Bitcoin’s price action last week tells the perfect story about its performance this year. The top cryptocurrency has experienced incredible levels of volatility throughout the week, fluctuating between $90,000 and $86,000 over the past few days.

Recent market assessments suggest that the future of Bitcoin’s price may look bleaker than a simple period of sideways volatility. According to the visible cycle, BTC’s price cycle has changed and is entering a bear market.

Bitcoin’s cyclical behavior depends on the demand cycle: CryptoQuant

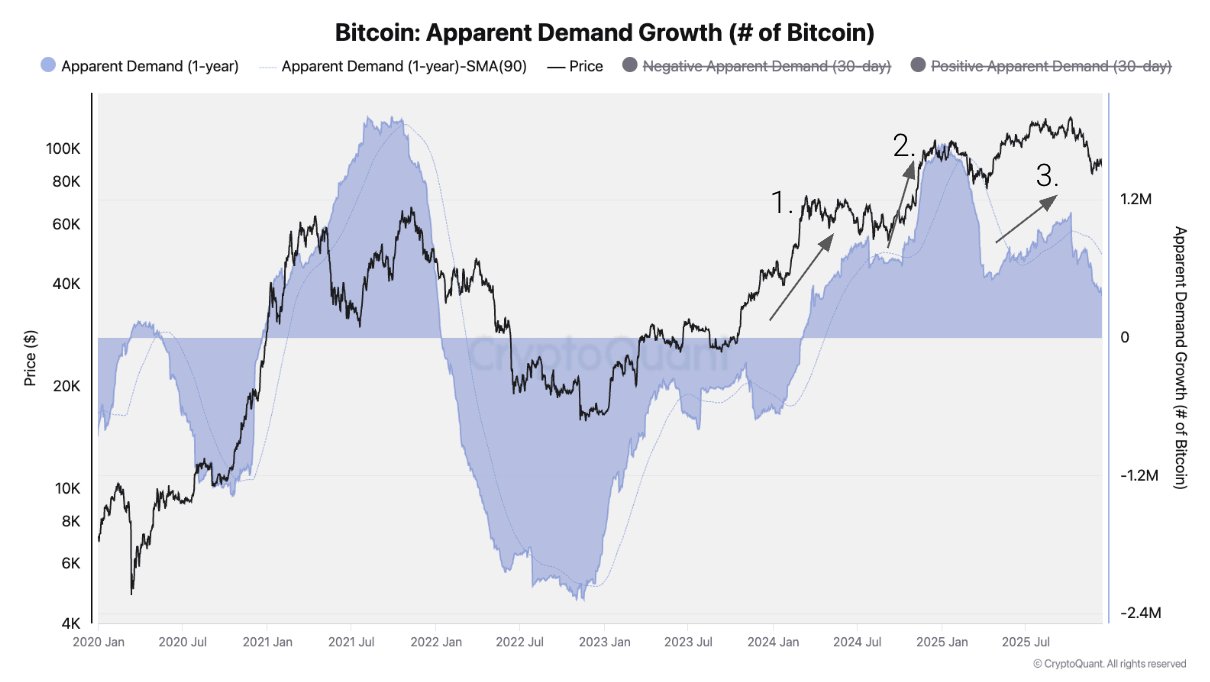

In its latest market report, blockchain analytics firm CryptoQuant linked the steady decline in Bitcoin price to a decline in the demand boom. Data from the on-chain platform shows that BTC demand growth will slow during 2025, signaling the start of a bear market.

CryptoQuant highlighted that Bitcoin has witnessed three major spot demand waves since the start of its bull cycle in 2023, triggered by the launch of US spot ETFs, US presidential election results and the Bitcoin Treasury bubble. However, demand growth has slowed since early October 2025.

Naturally, this trend reversal in increased demand coincides with the October 10th market carnage, one of the largest liquidation events in cryptocurrency history. Bitcoin prices have since struggled to make a convincing recovery, falling as low as $82,000 in late November.

Source: CryptoQuant

CryptoQuant went on to hypothesize that since most of the incremental demand in this cycle has already been realized, a key pillar of price support has been removed. For example, US-based Bitcoin exchange-traded funds (ETFs) turned net sellers in the fourth quarter of 2025, reducing demand from institutional and large investors.

According to data from CryptoQuant, U.S. spot ETF holdings fell by 24,000 BTC in the fourth quarter of 2025. This differs significantly from the steady accumulation seen in the fourth quarter of 2024. “Similarly, addresses holding 100-1K BTC, representing ETFs and Treasury companies, are growing below trend, reflecting the weakening demand seen in late 2021 ahead of a bear market in 2022.” Company has been added.

In addition to weakening spot demand, activity in the Bitcoin derivatives market has also declined and risk appetite has declined. CryptoQuant said BTC’s funding ratio has fallen to its lowest level since December 2023. This is an on-chain signal suggesting that traders’ willingness to maintain long-term exposure has decreased. This trend is often associated with bear markets.

Ultimately, the blockchain company concluded that Bitcoin’s four-year cycle depends more on demand phases (expansion and contraction of demand growth) than on halvings. Essentially, bear markets tend to occur after BTC demand growth peaks and then collapses.

What’s next for BTC price?

CryptoQuant said in a report that the Bitcoin price structure has deteriorated due to weak demand. The flagship cryptocurrency is currently trading below its 365-day moving average, a key long-term support level that has historically separated bulls from bears.

According to CryptoQuant, the falling threshold suggests that the Bitcoin bear market may not be as deep as feared. As with previous bear seasons, the realized price (currently around $56,000) has been identified as a potential low.

This means a 55% correction is possible from recent all-time highs, Bitcoin’s smallest decline on record (during a bear market). Meanwhile, the market leader has a median support level of around $70,000.

As of this writing, the BTC price is around $88,170, up 3% in the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for focuses on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of the content for readers.