- Ethereum fell 4% to $2,575, and took a long liquidation of $64.6 million in 24 hours.

- Open interest fell 4.5% to $31.52 billion, reflecting a lack of trust by traders.

- The ETH/BTC chart bottomed at about 0.045 and copied the 2019 formation before the 2021 breakout.

Ether fell 4% in the last 24 hours, falling to around $2,575 on May 15th. This decline followed a massive decline in the crypto market. A 2.4% decline in total market capitalization was recorded, nearly $3.3 trillion.

It gently reminds me that the bottom before $eth was September 199.

The bull market was then held on the 826th.

Currently, $ETH may have bottomed out a few weeks ago.

It’s just 21 days behind us. That doesn’t mean you’ll finish the bull in the next 50 days. pic.twitter.com/fkwtnxx7d1

– Mycal Van de Poppe (@cryptomichnl) May 15, 2025

The ETH/BTC chart showed how Ethereum created a bottom around 0.045 support. This format is almost a replica of the 2019 Cycle Low, followed by a breakout in 2021. That initial move was preceded by the consolidation period 118 weeks before the upward phase began.

Furthermore, the decline in Ethereum prices is in line with the same pattern as other major digital assets. This suggests an overall decrease in emotion. This adjustment reversed the recent improvements registered at the beginning of the month.

Traders will end their positions as liquidation increases.

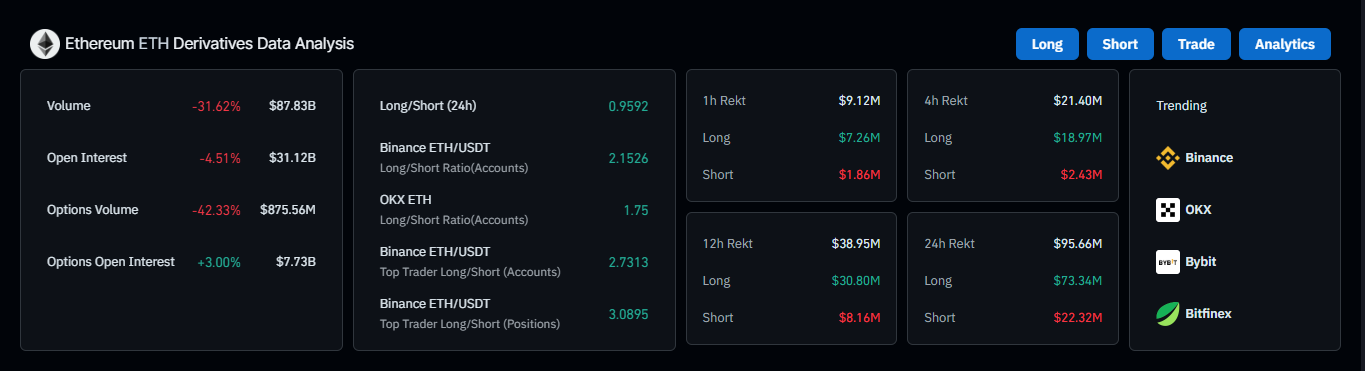

The decline in ether prices led to a massive liquidation of long positions. According to Coinglass data, the long position was worth $64.6 million in 24 hours. However, in the short liquidation, only $21 million was recorded over the same period. This difference shows a significant drop in bullish business transactions as prices reversed.

sauce: Coinglass

sauce: Coinglass

Additionally, open interest fell 4.5% to $31.52 billion, indicating a decline in trader confidence, and the derivative sphere has witnessed less activity. The 24-hour length/short ratio reached 0.9558, pointing to a small seller advantage across positioning.

sauce:Coinglass

sauce:Coinglass

Meanwhile, trading volumes fell dramatically by 32.5%. Together, these figures show a decline and decline in Ethereum’s participation in market activity.

Meanwhile, analysts were watching how forced sales exacerbated the negative side’s movement. The decline in open profits and reduced inflows further confirmed investors’ unwillingness. Such actions were consistent with previous market corrections, which were subject to price pressure following major liquidation and loss of interest.

Technical indicators show slower momentum

Ethereum’s market capitalization continued trading at over $3008 billion at the time of press, a mere 0.93% increase since its last session. The asset previously came above the $275 billion mark, but has since entered short-term integrated mode.

The 4-hour chart’s relative strength index decreased to 53.68 from territory bought at 70, reducing purchasing power. At the same time, the MACD indicator displayed a crossover of signal lines on the MACD line. That means you lose your bullish momentum.

sauce:TradingView

sauce:TradingView

The Fibonacci Retracement Tool has identified essential support at the $302.4 billion 0.236 level. Ethereum surpassed that level and stagnated at $30.846 billion. Below is support measured at $28.5 billion, $27.1 billion and $256 billion.

TradingView

TradingView

Furthermore, recent rally has taken measures as low at $211.6 billion, with significant Fibonacci retracement levels recognized at 38.2%, 50%, and 61.8%, consistent with the historically restrained support zone. The $302.4 billion price is at about $300 billion, suggesting a temporary hold in the current revision process.