Bybit has recovered the depth of the Bitcoin (BTC) market to a level even before this February hack. The attack primarily affected Ethereum (ETH), but led to traders and liquidity leaks.

Buybit Exchange has regained liquidity in the Bitcoin (BTC) market and has gradually improved the market depth since the February hacking.

Data collected by Kaito Research It reveals market resilience and current reserve status. It has become a case study of crypto resilience as market operators restructure market depths to control slipping, while regaining trader trust.

Bybit offers an extraordinary liquidity depth for retail orders, creating a deeper pool of matchable prices for smaller traders. This feature could further rebuild retailer trust.

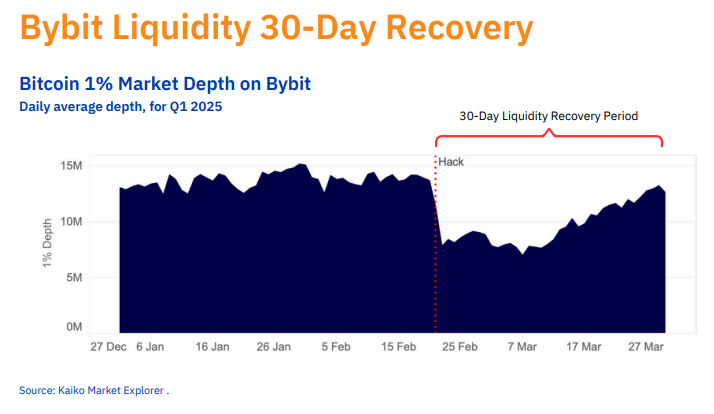

Bibit has restored most of its liquidity in 30 days

Kaito noted that the first 30 days after the hack are important to restructure liquidity and market depth.

Bybit had the most serious liquidity issues in the first month after the hack. |Source: Kaito Research

The BTC market also crashed, but BYBIT negotiated the terms of the loan to ensure that all withdrawal claims were met. Kaito Research noted that the exchange handled a withdrawal request of more than $350,000.

As of May 7, BYBit had carried $2.8 billion daily trading volumes, with BTC still accounting for more than 39% of its trading activities. The BTC market has a market depth of $2.8 million with a 2% slip based on Coingecko data.

According to a report by Kaito, the average daily market depth is $13 million. Nevertheless, BYBIT is considered one of the more fluid and concentrated markets.

The exchange lost some of it market share Following the exploit, we are currently trying to attract users with new ones Traded products. The exchange then had to face a market-wide slump related to US tariff negotiations and the threat of trade wars.

Hacks generally occur when exacerbating market sentiment. Almost all major exchanges have lost some of the fluidity. Bibit’s organized approach to finding sources of fluidity has resulted in the fastest recovery of other exchanges. Some exchanges such as HTX, Bithumb, and MexC saw double digit liquidity in the month after the Bibit hack.

Kite noted that major events disrupt the liquidity of the exchange. Following the June 2023 SEC lawsuit, even Binance lost up to 80% of its liquidity in the 2023 bare market. Some of the lost fluidity has not yet been restored. This makes Bybit’s feat worthy of even more noteworthy following the biggest exchange hack in Crypto’s history.

Altcoins restore liquidity at a slow pace

BYBIT is also a key market for Altcoins and Niche Assets. Following the hack, fluidity regenerated more slowly. About a month after the hack, the exchange recovered 80% of the normal market depth.

Bybit focuses on top 30 altcoins, which has not yet returned to pre-hack market depth. The Altcoin market is also affected by bearish sentiment.

The recovery in the Altcoin market has benefited from the official Trump (Trump), one of the most liquid new tokens in exchange. Established coins and tokens such as Uni, Ondo, LTC increased liquidity by 50% immediately after exploiting.