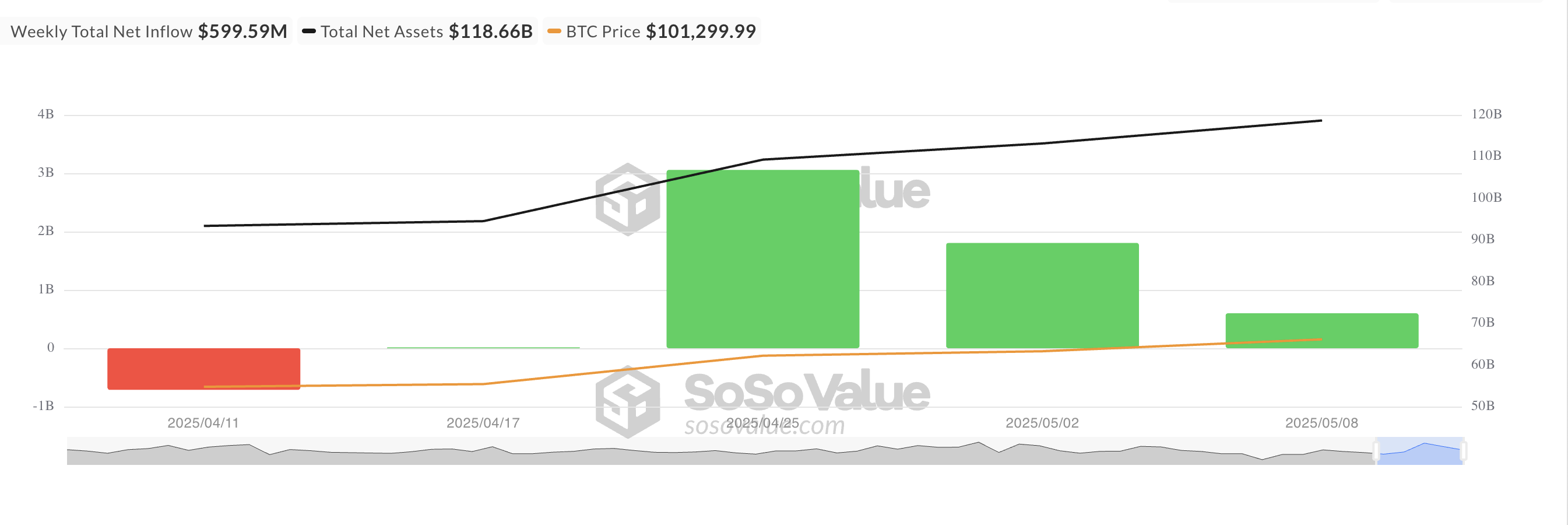

Last week, Bitcoin-backed funds had net inflows of $600 million. This was a positive inflow of capital, but represents a sharp 67% decline from the recorded $1.8 billion the previous week.

Interestingly, a slower flow at the facility occurred despite the rally, when BTC surpassed the $100,000 price mark for the first time since early February. So, what does this divergence tell us about investors’ feelings?

Bitcoin ETF capital inflows decline amid cautionary investors’ sentiment

Last week, the inflow into Spot BTC ETFs totaled $600 million. It was a net positive in terms of capital inflows, but these funds marked a 67% DIP from the $18.1 billion seen last week.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

In particular, this trend occurred the same week that, for the first time since February, major coins decisively violated the $100,000 price mark. This suggests that rather than causing a shopping frenzy, some ETF holders have now locked their profits or refrained from fresh entries.

The decline in influx last week suggests that while the institutional appetite for BTC exposure remains, the pace is slowing down perhaps due to attention and fear. This reflects the wait attitude from investors who have been waiting for the coin to exceed $100,000, and see if they can stabilize beyond that key level.

