Bitcoin BTC$115,812.25 It’s about 4% more than a week ago. It’s good news about digital assets, but bad news for the economy.

The recent negative tone of economic data points since last week has raised expectations that the Federal Reserve will cut interest rates on Wednesday, making risky assets like stocks and Bitcoin more attractive.

Let’s summarise the data supporting that paper.

The most important figures for the US CPI came out Thursday. Headline rates are slightly higher than expected, and sign inflation may be more sticky than expected.

Before that, there was a revision to Tuesday’s job data. The world’s largest economy has generated nearly 1 million jobs than reported in the year ended March.

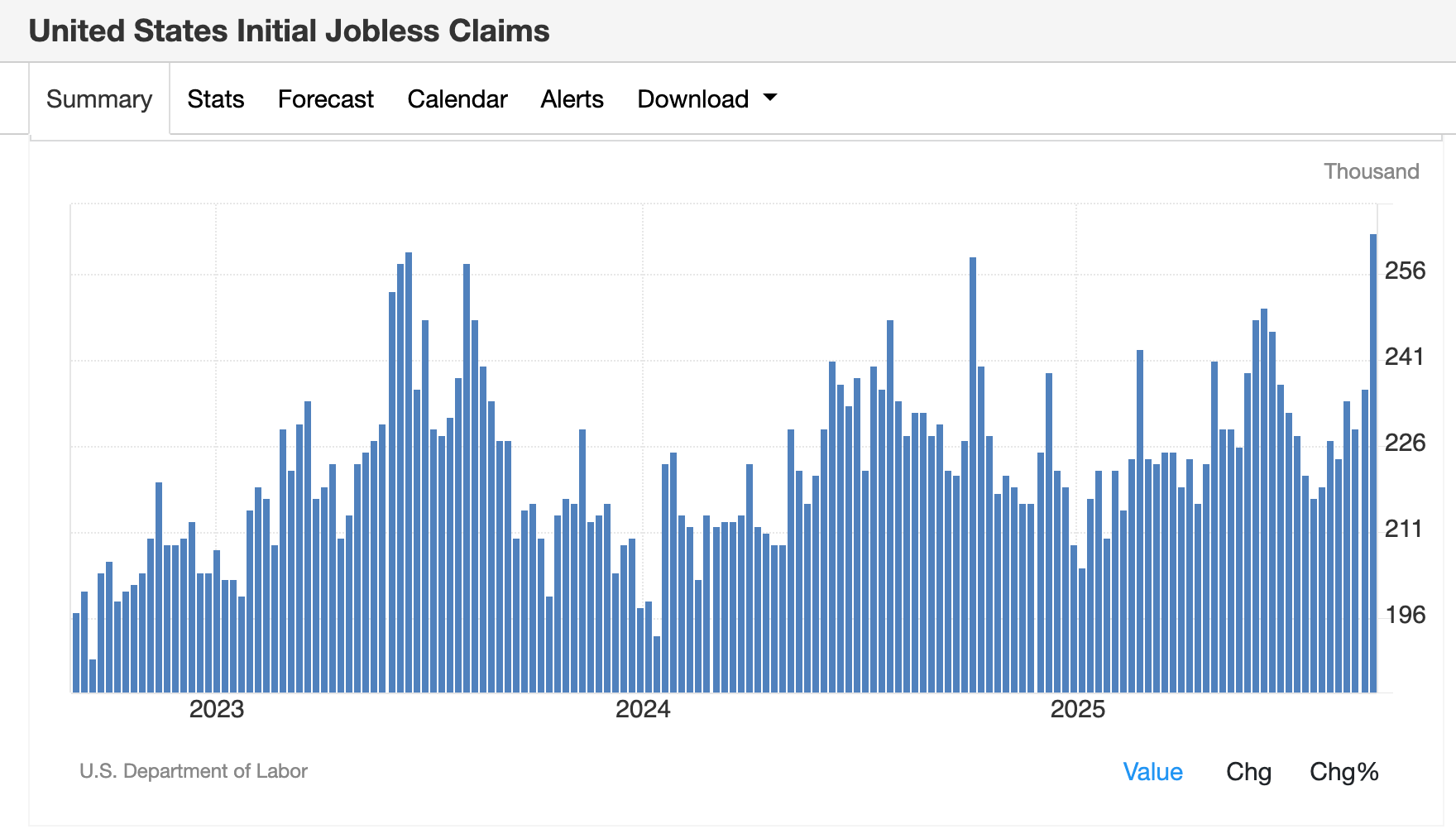

The numbers followed the highly watched monthly job report released last Friday. The US added just 22,000 jobs in August, bringing the unemployment rate to 4.3%, the Bureau of Labor Statistics said. The initial unemployed claims rose from 27,000 to 263,000. This is the best since October 2021.

Our First Unemployment Claim (TradingConomics)

Higher inflation and less work are not great for the US economy, so it’s not surprising that the term “stagflation” is beginning to creep up into the macroeconomic commentary.

Against this backdrop, Bitcoin almost closed its CME futures gap at 117,300 on Friday, taking into account risky assets from Wall Street.

It’s not surprising, as traders are also bidding on stocks, the biggest risky asset. Let’s take a look at the S&P 500 index. This closed on the second day record with hopes of rate reduction.

So, how should traders think about BTC price charts?

For this charter enthusiast, the price action remains constructive, forming a higher low from the September bottom of $107,500. The 200-day moving average rose to $102,083, while short-term holders saw prices (often used to support bull markets) rise to a record $109,668.

Short-term realised price (GlassNode)

Bitcoin Linked Stock: Mixed Bags

However, Bitcoin’s weekly plus price action did not support Strategy (MSTR), the largest company in Bitcoin finance companies. The performance of that rival has improved: Mara Holdings (Mara) 7% and XXI (CEP) 4%.

Strategy (MSTR) has been below Bitcoin since the start of the year and below its 200-day moving average, currently at $355. At the end of Thursday’s $326, we are testing the important long-term support levels seen in September 2024 and April 2025.

The company’s MNAV Premium has been reduced by approximately 1.3 times when it accounts for unpaid convertible debt and preferred stock, or based solely on the stock value.

Preferred stock issuance remains stifled, with only $17 million being tapped this week, past STRK and STRF. In other words, the majority of AT-The-Money issues still flow in common stock. According to the company, the option currently lists and trades all four permanent preferred stocks. This is a development that can provide additional yields on dividends.

Bulling catalysts for crypto stock?

CME’s FEDWATCH tool shows traders expect US interest cuts by 25 basis points in September, and priced with a total of three interest rate cuts by the end of the year.

This is a sign that feelings of risk could lean towards growth and crypto-related stocks, highlighted by a 10-year US Treasury Department temporarily breached this week by under 4%.

Still, Dollar Index (DXY) continues to retain multi-year support, a potential inflection point worth watching.