Bitcoin (BTC) has struggled to set up an optimistic form that has led to a decline over the past two months since its new record high in January. According to the prominent market analyst EGRAG Crypto, premium cryptocurrency can maintain a modification for the next few months before starting the price rally.

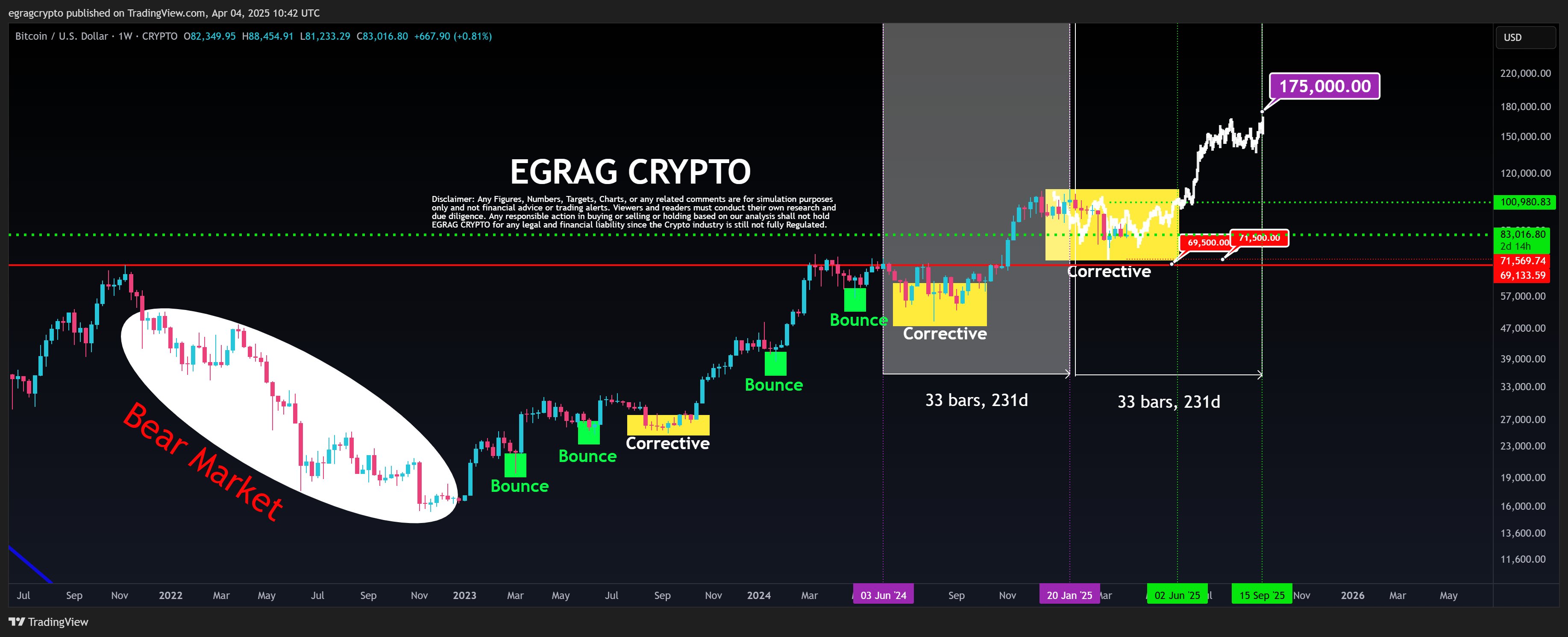

Bitcoin’s 231 -day cycle suggests a $ 175,000 goal by September.

Due to the initial price drop in February, EGRAG Crypto assumes that Bitcoin can experience price modifications due to the CME gap before Bitcoin experiences the price bounce. However, over the past few weeks, the lack of strong strength has concluded that Premier Cryptocurrency is in a potentially long fertilization stage.

According to EGRAG in recent posts, Bitcoin’s continuous correction matches the fractal pattern. This pattern is transported by the BTC to an explosive price rally at the 33 bar (231 days) cycle.

Compared to the current cycle of the previous cycle, EGRAG predicted that Bitcoin could potentially withdraw from regeneration by June. In this case, the analysts expect the Crypto Market leader to record the highest market of $ 175,000 by September, suggesting that it will suggest 107.83%of the current market price.

However, when igniting this price rally, Market Bulls must ensure $ 100,000 breakdown than a stiff price barrier. On the other hand, the potential of less than the support price of $ 69,500- $ 71,500 invalidates the current optimistic setting and knows the end of the current bull run.

BTC investors wait until the exchange activity is slow.

