Institutional investors are increasingly at risk aversion to move capital from Bitcoin ETF products. This shift in sentiment has caused capital exits to surge sharply, with US listed spot Bitcoin ETFs recording another leak on Tuesday.

This trend maintains bearish pressure and lack of conviction from the institutional players who previously burned bullish momentum in the ETF market.

Bitcoin is seeing its sharpest fund outflow since March

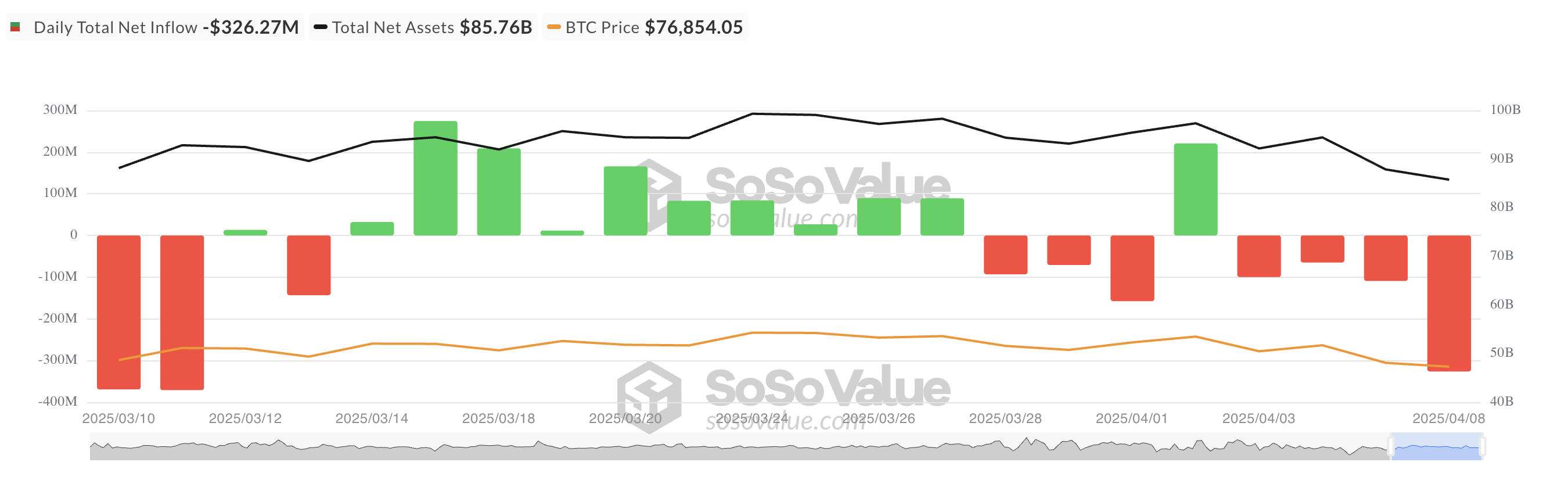

On Tuesday, the capital outflows from the Spot BTC ETF totaled $326.27 million, marking a consistent outflow for four consecutive days. Yesterday’s figures represent the highest daily outflow from the Spot BTC ETF since March 10th, indicating a noticeable change in emotions.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

This sustained capital flight suggests that large investors are at risk in response to the macroeconomic pressures caused by Donald Trump’s trader war. This trend is important considering the role that institutional flows have played in promoting BTC assembly through historical ETF demand.

According to Sosovalue, BlackRock’s ETF IBIT saw its highest net spill on Tuesday, bringing its total historic net inflow to $39.66 billion, totaling $252.29 million.

Bitwise’s ETF BITB ranked second in a daily net leak of $2,127 million. At the time of writing, the total historical net inflow of ETFs is still $1.97 billion.

For the second time this week, none of the 12 12 spot Bitcoin ETFs in the US recorded a single net inflow.

