President Donald Trump has publicly signaled hesitation about moving Kevin Hassett to the Fed, casting doubt on Hassett’s chances of succeeding Jerome Powell as Fed chair.

President Trump said at a news conference that he wanted to keep Hassett in his current role, citing concerns that he would lose a trusted advisor if he were sent to the Fed.

BREAKING NEWS: President Trump made the following comments about Kevin Hassett, who is expected to succeed Fed Chairman Jerome Powell.

“You looked great on TV today, I actually want to keep you like this.”

“If I move him, I’m going to lose you because the Fed guys don’t talk much. That’s a serious concern to me.”… pic.twitter.com/em0C28Oe6A

— Kobeissi Letter (@KobeissiLetter) January 16, 2026

Kevin Hassett’s Chance Cool

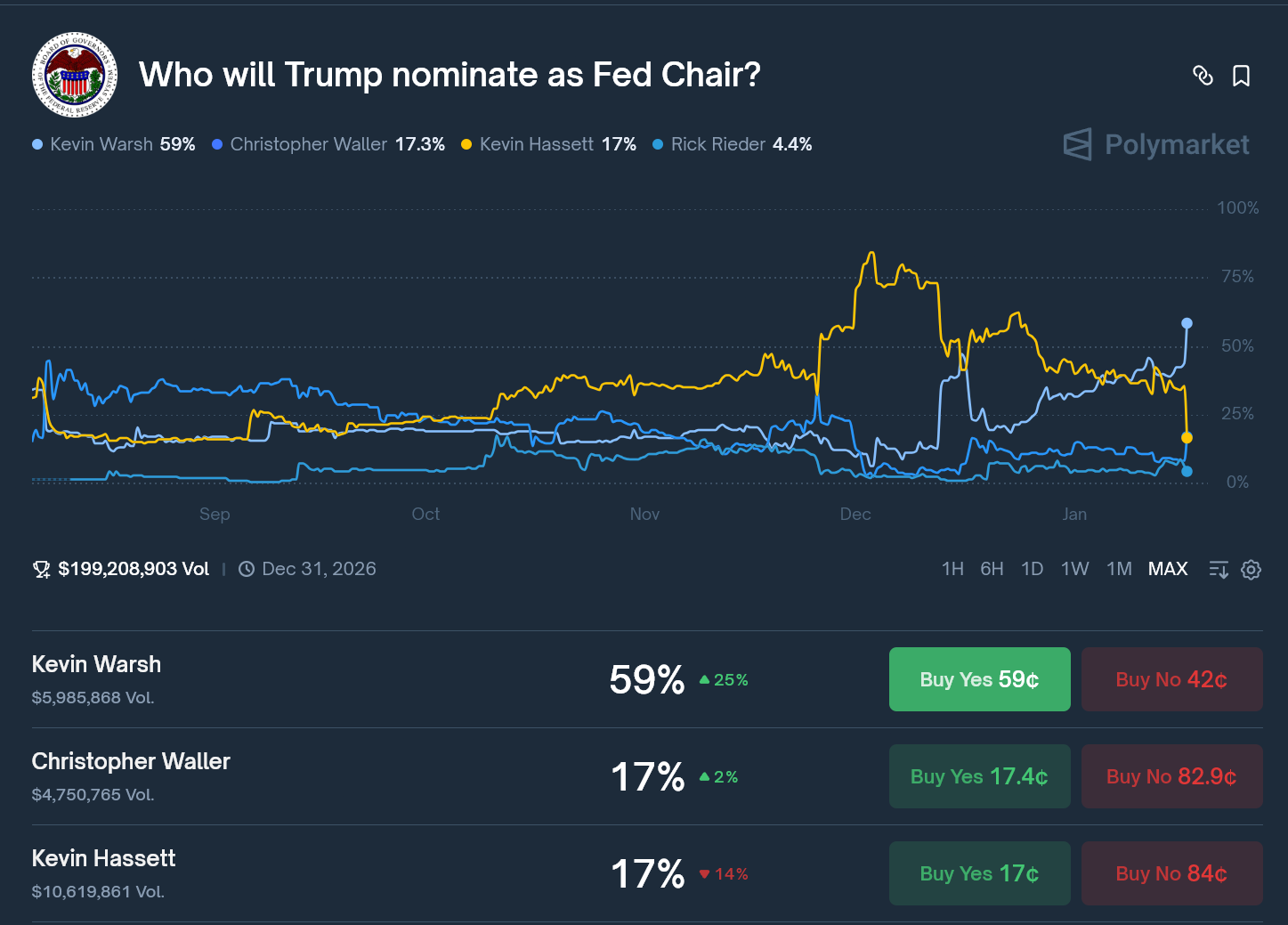

This comment immediately reorganized expectations regarding the next Fed chair. With Hassett’s odds down, attention shifted to what’s next. Kevin Warshis currently considered a strong candidate by the market and Washington officials.

Mr. Hassett had been widely discussed as Mr. Powell’s successor at the top ahead of the government’s transition in May 2026.

But President Trump’s comments suggest he is prioritizing continuity within the White House over a transition to the central bank.

As a result, prediction markets and analyst chatter have shifted away from Hassett in recent days.

Kevin Warsh rises in Polymarket odds. Source: Polymarket

Kevin Warsh to the front

Kevin Warsh brings past central banking experience, having served as Fed Governor during the global financial crisis. His profile has long appealed to Republicans seeking credibility with the markets and a clear separation between monetary policy and day-to-day politics.

