Ethereum’s continued underperformance against Bitcoin has reignited debate about what is supporting the asset and who is really behind the demand.

About $6 billion in South Korean retail funds are currently backing so-called Ethereum government bonds, with companies accumulating ETH as balance sheet assets to reflect MicroStrategy’s Bitcoin strategy, according to Bitcoin advocate Samson Mo. Mo made this claim in a post on X on October 5th, claiming that “ETH influencers” were flying to Seoul to court retail traders chasing the next “strategic strategy.”

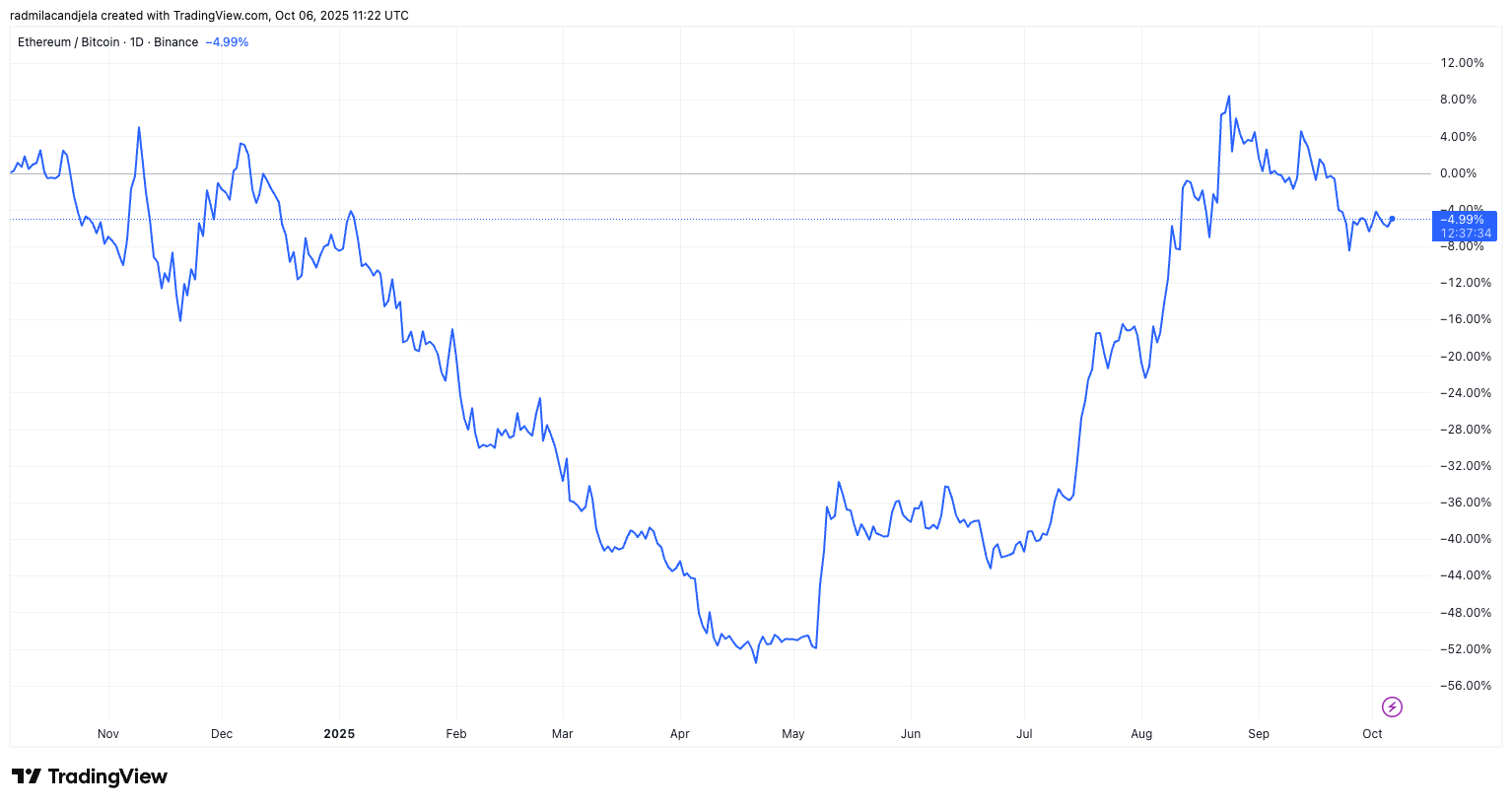

As of October 6, ETH has fallen about 1.9% in the past 24 hours and has fallen about 5% versus Bitcoin over the past month, according to CoinMarketCap. Mow suggested that this weakness reveals how short-term retail enthusiasm, rather than institutional belief, is underpinning Ethereum’s valuation.

