October of this year was a rough month for the crypto market, with Bitcoin hitting a new all-time high of $126,295 at the beginning of the month, only to hit its lowest since July at $102,329 just a few days later. Now, as “Uptober” draws to a close, all eyes are on what the major cryptocurrencies have in store for November.

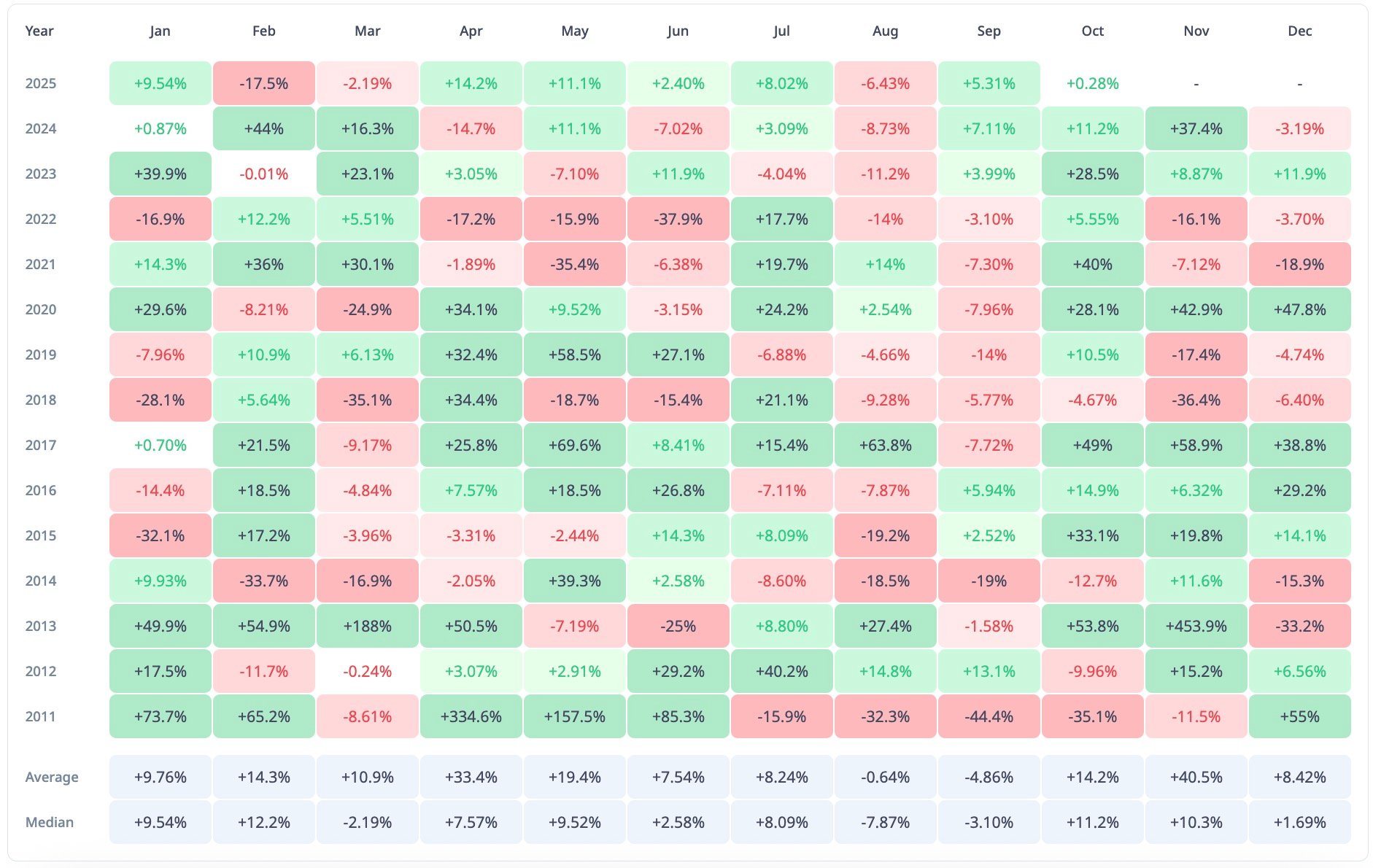

CryptoRank’s heatmap of monthly returns is full of red and green spots, but November stands out, with an average increase of over 40% throughout the year.

In fact, Bitcoin’s performance in November is one of the most stable growth periods in Bitcoin’s history. Back in 2013, the coin rose a whopping 453.9%, setting a precedent that would influence subsequent cycles.

Bitcoin rose 42.9% in November 2020 and nearly 59% in 2017. This pattern has only broken a few times, with far fewer reds than greens in November, making the statistical slope quite bullish.

“Santa Rally” in November

The setting for 2025 is also unique. Bitcoin is now in November after spending most of this year coming out of a correction and consolidation, and investors are already whispering cautiously about the possibility of a repeat of the historic Santa Rally.

With an average historical increase of 40.5% and a median of nearly 10%, even a conservative reading of price history looks in favor of the bulls.

Price history doesn’t guarantee results, especially in a chaotic environment like cryptocurrencies, but if the same month keeps showing the green light throughout the cycle, it’s more than just a coincidence.

If Bitcoin follows its seasonal rhythm, November 2025 will be the start of the year, and this could be another memorable year for cryptocurrencies.