The total amount of real world assets (RWAS) on the Arbitrum network has risen more than 1,000 times since its launch in 2024.

Starting from the modest $100,000 to $200,000 in early January last year, Arbitrum currently hosts more than $200 million tokenized RWAs. This reflects one of the most explosive growth trajectories in Decentralized Finance (DEFI) this year.

Arbitrum’s total RWA value increases by 1,000 times

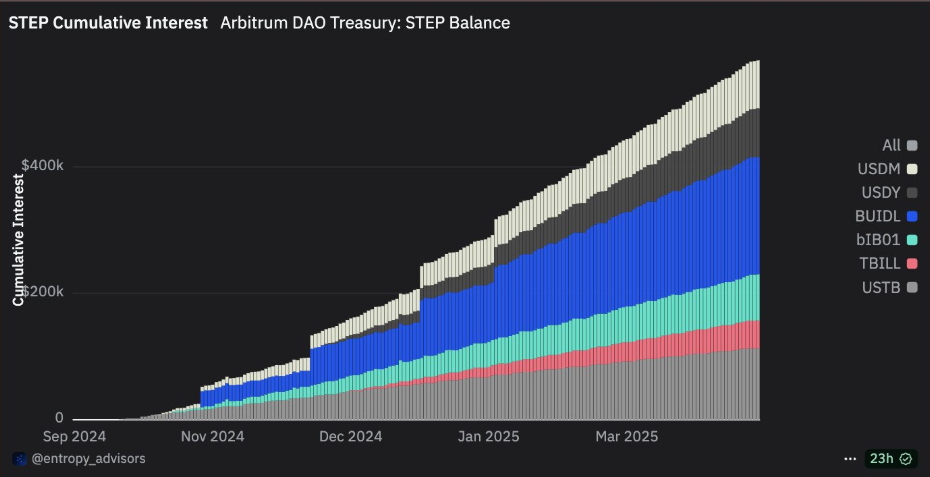

This exponential extension is primarily due to Arbitrum Dao’s stable financial fund program (STEP), and is currently in the 2.0 phase. The program allocated 85 million ARB tokens to support stable liquid, yield generation RWA.

“DAO has approved the 35m ARB for RWA through step 2.0, which will bring total RWA investment to 85m ARB, one of the largest DAO-led RWA allocations in Web3 from the DAO Ministry of Finance,” Arbitrum said in February.

The objective of this strategy is to reduce DAO’s exposure to unstable native crypto assets and help build a more resilient Treasury Ministry, with results apparently being obtained.

Arbitrum tokenization. Source: x’s learning medication

The US Treasury controls Arbitrum’s RWA ecosystem, accounting for 97% of the sector. Franklin Templeton’s Benji leads the pack, holding a 36% market share, with Spico’s European Treasury accounting for 18%.

This diversification beyond US-centric instruments is a healthy indication of global institutional involvement with the arbitrum.

“Eco welcomes global diversification beyond US instruments,” the Learning Medication said.

Newcomers like Dinari also add ecosystem momentum and offer tokenized versions of traditional securities. These include stocks, ETFs (exchange agreement funds), and REITs via the DSHARES platform.

Over 18 tokenized RWA products live in Arbitrum and cover a wide range of asset classes, from bonds to real estate. Arbitrum itself highlighted this institutional influx into X (Twitter).

“The adoption of RWA and Stablecoin at Arbitrum has been monumental! Some of the largest institutions bring tokenized assets with $4.7 billion of Stablecoins and RWA already at RWA over $214 million,” the network says.

Teams such as Securitize, Digift and Spiko represent everything from sovereign debt to real estate portfolios, indicating the early formation of new financial substrates.

