Binance’s spot trading volume surpassed all other exchanges, reaching an impressive market share of 41.87%. This is the best in the last 10 months.

Binance has solidified its position as a major crypto exchange. However, this domination raises concerns about market concentration and wider impact on the crypto industry.

Binance continues to lead the Crypto market

Binance has strengthened its top crypto exchange status, with its spot trading volume combining all its competitors. In a post by analyst Joao Wedson on March 30, 2025, X highlighted that Binance’s spot trading volume is eight times that of Coinbase, the largest exchange in the US.

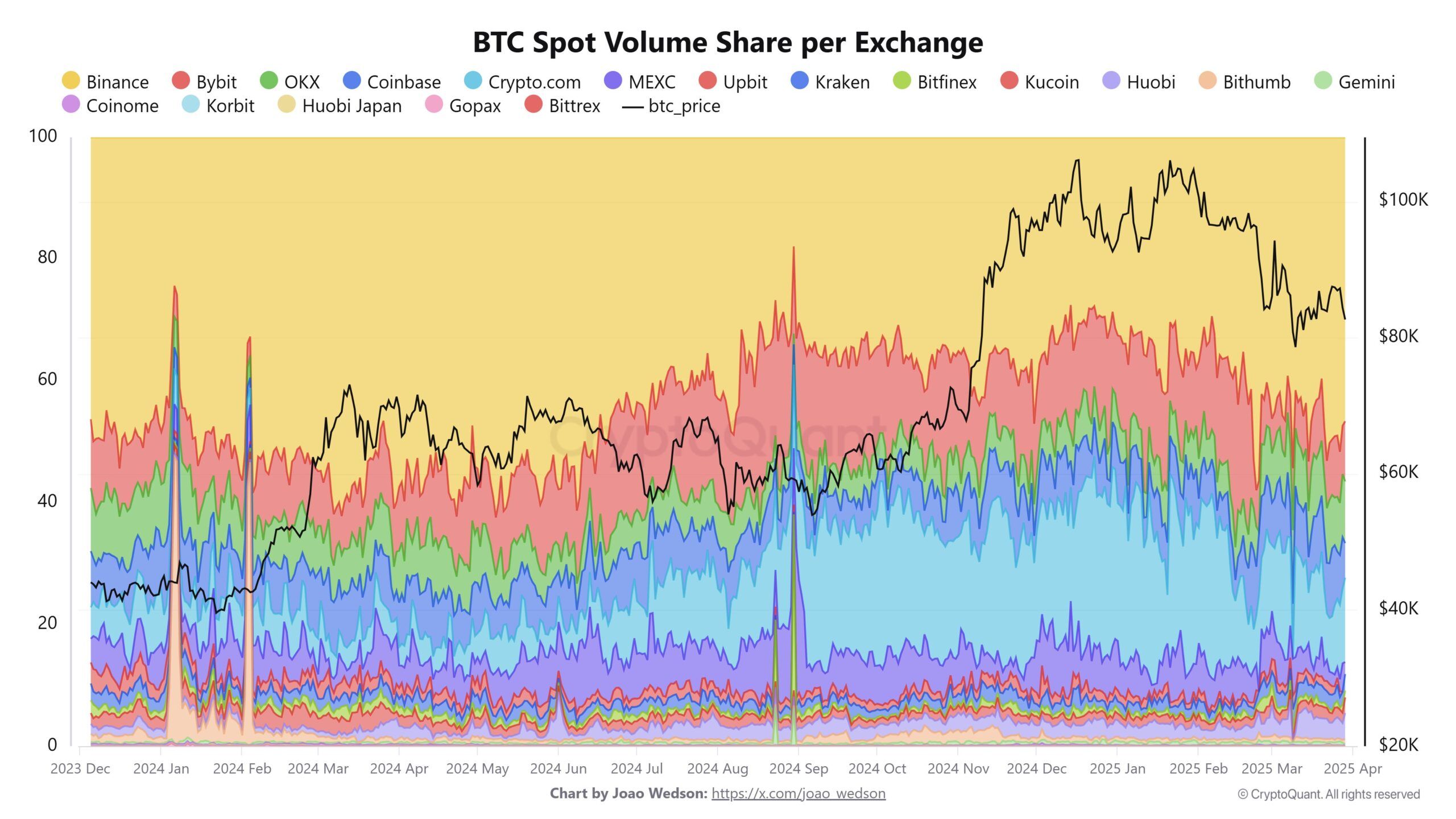

BTC spot volume share per Exchange. Source: Joao Webson/X

This figure is down compared to early 2024, but shows Binance’s global dominance. Despite the decline in overall spot trading volume across the market, Binance’s leadership remains unshakable.

Additional data from X’s encrypted posts show that Binance’s market share has risen to 41.87%, indicating a 10-month high. This number is five times more than Coinbase and nearly six times more than another major player, OKX.