Bitcoin sees bullish signals from the derivatives market

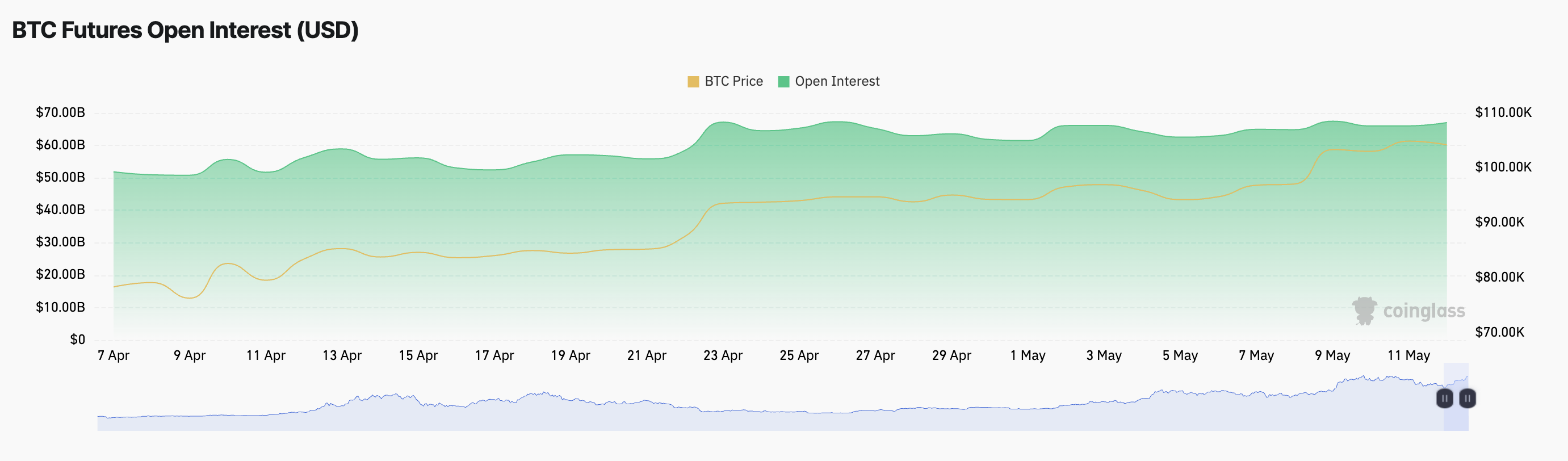

BTC trades at $103,979 and has earned 0.24% over the last 24 hours. During that period, open interest in BTC futures rose 2%, reflecting an increase in trading participation. At the time of pressing, this is $67.044 billion.

BTC futures are open to interest. Source: Coinglass

It shows the confidence in BTC prices and open interest as more traders are taking their positions. This combination suggests a strong trend, with traders expecting price movements to continue in the direction they are heading.

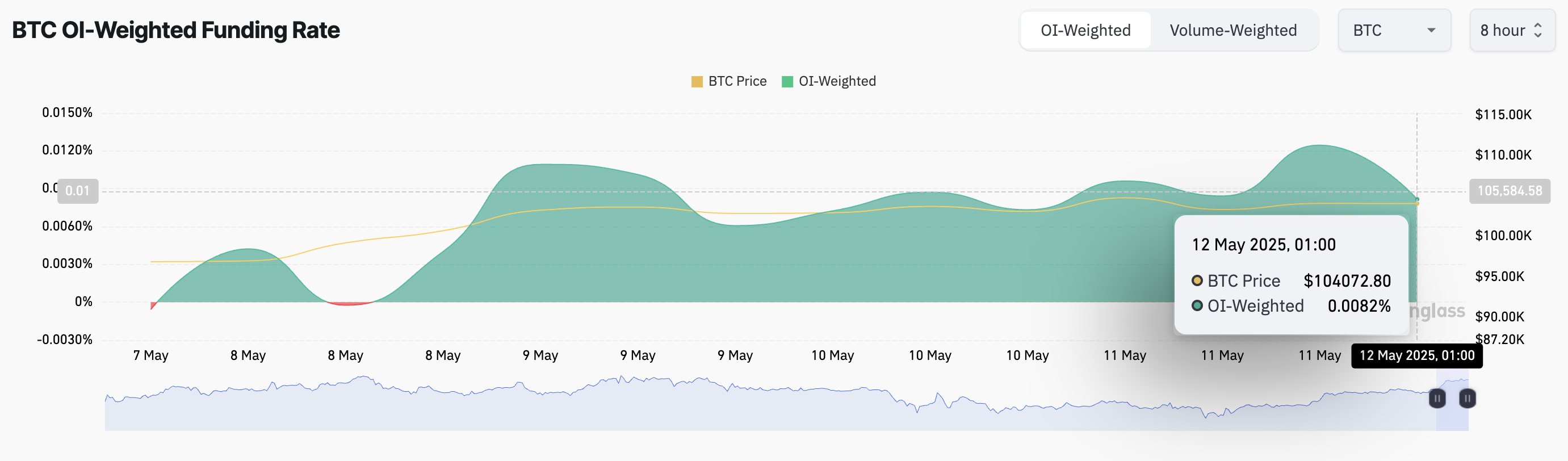

Furthermore, the coin’s funding rate remains positive at 0.0082%. This means that the long position pays for the shorts, indicating that market participants are bullish.

