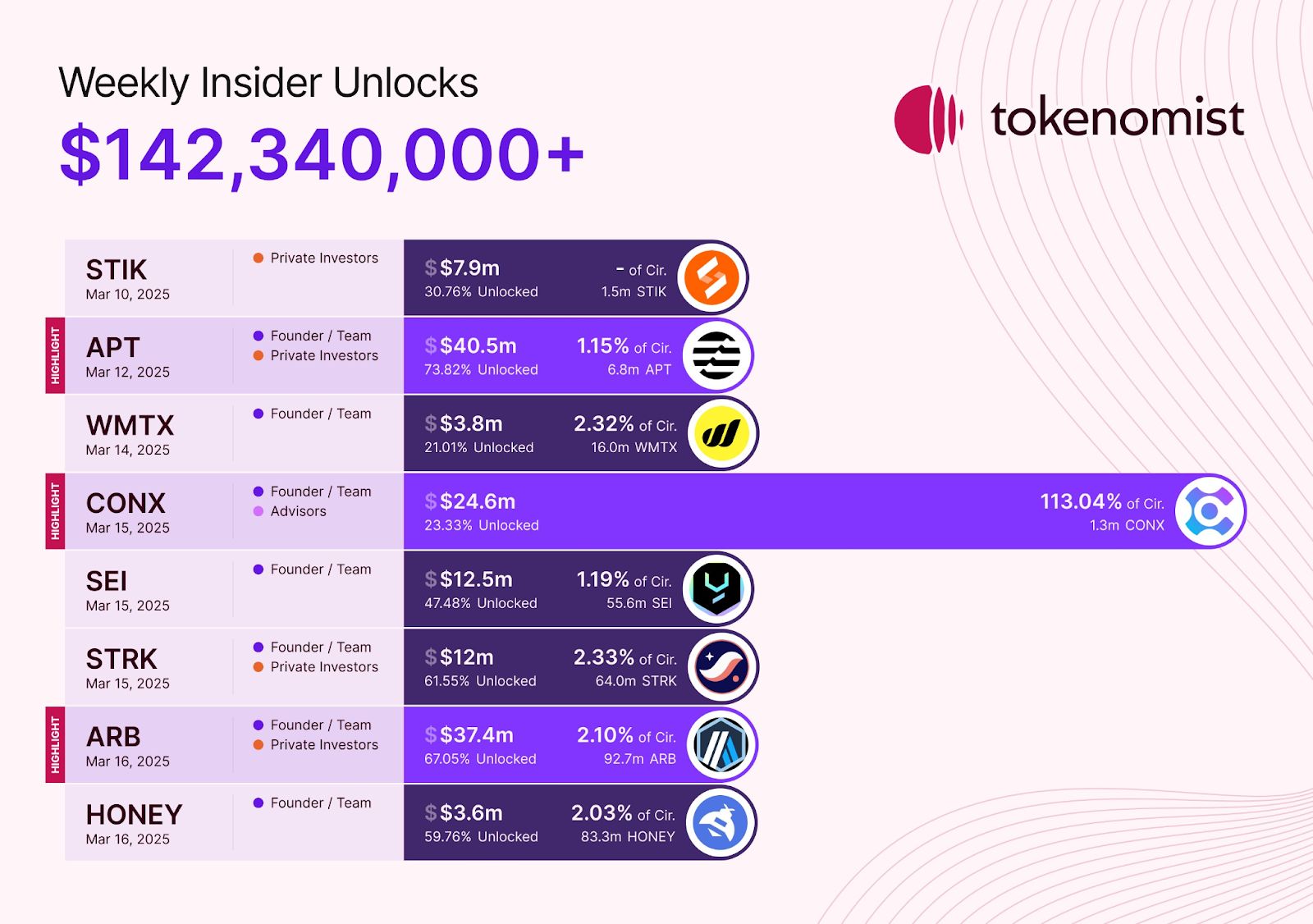

A massive influx of tokens is coming to the crypto market. More than $142 million in cryptocurrency tokens are scheduled to be unlocked next week between March 10th and 16th to be precise.

APTOS (APT), Arbitrum (ARB) and CONX are one of the most notable tokens in this release. These unlocks are expected to distribute tokens to private investors, founders and team members, affecting market liquidity and triggering price movements.

Apt & arbitrum leads for weekly token unlock value

Tokenomist data shows that Aptos experienced the biggest unlock of the week, with $40.5 million worth of tokens being available on March 12th. This represents 1.15% of the circulation supply.

APTOS unlocks 73.82% of the total supply after this release. Currently, APT is trading at $6.05, down 1.1% on the last day and 5.3% over the past week.

conx unlocks dwarfs circular supply, followed by Arbitrum

Arbitrum accounts for 2.10% of the circulation supply with its $37.4 million unlock scheduled for March 16th. This event brings the previous lock to 67.05% level. Its price fell to $0.3912, showing a 3.5% drop per day and an 18.8% drop over the past month.

CONX stands out by unlocking its $24.6 million dollars on March 15th, accounting for 113.04% of distribution supply. For context, CONX has a circular supply of 1.15 million tokens.

However, with 1.3 million CONX tokens in circulation, unlocking is a potentially important event for price dynamics. It is worth noting that Conx tokens have dropped by 2.32% in the past day and 12% in the past month.

Related: Crypto Token unlock schedule shift: Are the projects changing emissions strategies or are they just market dynamics?

StarkNet (STRK) and SEI are other notable projects that are expected to unlock $12 million and $12.5 million on March 15th.

Token vesting and market dynamics

Crypto Vesting is a common practice designed to prevent early investors and project teams from selling large quantities of tokens immediately after launch. By using a lockup mechanism, the best aims to ensure a gradual distribution. Therefore, it helps to maintain price stability.

However, token releases, especially large cliffs, are unlocked, and usually increase supply. If market demand does not properly absorb this increase in supply, prices could potentially drop. Prominent projects Aptos and Arbitrum may experience an increase in trading activity after their respective unlock.

Related: Solana’s $2 Billion Token Unlock: Is the Sol Portfolio Safe from March 1st?

In the case of CONX, the unlocking exceeds the existing circular supply, raising questions about the market’s ability to absorb this substantial new liquidity.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.