Key Bitcoin

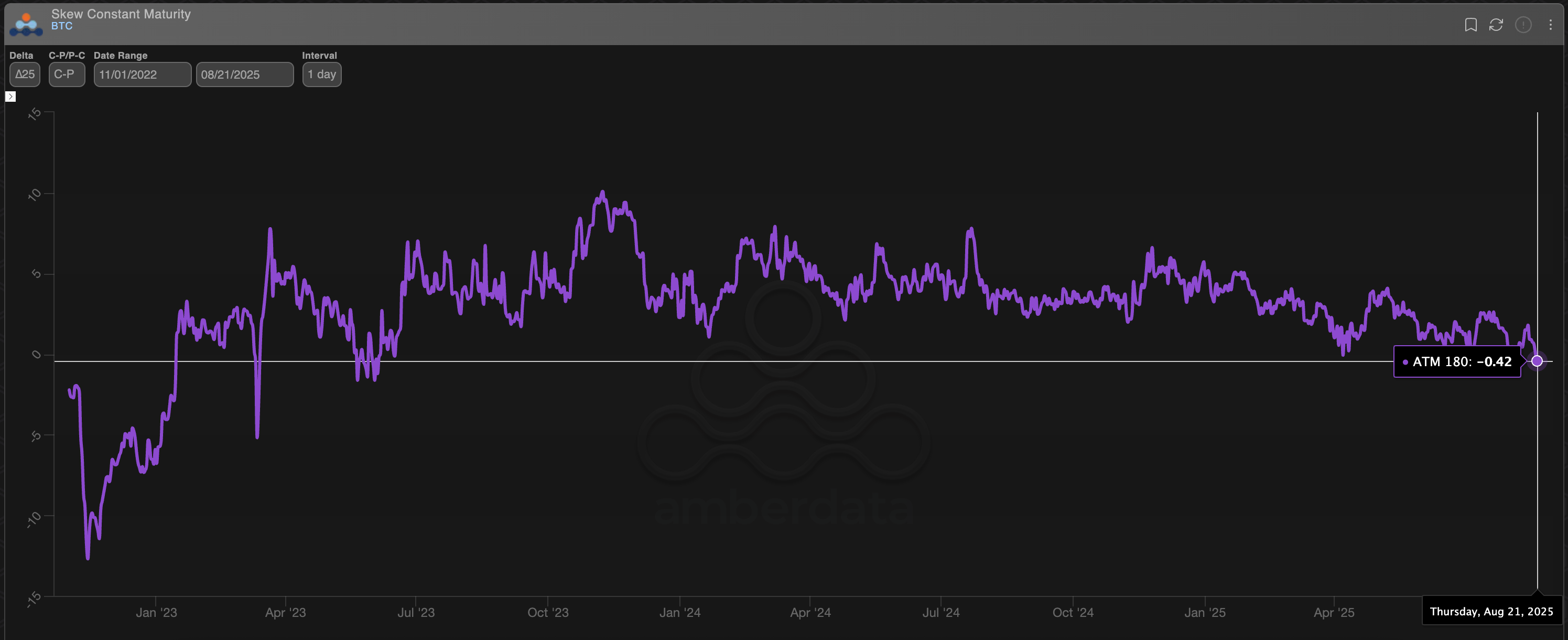

The first is a 180-day call putt skew derived from trading on Deribit, the biggest exchange of crypto options by volume and open interest.

At the time of writing, the 180-day skew was 0.42, the lowest since June 2023, according to data source Amberdata. Negative call put skew suggests that traders are priced higher demand prices for put options (providing protection against price drops) against call options. Data can be interpreted as market attention or bearish sentiment over the medium term.

“BTC’s long-dated skew could be a sign of a government shift by flipping to Put Premium,” Imran Lakha, founder of Options Insights, said in X.

180 days of BTC skew. (Deribit/Amberdata)

Negative readings appear as a change in the administration as they continue to be consistently positive values for two years.

More importantly, BTC has only been pulled back about 8% from its record high above $124,000 it reached a week ago. However, the long-term sentiment turned bearish.

According to Lakha, the price pullback caused demand for put options.

“The skew of BTC and ETH is pulling towards the premium because the market is right. BTC won’t show the call premium again until March 2026. The August/September move trigger purchase will cause a $110,000 strike.

Federal Reserve Chair Jerome Powell will speak at the Central Bank’s annual Jackson Hole Symposium on Friday. Most traders expect Powell to signal a rate cut that starts in September, and if he gives what he expects, the market might be right, according to research analyst Nikolai Sondergaard at Nansen.

“At this stage, the market is already priced because it is highly anticipated for cuts. If Powell is accurately predicted, Crypto can see the sideways.

Stock trader chase will be placed

The demand for negative side protection at BTC is in line with activities on Wall Street where traders prepare to sell on key technology stocks.

“Traders are buying ‘disasters’,” said Jeff Jacobson, head of derivatives strategy for the 22V research group.

Guppy Multiple Moving Average Indicators

The second indicator for bearish changes in the regime is the Guppy Multiple Moving Average (GMMA) indicator.

Developed by Australian trader Daryl Guppy, this indicator is used to identify reversals and assess trend strength by analyzing bands formed by short- and long-term moving averages. A bullish cross occurs, showing the green bands representing the long-term moving average cross over the red band of the long-term moving average, showing that upward momentum is gathering pace.

BTC Daily Chart. (TradingView)

BTC prices are above the Guppy’s moving average band. This is a sign that the Bulls may have lost control and long-term emotions may be bearish. This is often seen as a warning sign that the momentum on the negative side is about to be strengthened, paving the way for notable price weakness.

Other indicators, such as the MACD histogram, also suggest a strengthening of negative side momentum.

Read more: bitcoin whiver for $113,000. Solana and Dogecoin leads earn ahead of Powell’s Jackson Hole speech