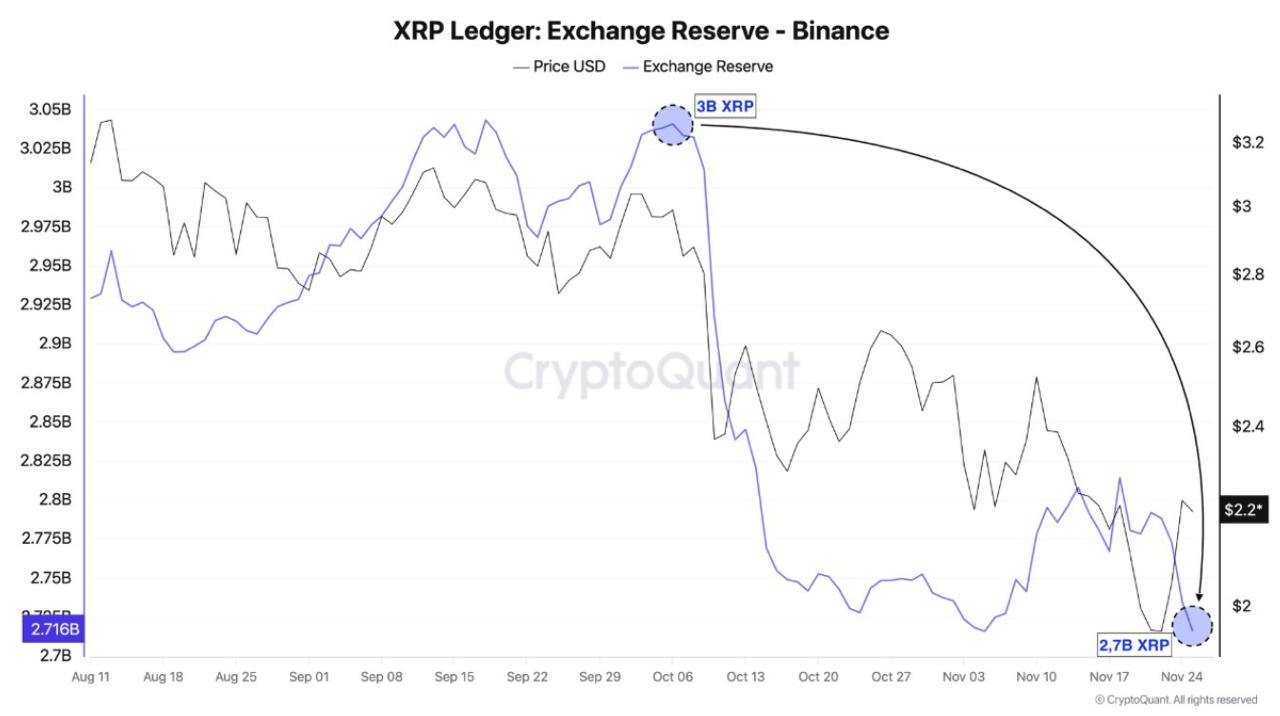

XRP reserves held on Binance have fallen sharply in recent weeks, suggesting increasing pressure on the liquid exchange’s supply at a time when the token is trying to stabilize after months of selling fatigue.

Per data retrieved from on-chain analytics platform by Finbold cryptoquantXRP exchange reserves have declined from approximately 3 billion tokens in mid-October to just 2.71 billion tokens as of November 27, consistent with a continued decline in price momentum.

During its peak accumulation period of approximately 3 billion XRP, the asset was trading around $3.025, but it is currently trading at $2.17, marking an increase of just 1% in the past 24 hours. A sharp contraction in foreign exchange reserves indicates either increased withdrawals towards self-storage or strategic long-term holding actions at lower price levels.

