Crypto strategists say Bitcoin (BTC) has shown a setup that has only been spotted three times in the past.

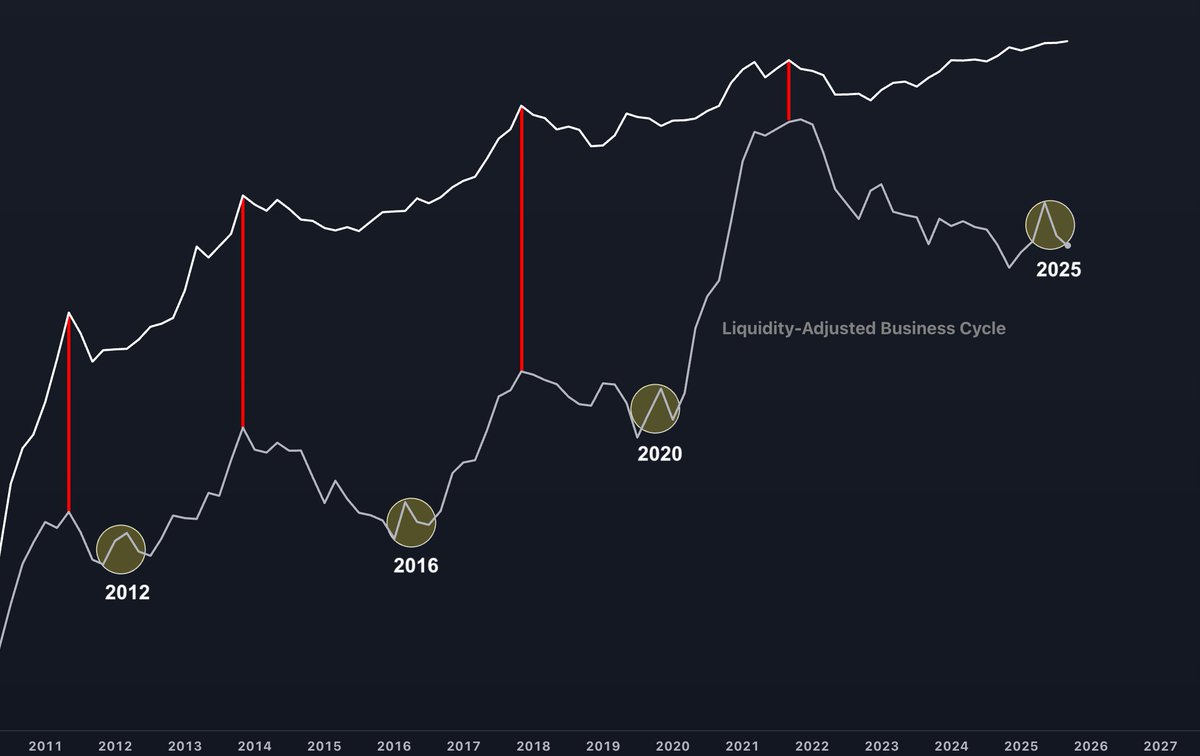

Pseudonymous analyst TechDev tells X’s 548,100 followers that he is considering liquidity-adjusted business cycle metrics designed to analyze the interconnectivity between financial markets and the actual economy.

TechDev shares a chart suggesting that Bitcoin tends to launch the steepest rally after the metric prints bullish high low setups.

“the…

Setup for 2012 before the 2013 run.

Setup for 2016 before the 2017 run.

Setup for 2020 before the 2021 run.

once again. ”