Mr. Trump’s reluctance to part ways with Mr. Hassett elevated Mr. Warsh to the top of the list of candidates.

Crypto Lens: Warsh vs. Powell

When it comes to cryptocurrencies, the difference between Mr. Warsh and Mr. Powell is more in tone than in results. Powell has maintained a cautious, institution-first approach, repeatedly emphasizing financial stability, consumer protection, and clear regulatory lines for stablecoins and exchanges.

Former Fed Governor Kevin Warsh: Bitcoin “can provide discipline to the market, and it can also tell the world that things need to be fixed.”

“Bitcoin doesn’t make me nervous.”

“In many cases, they can be very good police officers when it comes to policy.” pic.twitter.com/3pYKyCFiCy

— Fiat Archive (@fiatarchive) December 27, 2025

He has avoided recognizing cryptocurrencies as currencies, although he has acknowledged that markets can develop under existing rules.

Mr. Warsh’s record shows pragmatic skepticism. Although he acknowledges Bitcoin’s potential as a store of value and often compares it to gold, he remains wary of private cryptocurrencies functioning as everyday money.

This stance suggests strengthening guardrails rather than outright hostility. Compared to Powell, Warsh may sound more open to discussions on digital assets, but his policy outcomes are likely to remain conservative.

Powell’s clock is ticking

Fed Chairman Jerome Powell’s term ends on the 20th. May 15, 2026. He can remain on the board until 2028, but it is rare for board chairs to remain on the board after leaving office.

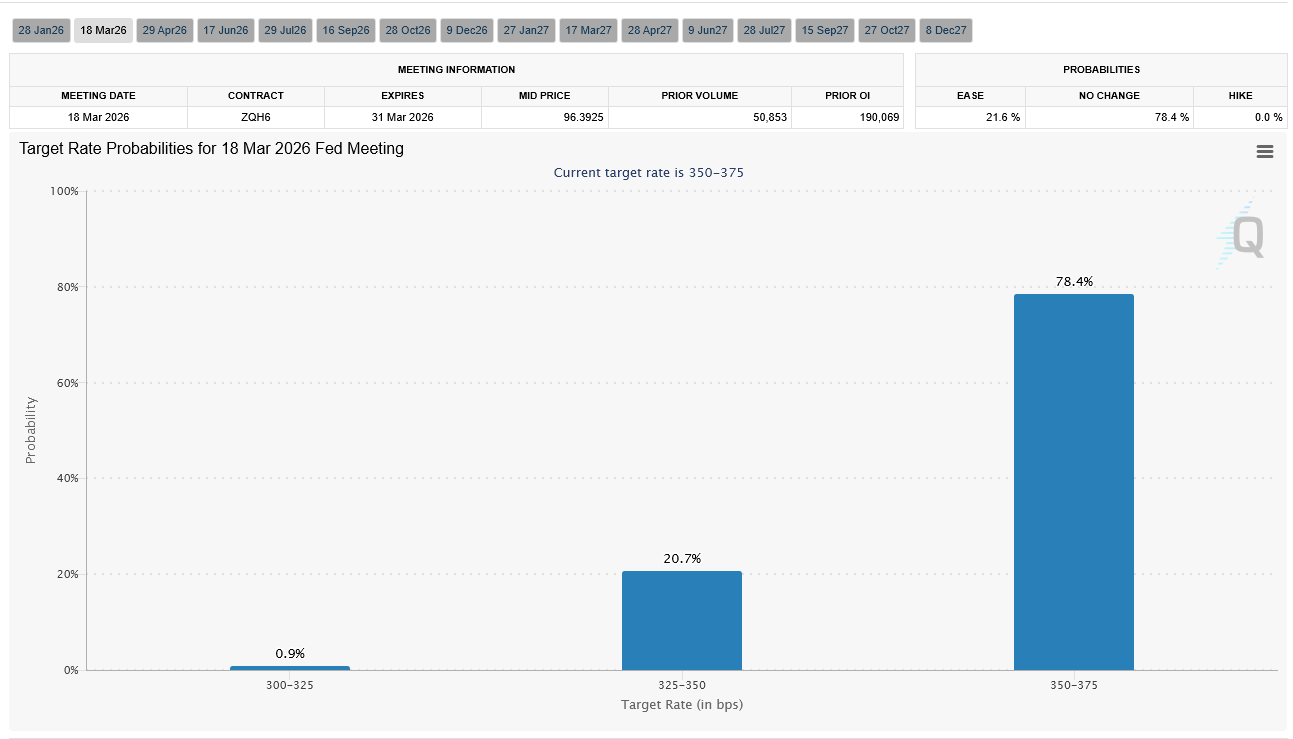

Markets expect there to be limited room for major policy changes before he leaves office, as inflation has eased but has not been completely eliminated.

Traders bid more and more Another rate cut Under the pre-transition Powell administration, assuming the data cooperate.

The market largely expects interest rates to remain unchanged until April 2026. Source: CME FedWatch

At this point, it seems unlikely that there will be a major change in direction, and there is a growing view that the next chair will decide the direction of policy from 2026 onwards.

Meanwhile, Mr. Powell faces an unusual political backdrop. The Justice Department’s investigation into his congressional testimony about overspending on renovations to Federal Reserve headquarters includes subpoenaing records.

Chairman Powell said the issue does not affect monetary policy. But as a leadership change approaches, the investigation has intensified debate over the central bank’s independence.