Bitcoin futures cool off as options traders bet on rebound

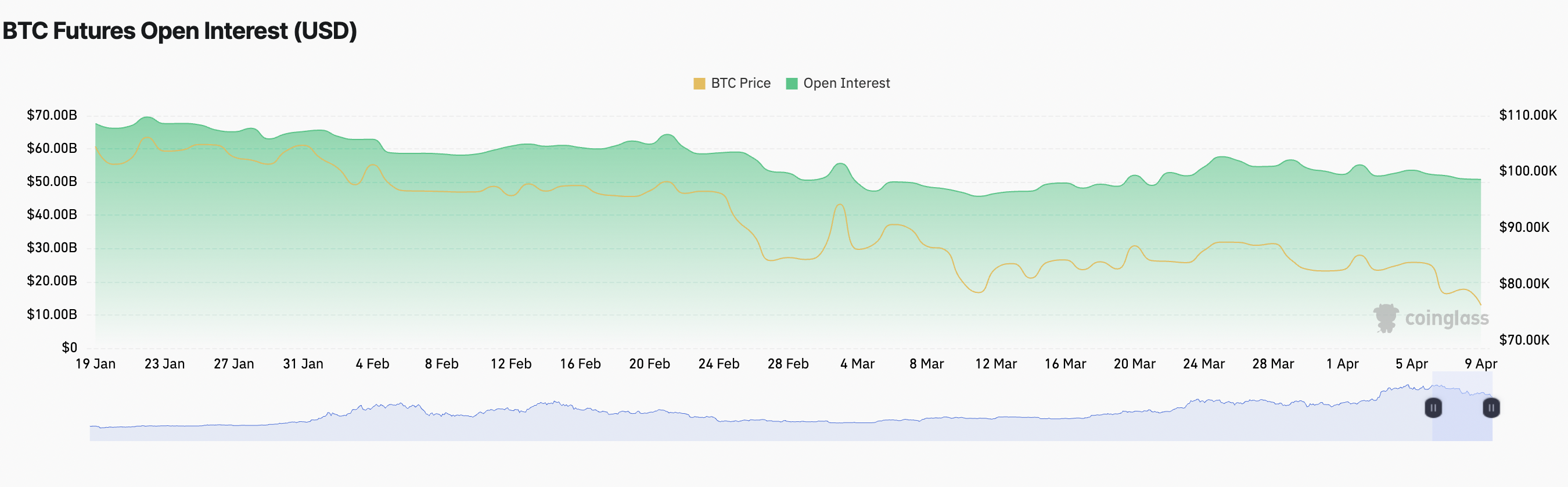

At the same time, open interest (OI) in BTC futures remains restrained, indicating that convictions among leveraged traders have not returned. This was $508.1 billion, a 0.27% drop in the past day.

BTC futures are open to interest. Source: Coinglass

When BTC’s OI falls, existing futures contracts are either closed or cleared faster than new ones open. This reduces trader participation and reduces convictions in current market trends.

Nevertheless, many futures traders remain optimistic, to be at 0.0090% at press, as reflected in the positive funding rate of the coin. BTC’s lower OI and positive funding rates suggest that traders still pay premiums to hold longer positions, but overall market participation is declining.

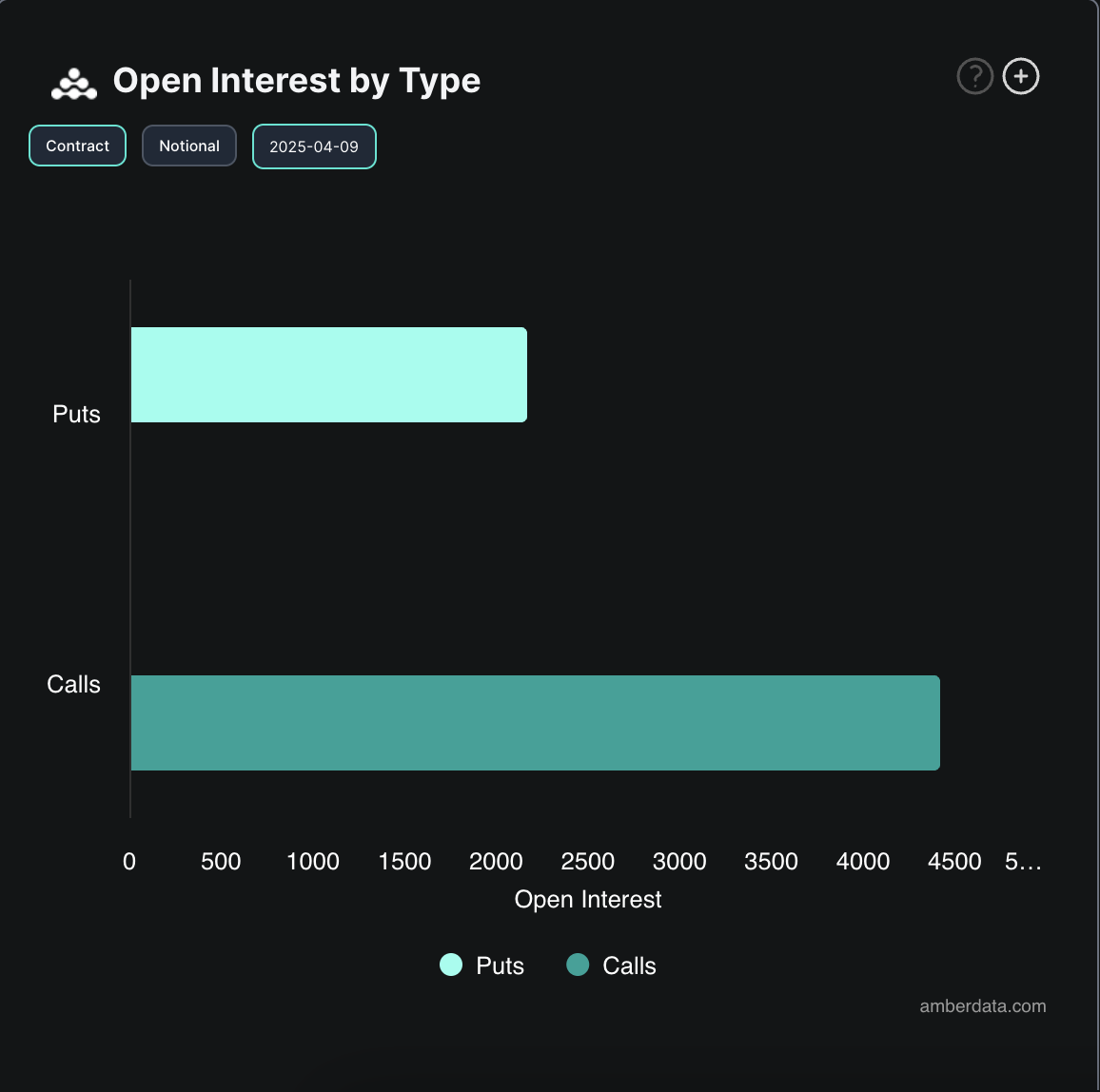

In particular, on the options side, call contract demand exceeds PUTS.

Interested in BTC options. Source: Deribit

This means that more traders bet or hedge on price increases. This indicates an increase in demand for upward exposure, suggesting confidence in potential gatherings.