Partisan fiscal disputes have led to cryptocurrency recovering since the US federal government shut down midnight on Wednesday.

Federal impasse pushes Bitcoin to record highs

It was the third day of the federal government closure, but by looking at the market, I couldn’t tell. Stocks are mostly on the rise, with the exception of a few high-tech companies such as AI company Palantir Technologies (NASDAQ: PLTR). The broader crypto market has jumped 1.48% since yesterday, with Bitcoin (BTC) at a record high of less than $2,000, bringing the broader crypto market to around $4.2 trillion.

The US government ran out of money in the middle of the night Wednesday and was forced to close for 15 years from 1980. Senate Republicans and Democrats had proposed temporary funding bills to avoid the closure, but both failed, leaving millions of federal employees in the area. Previous closures occurred at the end of 2018 under the Trump administration. It was the longest ever, lasting 35 days and costing an estimated $3 billion, according to Democrats.

Then, just hours after closure on Wednesday, personnel firm ADP filed a terrible indictment of the previous Fed’s interest rate policy by reporting that the country’s private sector lost 32,000 jobs. But even that didn’t surprise investors who were even more bullish in anticipation of additional interest rate cuts later this year.

“BTC will print a fresh all-time high next week and will likely hit my third quarter forecast of USD 135,000 soon after,” said Jeffrey Kendrick, head of digital assets research at Standard Charter Bank. “This closure is important. During the previous Trump closure (December 22, 2018 to January 25, 2019), Bitcoin was in a different place than it is now, so it was very rare.”

Market Metric Overview

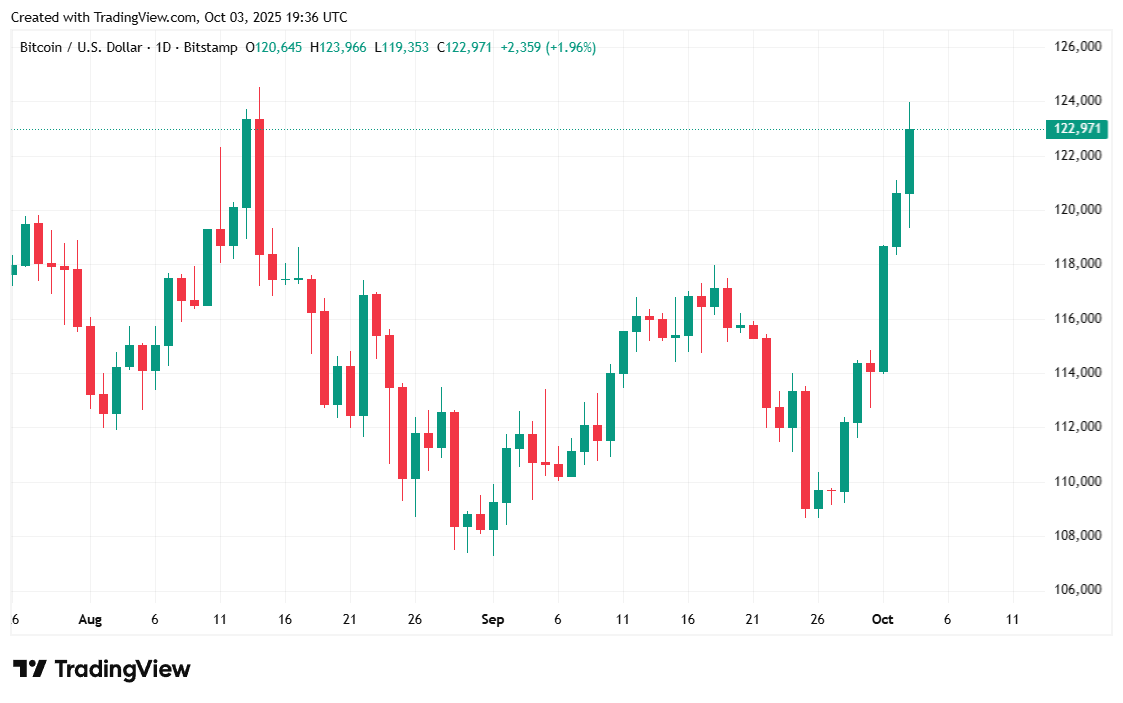

Bitcoin increased by 1.62% over 24 hours at $122,958.26 at reporting, and increased by 12.55% over 7 days based on CoinmarketCap data. Digital assets have fluctuated between $119,344.31 and $123,944.70 since yesterday.

(BTC Price/Trade View)

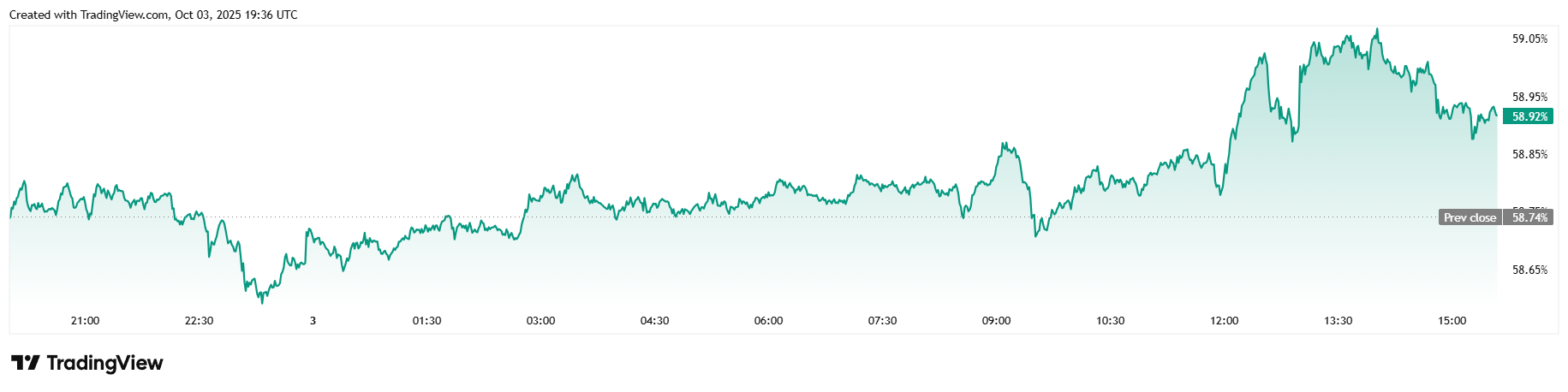

The 24-hour trading volume rose 19.25% to $870.9 billion, while the market capitalization rose 1.44% to $2.44 trillion, along with the price. Bitcoin’s dominance rose 0.31% to 58.91% as cryptocurrencies surpassed most of the Altcoin market.

(BTC dominance/trade view)

Total interest on Bitcoin futures rose 1.03% to $8,9630 million in 24 hours, according to Coinglas, with Bitcoin liquidation jumping to $211.58 million since yesterday. Many of them were short liquidations, tilting the scale at $153.36 million, with the rest coming from Long, explaining that the overall liquidation is less than $58.22 million.