Avalanche’s native token Avax responds to the latest news on the growth of the network and has been relocated for Defi, over $35. Additionally, trading volume rose to its highest level in three months to $2.12 billion. Avax also experienced short apertures and settled short positions above $35.

The latest rally also surprised high-lipid whales who were betting on price slides. Total of 17 Whale Holds small amounts of profit or unrealized loss, but only long whales in avax. For now, the token appears to have finished a short liquidation, and the recession is capable of attacking liquidity that has occurred in a long position of around $33.

Avax Open Interes is nearing its peak at $924 million, with over 73% of traders taking long positions. Tokens are one of the relatively old assets of the bull market in 2021, reinventing networks and debt functions.

Avax continues to expand after recent plans Billion Dollar Ministry of Finance Based on Avalanche Foundation discount tokens. Additionally, the chain has increased activity 78K Daily active address.

Avax gathers in a rapid USDC influx

Avax’s USDC is the fastest expanding Stablecoin version based on token terminals data. Over the past month, the chain has expanded its supply by 65.9%, totaling over $1.2 billion.

In total, Avalanche is over $2.4 billion in various stub coins, locking at $22.6 billion.

One of the main factors in the expansion is the chain version of Aave. 33% last month. Recently, Aave C-Chain has also made its way into the top five networks with the largest influx, adding a net $6.3 million over the last 24 hours. The C-chain outperformed with the BNB Smart chain just behind Ethereum and Solana.

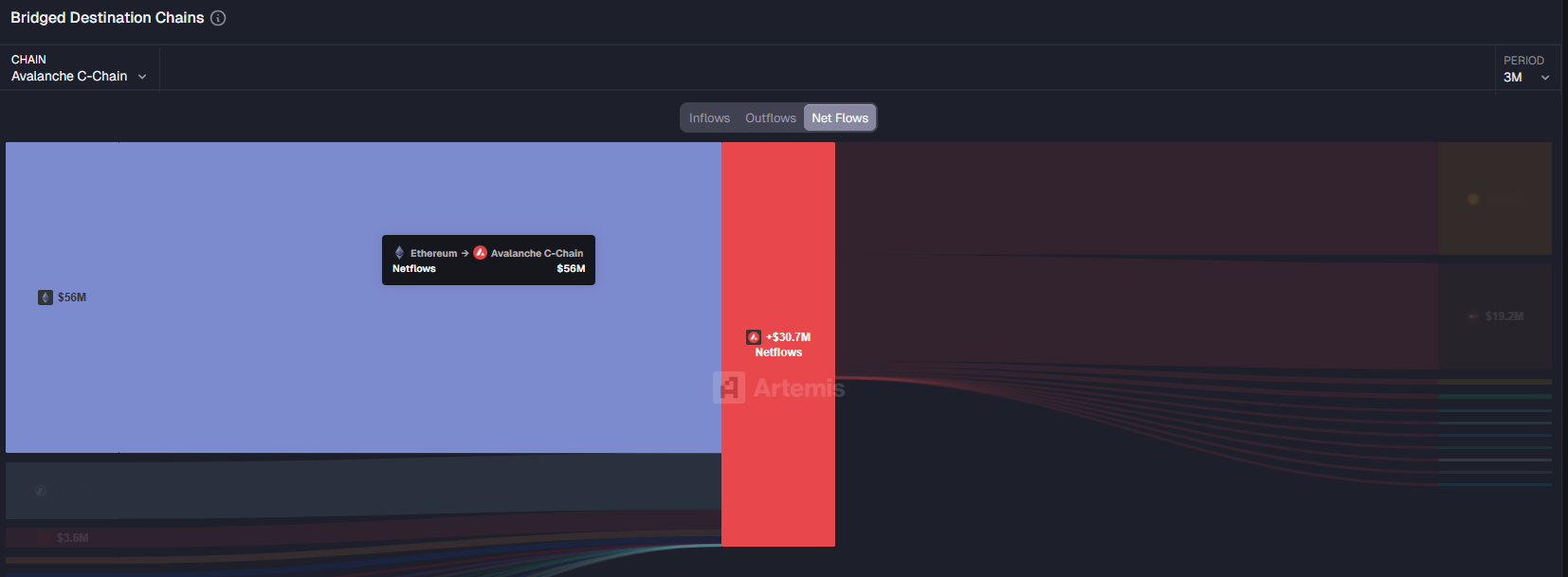

Over the past three months, more than $30 million in nets have flowed into the avalanche C-chain, with most of the funds coming from Ethereum.

Ethereum is the largest source of influx into the avalanche C chain. |Source: Artemis

Avax is seeing other Stablecoin spills, but USDC has an advantage at around 50% of the total standard supply of the chain.

Avalanche achieves the best APY with Aave

Avalanche C-Chain is chosen by users for higher yield opportunities. The chain’s Aave protocol offers up to 5.22% APY in USDC, which is relatively higher than chains like Arbitrum.

The Aave protocol uses the same approach, but still has different yields across different chains. Avalanche achieved the highest yield. This is becoming a major attractor for USDC use.

At Avalanche, Aave’s Eurc Tokens can earn up to 9% yields, while USDC wins 5.22%. Eurc has recently arrived 17.9% Yields show potential niche markets. The USDC deposits are relatively stable based on current APYs provided.

Stablecoin’s arbitration terms may change, but for now, avalanches are being boosted by demand for passive yields. As its drawbacks were recovered in 2025, yield abnormalities have avalanches on the radar.