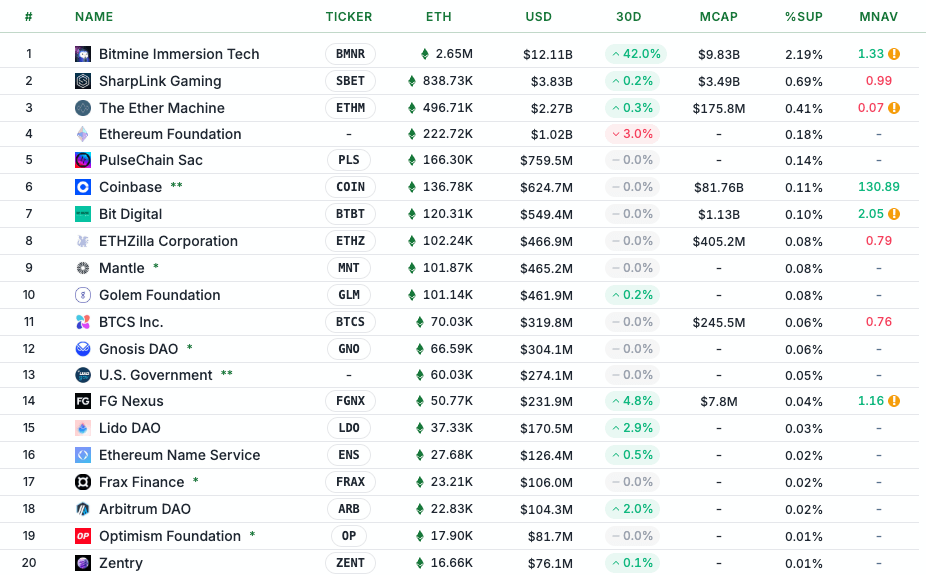

According to Strategic ETH Reserve data, 67 entities, including BitMine and SharpLink, collectively hold approximately 5.49 million ETH (approximately $25 billion), or 4.5% of the total supply.

Moh attributed much of this exposure to a Korean individual investor known locally as Sohak Gemi, who he claimed has funneled about $6 billion into the Ethereum treasury company. He claimed that promoters are marketing these companies as “the next MicroStrategy” to lure traders looking for something easily analogous to Bitcoin’s corporate accumulation strategy.

“Many of these investors have no knowledge of the ETH/BTC chart and think they are buying the next strategic trade.”

He warned that enthusiasm based on “financial literacy” could backfire, especially as Ethereum continues to lag behind Bitcoin in relative performance.

Ethereum’s price performance reflects concerns. Despite regular inflows and a new narrative boost, ETH remains below its all-time high of $4,946 and continues to decline against Bitcoin. The ETH/BTC ratio has fallen over 5% over the past year, reinforcing the perception that much of Ethereum’s market cap support is narrative-driven rather than based on fundamental growth or institutional adoption.

Mow’s criticism echoes comments from Mechanism Capital co-founder Andrew Kang, who also questions the financial logic behind Ethereum-based government bonds. Kang cited projects like Tom Lee’s BitMine as examples of “undisciplined financial models” that lack the financial structure found in successful Bitcoin-holding companies. “Ethereum technicals are bearish,” Kang said, adding that ETH’s long-term range could remain between $1,000 and $4,800 unless there is a significant change in fundamentals.

Kang compared its speculative momentum to XRP’s historic rise and concluded that Ethereum’s valuation is “largely driven by financial literacy.” He argued that while retail hype can sustain large market caps for a while, it’s not a permanent foundation, and said, “The valuations that can be gained from a lack of financial literacy are not infinite.”

Whether Korean retail demand becomes a new structural pillar for Ethereum or the last gasp of a fading story may depend on how long the “ETH Treasury” story can outrun the charts.