BTC funding rate. Source: Coinglass

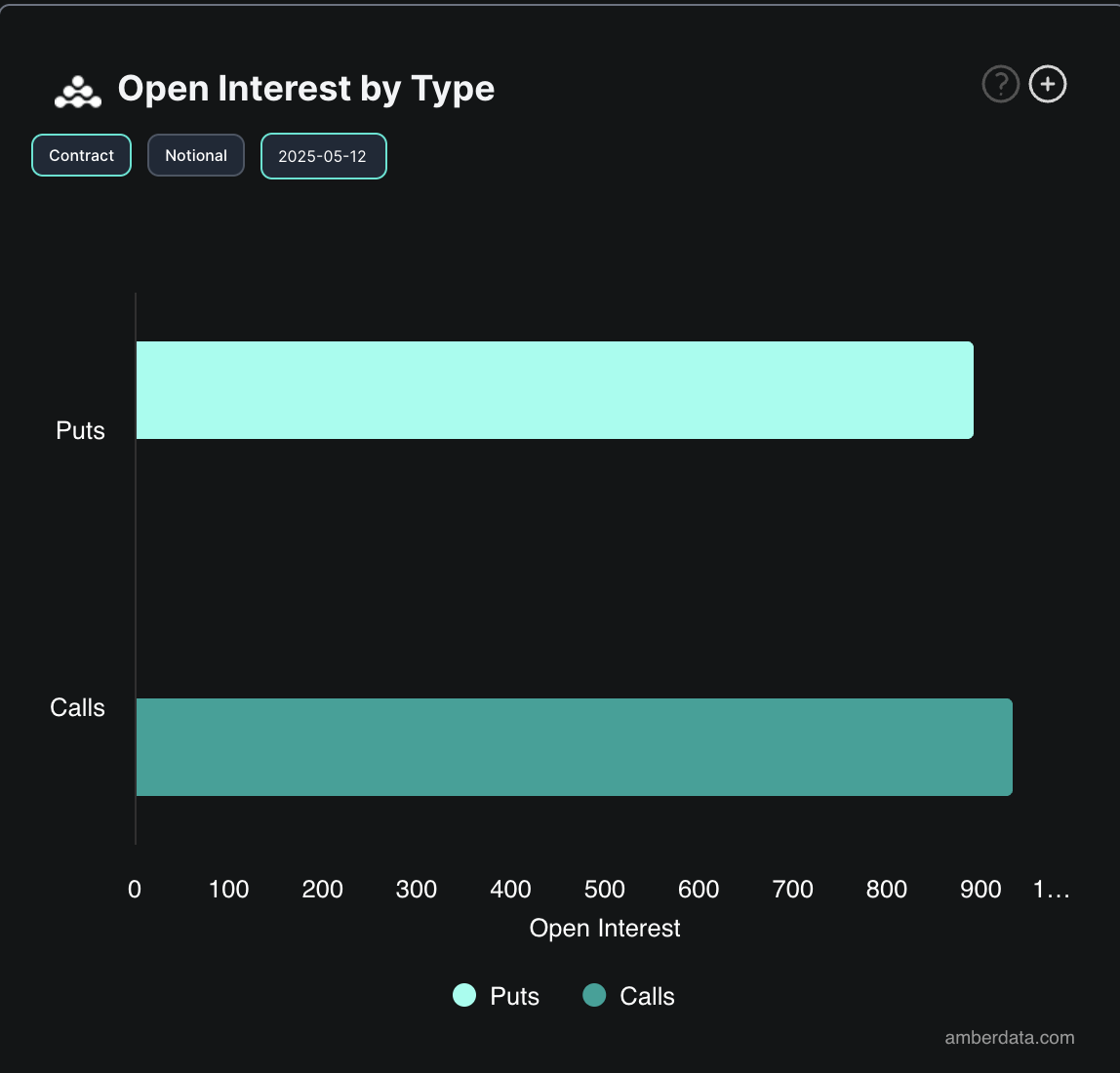

Activities in the options market also strengthen this bullish outlook. Today, call contracts are beyond puts, indicating that traders are betting more upside down.

Interested in BTC options. Source: Deribit

A combined reading of these metrics suggests that ETF influx may be pervasive, but broader market sentiments remain confident and risk-on.