Source: TechDev/X

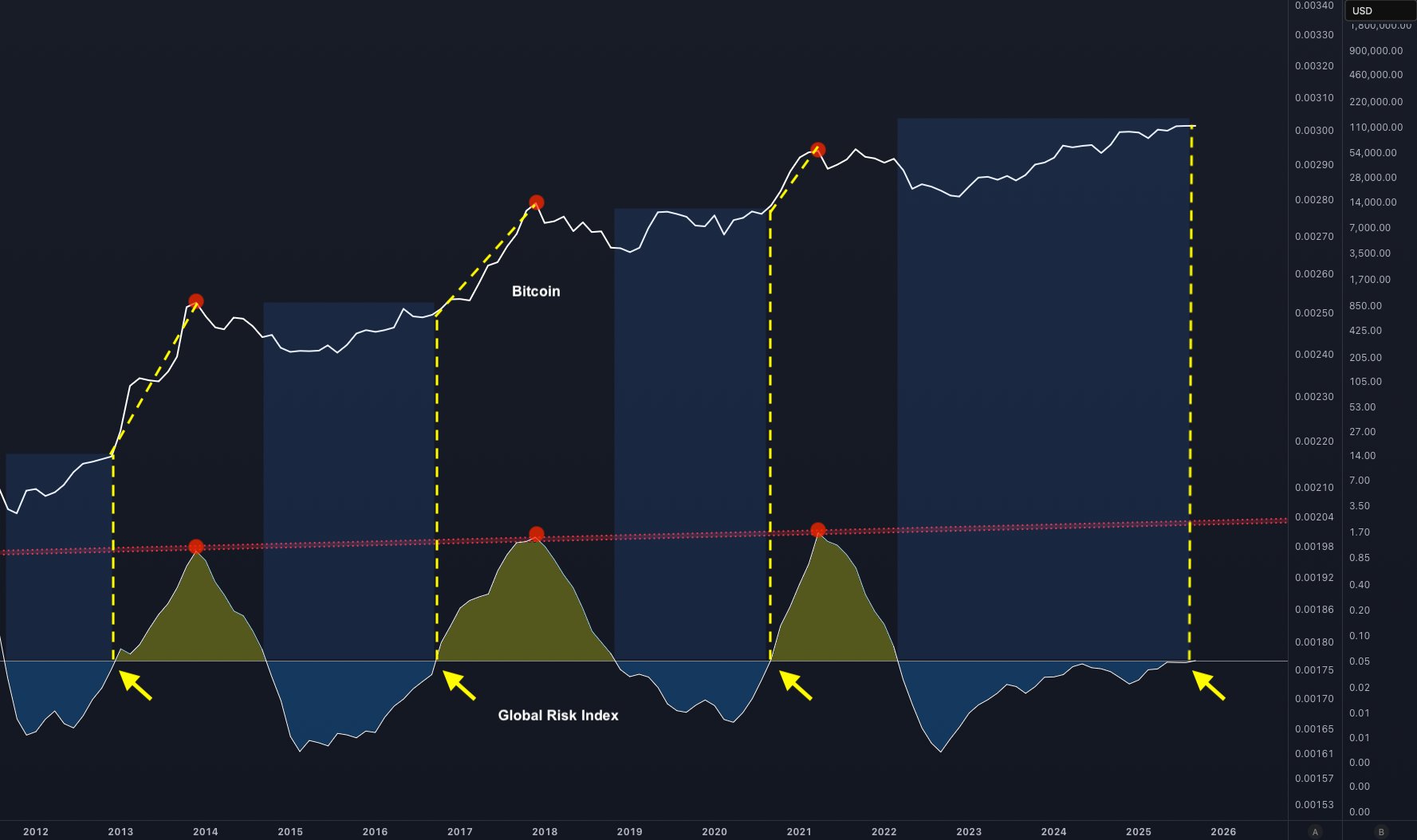

Analysts also say the rebound liquidity-adjusted business cycle metrics appear to coincide with rising global risk indexes. According to TechDev, the global risk index is the ratio of three macro signals, which are independent of Bitcoin and much larger than BTC. He also states that the index has no weights or fitting parameters.

“It’s potentially important.”

Source: TechDev/X

Based on the trader’s chart, he appears to suggest that BTC tends to rise after the global risk index rises above the midpoint line.

At the time of writing, BTC is worth $119,946.

As for the Altcoin market, TechDev believes that ALT is being prepared to explode after it escapes its enormous bullish pattern.

“Most of us don’t seem to know what’s coming. We’re just starting to expand our macro altcoin.”

Source: TechDev/X

At the time of writing, Total3, which tracks the total market capitalization of cryptocurrencies excluding Bitcoin, Ethereum (ETH) and Stubcoin, is trading at $1.122 trillion.

Generated Image: Midjourney