XRP price divergence

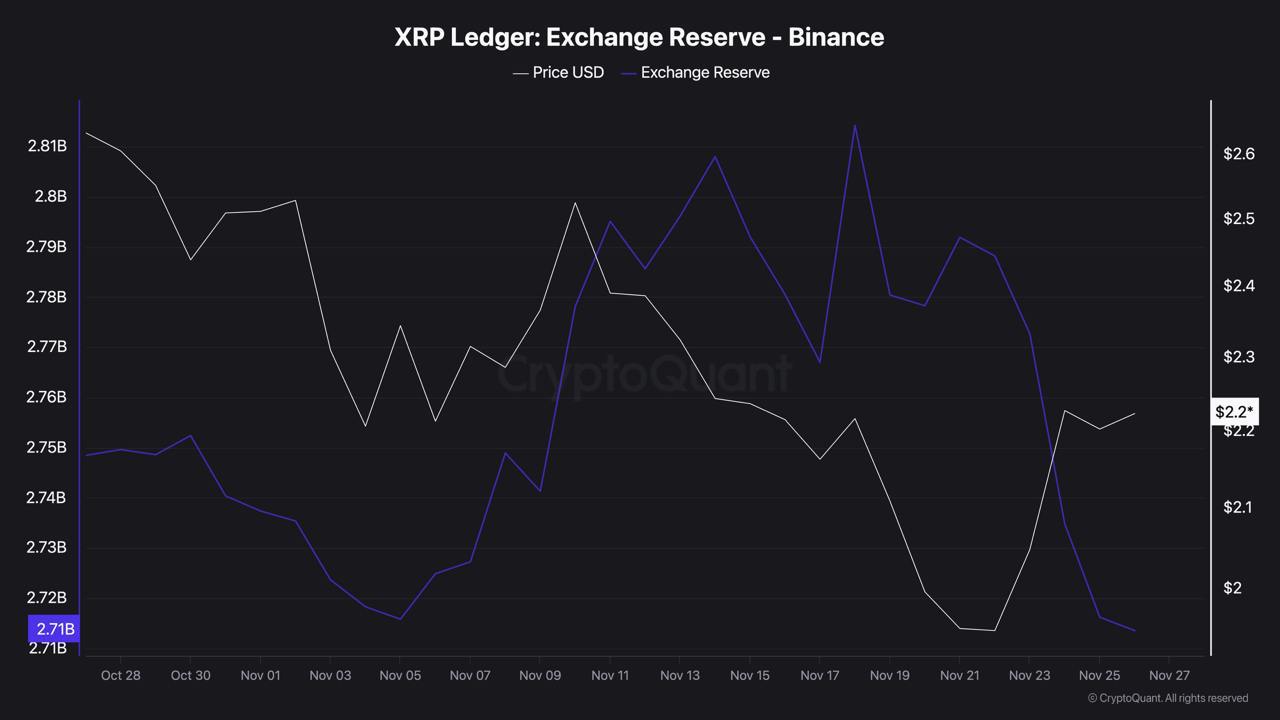

XRP prices have been steadily declining since early November, but at the same time exchange-held reserves have also been trending lower, indicating a potential inverse relationship between available liquidity and investor confidence. A decline in foreign exchange reserves is usually considered a bullish indicator over the long term. This is because reduced supply limits pressure on sellers and can increase price elasticity when new demand arises.

However, the move also reflects fragility in short-term sentiment, with market participants hesitant to deploy capital until XRP moves beyond key resistance levels, particularly the $2.40-$2.50 range that has capped multiple upside attempts this month.

If supply continues to shrink, institutional investor interest in XRP may increase.

Historically, supply reductions on major exchanges such as Binance have been preceded by accumulation from wealthy individuals and custodial platforms seeking lower entry points.

That said, momentum remains weak across the broader altcoin market, consistent with heightened macro uncertainty ahead of the December Federal Reserve meeting. XRP is currently trading near its two-week moving average, reflecting a sideways consolidation rather than a definitive trend reversal.

Can XRP sustain support above $2.15 as liquidity tightens?

With foreign exchange reserves at their lowest level since August, market trends increasingly depend on whether XRP can sustain support above $2.15. A break below this level could trigger risk aversion and invalidate the bullish supply-driven theory. Conversely, if current levels continue to be sustained, coupled with continued provision reductions, XRP could be structurally primed for a stronger breakout if institutional flows start to materialize.