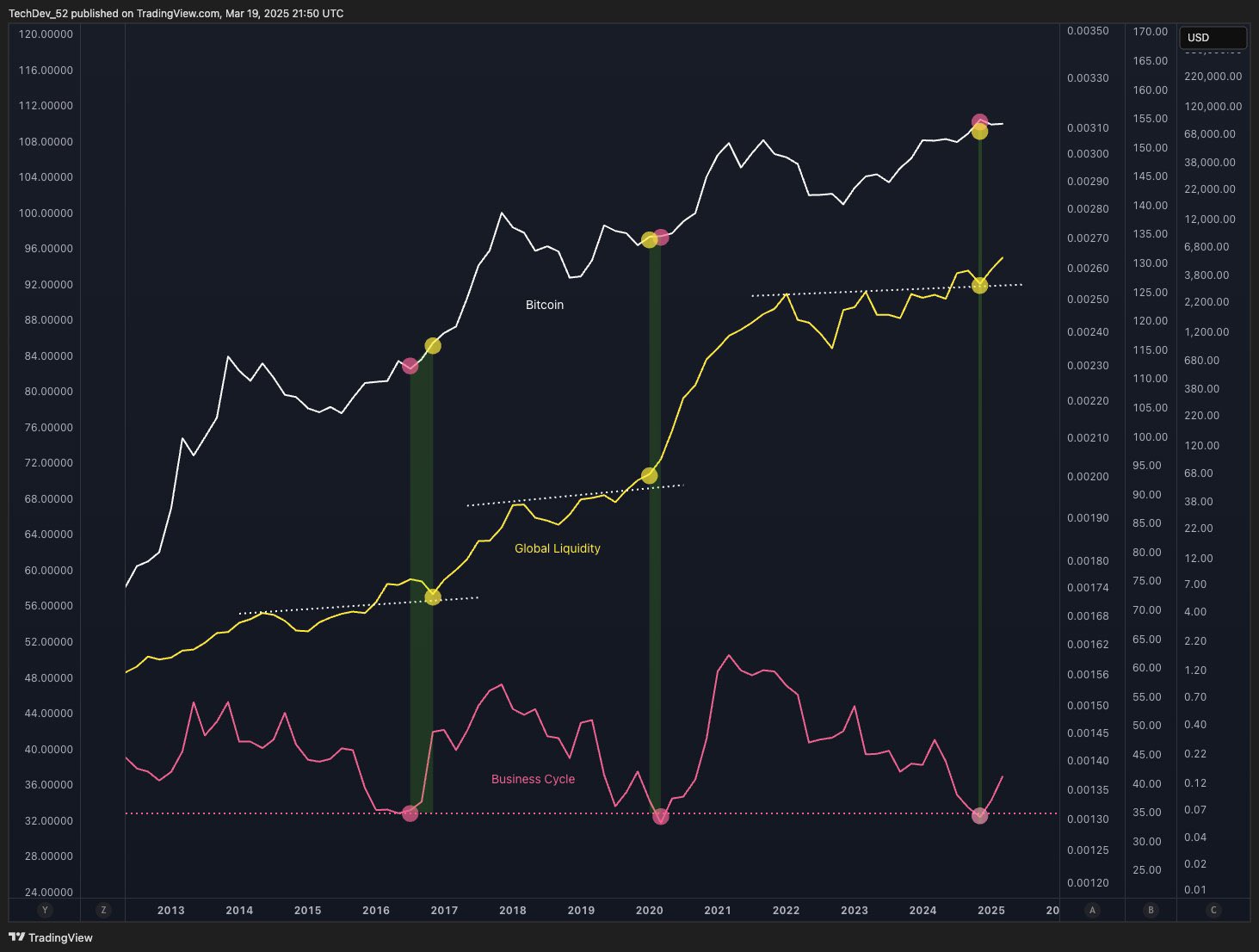

Pseudonymous analyst TechDev tells 517,800 followers of social media platform X that Bitcoin Bull Market is not yet finished based on a setup featuring a global increase in liquidity and a bottoming business cycle.

Global liquidity measures the amount of money in the global financial system, while business cycles refer to the rise and decline in economic activity over time.

According to Crypto Trader, Bitcoin tends to witness the most explosive portion of the bull market each time global liquidity rises to new record highs as the economy reaches its bottom and begins to recover.

“We’re at that rare point when liquidity has regained breakouts and is rising high and surged…

Just as the business cycle was running out and turned around.

Only a third of these setups in the last 12 years.

The other two pushed the crypto market to its steepest legs.

Ignore the noise. ”

Source: TechDev/X

Looking at the trader’s charts, he appears to suggest that Bitcoin followed the bull market footsteps in 2016 and 2020, while BTC printed up new highs as global liquidity increased and business cycles reversed.

At the time of writing, Bitcoin is trading at $86,635.

Generated Image: Midjourney