Bitcoin soared above $94,000, ending several days of sideways trading between $88,000 and $92,000.

The breakout arrived suddenly on December 9th, accelerating within minutes and breaking out of the range that had been the upper end of the market for almost a week.

Whale accumulation and short-side liquidity fuel breakout

Trading data shows that in the hour leading up to the rally, large amounts of money flowed into wallets linked to major institutional investors and exchanges.

Some high-capacity custodial addresses have accumulated thousands of BTC in a short period of time, indicating that liquid buyers were the first to move before the squeeze took hold.

🚨 Breaking news:

Here’s the exact reason why Bitcoin skyrocketed.

Binance purchased 7,298BTC

COINBASE purchased 3,412BTC

Wintermute purchased 2,174 BTC

BlackRock purchased 1,362 BTC

Random whale bought 6,192 BTCThis is the biggest insider pump ever!! pic.twitter.com/SImfFYuGT8

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) December 9, 2025

The speed of the breakout suggests that the order book will quickly thin out once the range resistance is broken. Momentum then gained momentum as the market structure changed rapidly and shorts began to close under pressure.

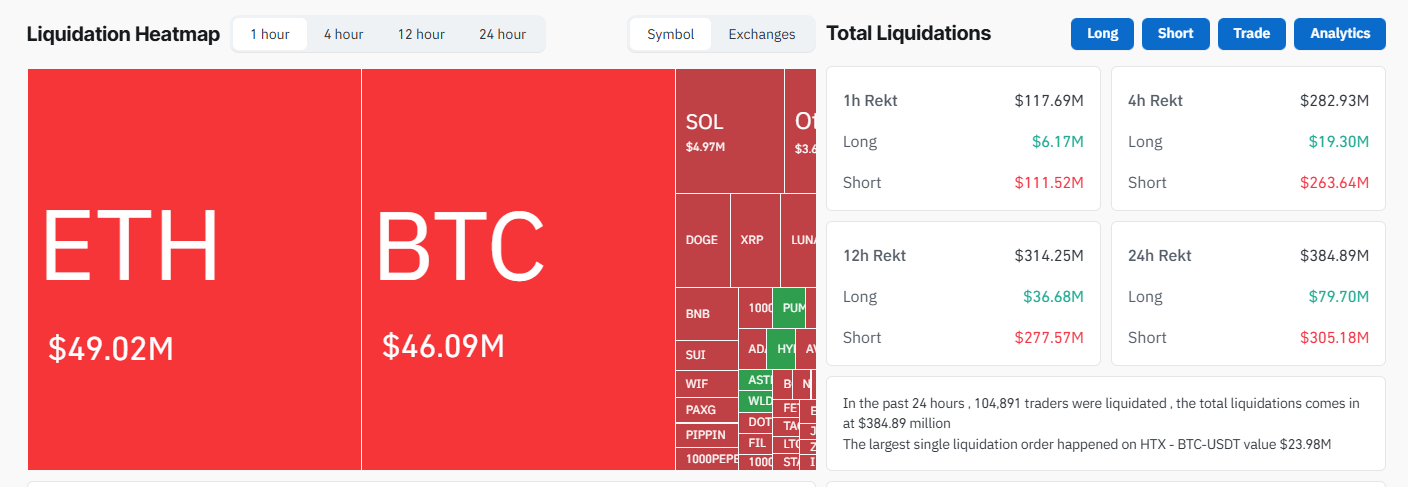

Liquidation data confirms that the futures market actively absorbed this movement. more 300 million dollars Bitcoin accounted for more than $46 million and Ethereum accounted for more than $49 million in total crypto liquidations in the past 12 hours.

Most liquidations were short positions, indicating that the move was a classic squeeze rather than a gradual trend build.

Once the cascading stop was triggered, price expansion accelerated vertically with little countervailing supply.

Regulatory support and FOMC expectations fuel sentiment

The rise followed a notable policy update from the U.S. Office of the Comptroller of the Currency, which confirmed that banks may engage in risk-free principal crypto trading. The decision will allow regulated institutions to broker the flow of cryptocurrencies without directly owning the assets.

This change could provide greater access for institutional investors, and the timing, just hours before the breakout, may have facilitated positioning.

OCC Interpretation Letter 1188 confirms that national banks may engage in risk-free principal trading of crypto assets as part of their banking operations. https://t.co/gXirMExhCi pic.twitter.com/uPRFGqb2NZ

— OCC (@USOCC) December 9, 2025

As the Federal Reserve approaches its decision on interest rates, traders are now hoping that confirmation of a rate cut will ease liquidity conditions.

Bitcoin is hovering near intraday highs as volatility increases and funds reset across derivatives. The market will be watching to see if follow-through demand continues until the FOMC announcement, or if profit-taking dampens the upside momentum.

The post Bitcoin soars above $94,000 after a week of stagnation and why appeared first on BeInCrypto.