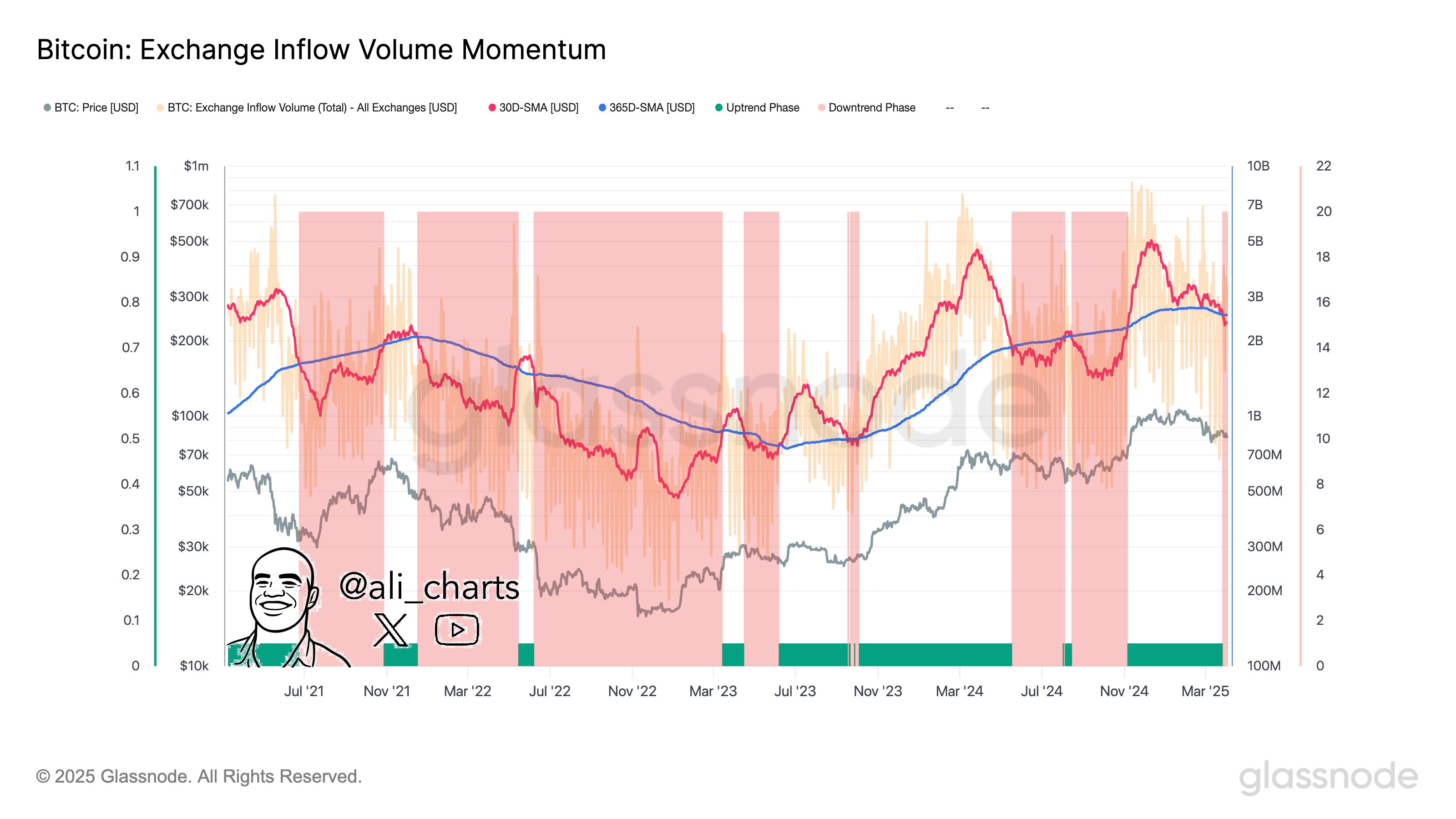

In other news, Ali Martinez, a popular encryption expert, reported that the Bitcoin exchanges related to the decrease in the interest and network utilization of investors. In particular, the development suggests that investors are hesitant to deposit or withdraw bitcoins on the exchange due to market uncertainty over the immediate future trajectory of assets.

According to Martinez, Bitcoin is now more likely to go through trend changes as investors are waiting for the next market catalyst. In particular, Bitcoin showed praise resilience despite the new tariffs imposed by the US government on April 2. According to Santiment’s data, the price of the BTC dropped only 4% in several hours after the announcement, and it is a gentle response compared to the previous tariff -related market movement.

Since then, BTC has risen, and it has been traded at $ 83,805 as investors gathered in the encryption market and recorded $ 5.16 billion in the past. Meanwhile, BTC’s trading volume increased by 26.52% and $ 43 billion.

The main image of UF News, the chart of TradingView

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.