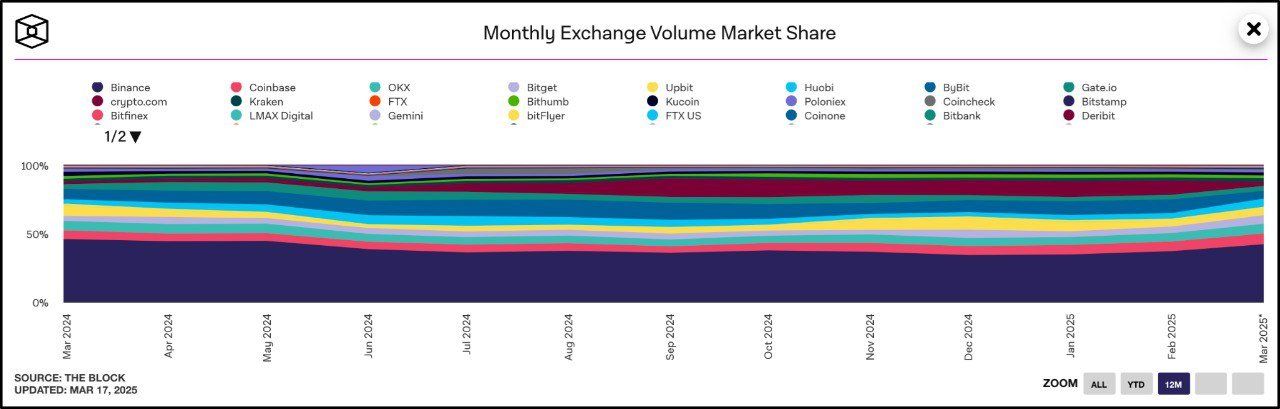

Monthly exchange volume market share. Source: Cryptoverse/x

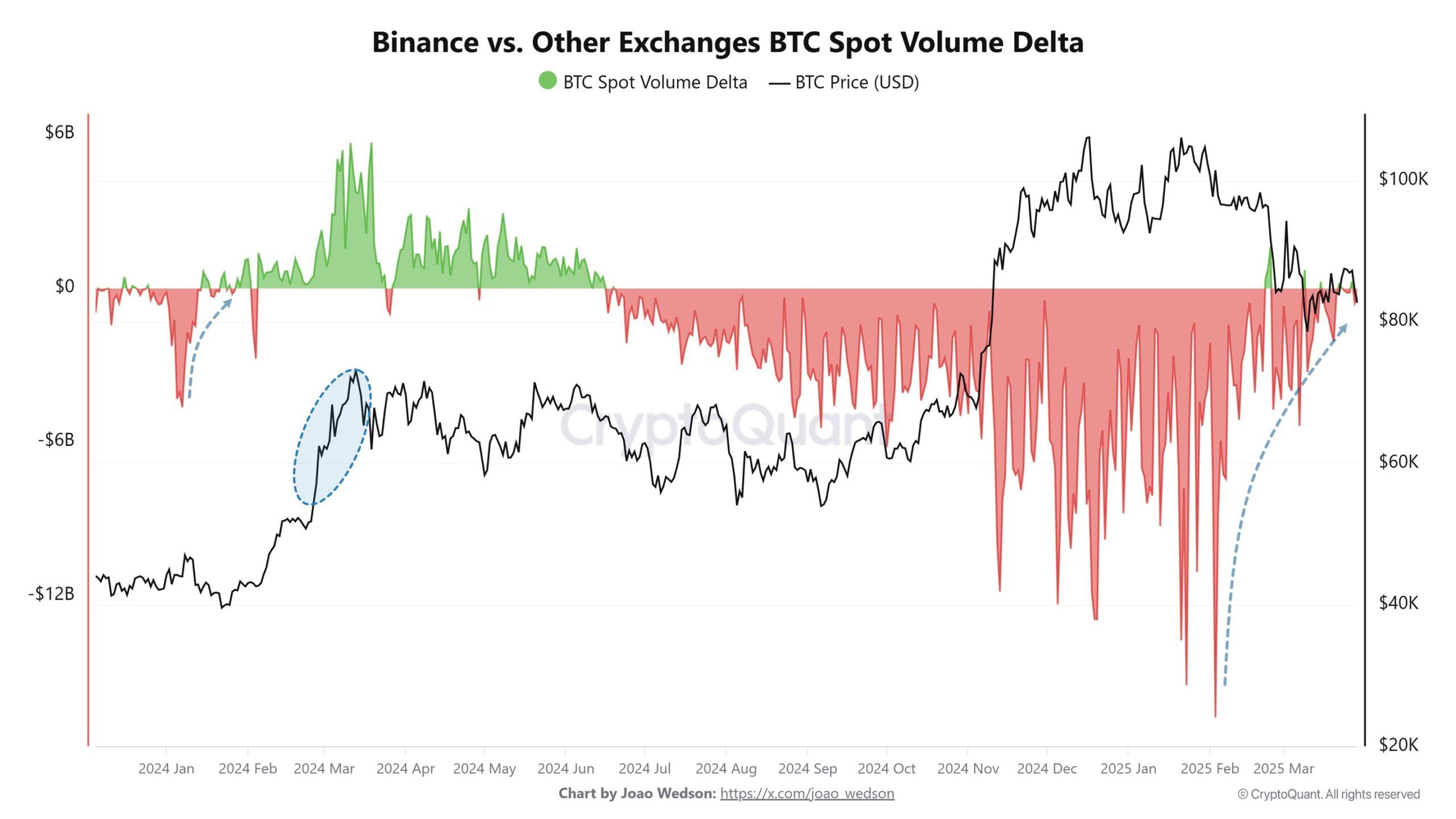

One of the most interesting aspects of Binance’s advantage is its historical correlation with Bitcoin price movement. According to Joao Wedson, in January 2024, when Binance’s spot trading volume first combined all other exchanges, Bitcoin prices were raised from $42,000 to $73,000 the following week.

Binance vs. Other replacement BTC spot volume delta. Source: Joao Webson/X

This pattern will be repeated in 2025. Binance and Other Exchange BTC Spot Volume Delta Index measured the difference in Bitcoin Spot trading volume between Binance and its competitors, and once again became positive. Analysis shows that this could indicate a bullish trend for Bitcoin over the coming months, even if the overall spot trading volume drops.

The correlation suggests that vinance advantage could be a major indicator of Bitcoin Bull’s execution. The ability of exchanges to attract key trading activities often reflects market interest and increased liquidity. This will help drive price momentum.

Several factors contribute to Binance’s sustained domination in the cryptocurrency market. First, its extensive global reach. According to Binance Report, the exchange serves more than 250 million users worldwide and consistently reports daily trading volumes of over $30 billion. Meanwhile, data from the block shows that Coinbase has 110 million users and only processes around $15 to $20 billion each day.

On the positive side, Binance’s high trading volume increases market liquidity, making it easier for traders to execute bulk orders without causing significant price fluctuations.

However, Binance’s overwhelming market share raises concerns about centralization. This could make Binance vulnerable to hacking and data leaks. Binance has also been caught up in many accusations related to the token list, causing mixed responses in the community.