The BR tokens listed on Binance Alpha have been priced at half after 26 addresses withdrew liquidity of nearly $50 million.

The Binance Alpha program is proud to have a thorough review of the project. However, on Wednesday June 19th, Bedrock (BR), one of the program’s tokens, fell more than 50% after a massive liquidity dump. Social media users have identified several addresses of whales that have sold tokens in a rapid succession.

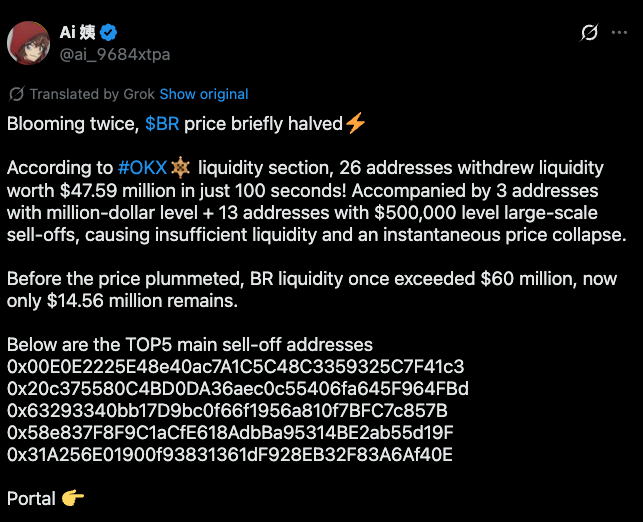

According to @ai_9684xtpa, 26 addresses retracted BR token liquidity by $407.59 million in just 100 seconds. Three of these addresses held more than $1 million in tokens, while 13 held more than $500,000.

Screenshot of translated post by @ai_9684xtpa Description of BR token crash | Source: x

Withdrawals near liquidity caused a price collapse. BR is currently trading 44% lower in the last 24 hours. The coordinated timing of these whale transactions sparked speculation that addresses could have acted in concert.

It is also possible that the token is held by team members or by fraudulent insiders, but this has not yet been independently verified.

You might like it too: Chain Analysis: Over 4.5% of all tokens released in 2024 have pump and dump characteristics

Binance Alpha faces criticism

Binance Alpha has become a hugely successful product for marketing Binance wallets. Thanks to the rewards of providing vinance wallet users, the wallet app has been far more maximized in terms of trading volume.

Still, the project attracted some criticism as traders claimed that alpha users were getting all the rewards. Additionally, the latest BR prices collapse has led some to call the program a bubble.

Pump and dump schemes, also known as lag pulls, are a type of cryptographic scheme in which whales try to artificially inflate the price of a token, and are sold only afterwards.

read more: The largest crypto market operation ever recorded