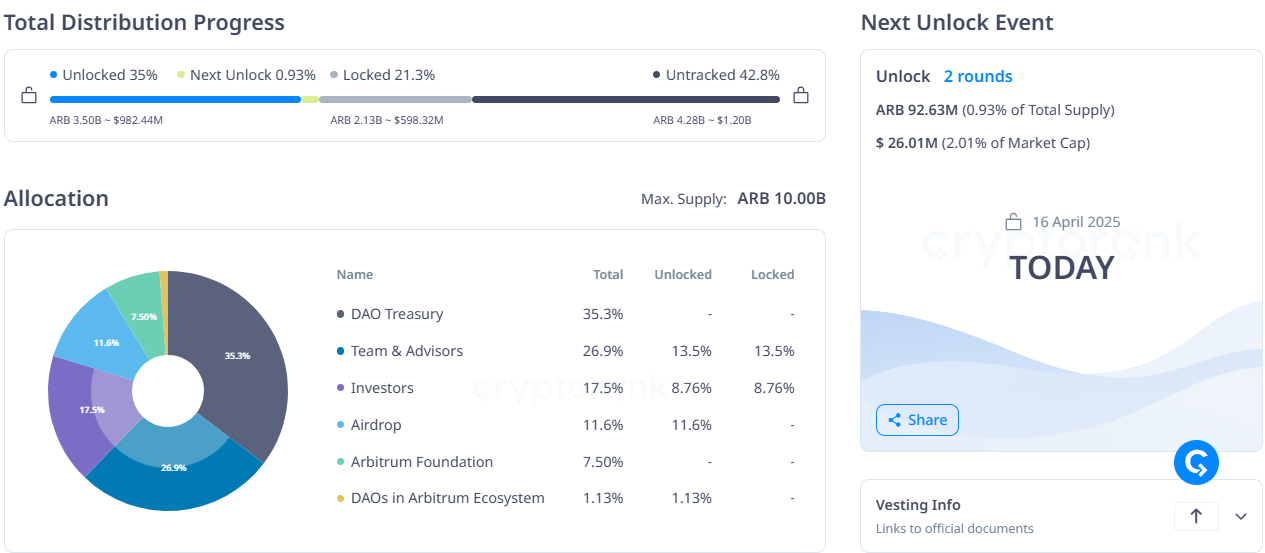

However, despite the strong ecosystem development, the network’s native token, ARB, has dropped by 88% from an all-time high.

Performance at the arbitrator (Q) price. Source: beinctypto

Furthermore, downside pressure is looming, with 9,263 million ARB tokens imminent. With only 46% of the total supply currently in circulation, concerns about dilution from RWA growth and lack of direct token generation remains a significant market overhang.

Arbitrator (ARB) token unlock. Source: cryptorank.io

Tokenized RWA cross $11 billion, Ethereum controls Onchain Finance Frontier

Beyond Arbitrum, the wider real-world asset sector has become quiet in one of the most important trends in crypto, even if it doesn’t control the headlines.

According to Defilama, on-chain RWA is over $11.169 billion, a total of 2.5 times over the past year.

RWA Ranking TVL. Source: Defilama

Tokenized US Treasury and tokenized gold are the engines behind this boom. BlackRock’s Buidl Fund currently holds more than $2.38 billion in tokenized Treasury alone. Meanwhile, a recent Beincrypto report shows that blockchain-based gold assets are over $1.2 billion based on rising market demand and metal prices.

Ethereum remains at the forefront and hosts around 80% of all chain RWAs. As the Tradfi giant seeks dollar yields and programmable exposure to real assets, Ethereum provides the infrastructure and liquidity needed to bridge the capital markets on blockchain rails.

“The top RWA protocols don’t follow the crypto story. They understand what the truck understands: yield, dollar exposure, gold. This is not the future of obligation. It is the future of finance.”

Builders point out that they’re already deeply embedded in the adoption of native applications with chains like Pendle, Morpho, Frax, various automatic market makers (AMMs) and staking layers. The “real yield” paper has arrived and coded into the basic layer of the new financial system.

“The Tradfi story is great, but so far adoption has been a chain,” says Artem Tolkachev of Defi Builder.

While flashy defi experiments often mimic casinos, RWA shows that slow, stable, scalable races win.

The next frontier is in improving access, liquidity and incentives, especially in non-echo chains like arbitrum, which has a strong technical foundation, but market confidence remains in the flux.

Tokenized RWAs may not be the biggest story in cryptography, but they are becoming the most consequential.

“Onchain RWA is quietly becoming the backbone of future finance. It’s not hype, it’s just a real value Tradfi.