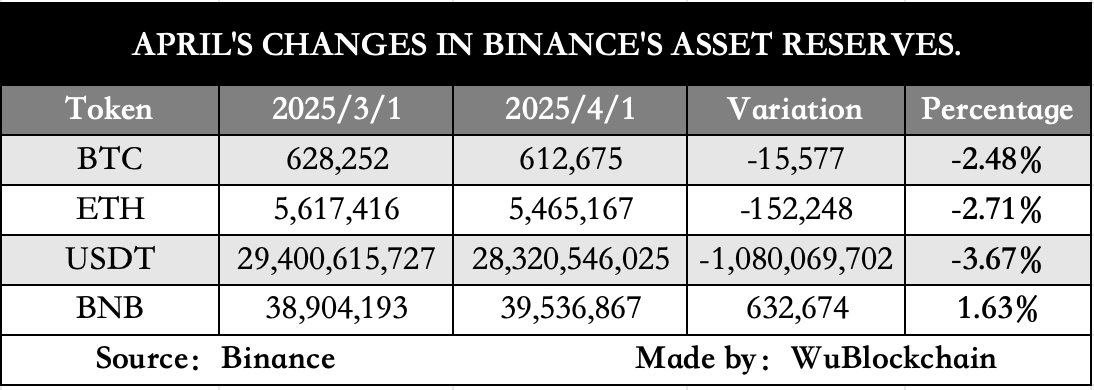

Binance Exchange has published its 29th Reserve Snapshot Report, based on what was taken on April 1, 2025. The report suggests that some of the largest cryptocurrencies carried by users of the platform have declined compared to last month.

Based on the numbers, Binance customers’ Bitcoin (BTC) holdings have reached 612,675 BTC. This is a 15,577 BTC (2.48%) decrease from the March 1 tally. Ethereum (Eth) Holdings has also dropped to 5,465,167 ETH. This represents a decrease of 152,248 ETH, about 2.71% since last month.

USDT Holdings recorded the largest percentage of its major assets, down 1.08 billion tokens (3.67%) to reduce USDT 28.32 billion. Compared to these declines, the traditional binance token BNB was the only important cryptocurrency with increased holdings.

Bitcoin Exchange Reserve lowers 15,577

The April 1 snapshot reveals that Bitcoin is reserved at a 612,675 BTC binance stand, with a collateral ratio of 100.99%. This ratio shows that the bitcoin needed to fully back up all customer deposits holds a little more bitcoin.

The exchange maintains 618,757 BTC in total net balance, 605,936 BTC is held directly in exchange, with 12,821 BTC retaining third party custody.

Source: WU Blockchain

Ethereum Holding follows a similar pattern with a customer net balance of 5,465,167 ETH, backed by a Binance Net balance of 5,466,653 ETH. The exchange maintains 5,285,682 ETH and 180,971 ETH on its platforms with third-party custodians.

USDT, which saw the largest percentage decline of key assets, maintains a healthy collateral of 104.42%.

28,320,546,024 USDT’s customer net balance is supported by a Binance Net balance of 29,572,017,129 USDT. Most of the USDTs were held on the exchanges of 2,890,216,271. Third-party custody included 681,800,858 USDT.

BNB was the only major asset to see growth in its April snapshot. Customer holdings increased to 39,536,866 bnb, supported by a 44,097,353 bnb binans net balance. Almost all BNBs (44,064,761) are held directly in exchange for just 32,591 BNB under third party custody.

Altcoin and Stablecoin Reserve Changes

In addition to the major cryptocurrencies, a backup proof report from Binance also reveals information about multiple Altcoins and Stablecoins on the platform.

Solana (SOL) corresponds to the net position of SOL customers of 25,938,721, supported by a collateral ratio of 100.04%. There are 25,615,708 SOLs directly on the exchange and 333,985 SOLs under third party custody.

Stubcoins other than USDT have different levels of reserve and collateral. USDC has the highest collateral ratio at 145.04%, with customer balances secured by USDC at 6,943,870,159 USDC at Binance Net Balance of 4,787,658,119 USDC. FDUSD has a robust 109.64% ratio, while TUSD is 102.45%.

Dogecoin (Doge) has a customer balance of approximately 15.2 billion Doge and a collateral rate of 111.64%. This results in a class of assets that are above average backed on the platform.

Other altcoins in the report are:

- XRP: 2,574,947,371 customer balance at 103.79% collateral ratio

- DOT: 137,981,565 customer balance, with a ratio of 104.79%

- Link: 100.34% ratio with 66,985,355 customer balance

- LTC: 6,648,918 customer balance at 109.13% ratio

SHIB shows a collateral rate of 100.53% for its large customer holdings, exceeding 56 trillion tokens. Trump Coin shows a customer balance of 45,556,616 tokens at a 100.60% ratio, while SUI holds 371,025,478 tokens at a 100.97% ratio of customer balances.

Reservation Proof Methodology and Security Measures

The Binance Exchange reserve proof mechanism is based on Merkle tree validation to allow users to independently verify that an asset is part of the reported amount of the exchange. This process involves generating encrypted proofs that certify the customer funds that reside in the exchange wallet without revealing any sensitive user data.

In the April 1 snapshot, Binance continued to set up a verification process that covers both exchange balances and third-party custody.

The two-character model is a risk management procedure, with most funds held in exchange-controlled wallets for operational reasons and held by trusted third-party custodians.

This report shows the different distributions between assets exchange balances and third party custody. In the case of Bitcoin, approximately 97.9% of the reserves participate in the direct exchange, with only 2.1% being under third-party custody. The same applies to ETH (96.7% for exchange) and BNB (99.9% for exchange).

Certain assets represent more substantial holdings in third party custody. For example, in Pepe, customers have 176 trillion tokens under third-party custody, totaling over 94 trillion tokens.