A prominent encryption analyst, Burak Kesmeci, achieved a $ 124,000 price target based on the data of the GOLDEN RALTIORER price model with Bitcoin (BTC). This strong prediction takes place after an increase in impressive prices last week, and it suggests that Premier Cryptocurrency may have more room for immediate prices.

Can Bitcoin go back to the 1.6x accumulation peak goal?

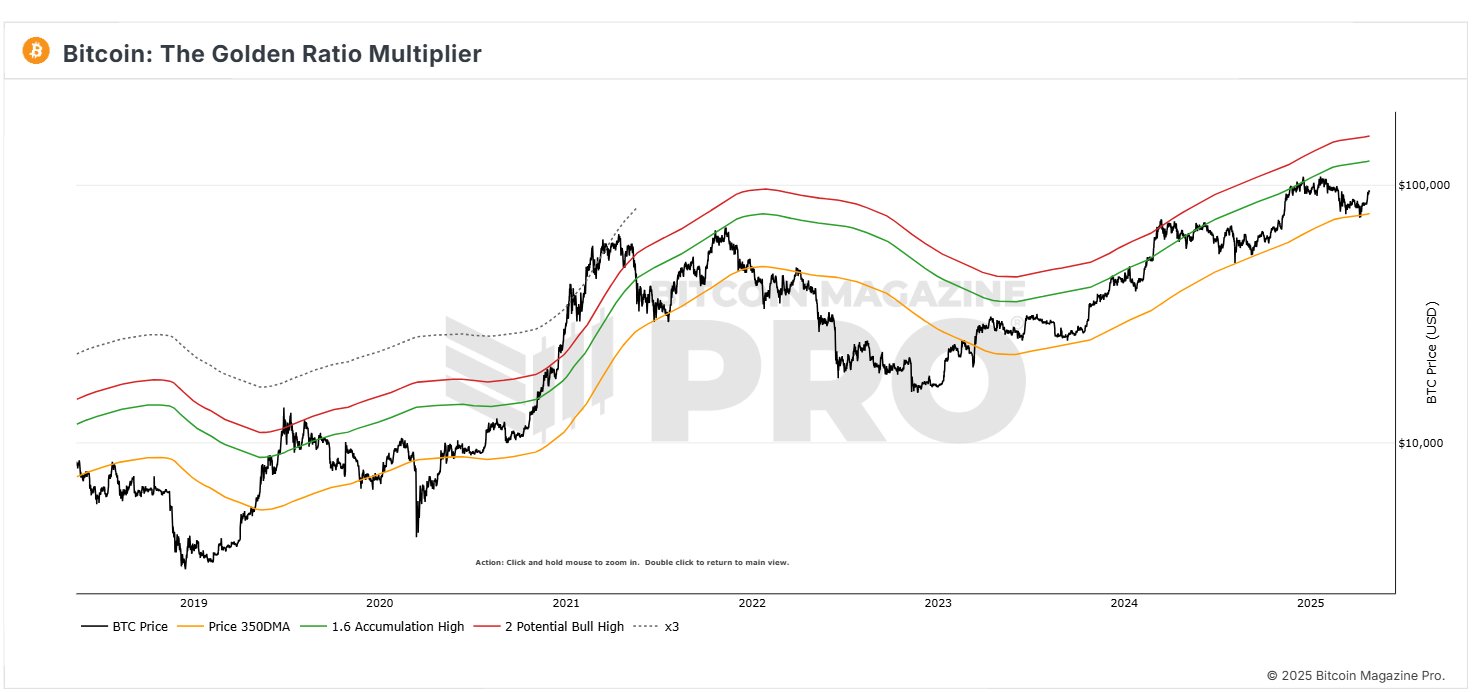

In the X post on April 26, Burak Kesmeci shared the latest update for the Bitcoin Golden Vation Multiplier price model that referred to the data from the Bitcoin Magazine Pro. In the context, the Golden Ratial Merchant Model uses the moving average and Fibonacci ratio to identify the time when the BTC may be overestimated or underestimated, identifying the time to inform the market tower or excellent accumulation opportunities.

According to the chart below, Bitcoin has recently tested the 350 -day moving average (350dma) to $ 77,000. As the name suggests, the 350DMA traces the average price of BTC and serves as a major support area for the last 350 days. If you touch it below this level or soak it for a while, you will often see a long -term purchase opportunity.

Bitcoin has recently rebounded 350DMA, and after the price has soared to $ 75,000, two prices rally followed by a high transaction of $ 96,000.

Along with the price of the GOLDEN Multiplier ratio, BTC is currently 1.6 times that is 1.6 times that of $ 350, or 1.6 times, now $ 124,000. Therefore, despite the progress of price integration, BTC is likely to produce another price rally based on the Golden Multi -Flyer ratio price model.

Interestingly, when Bitcoin moves beyond this level or more, it often represents the end of the accumulation stage and the start of a stronger strong trend. Therefore, when the BTC reaches $ 124,000, it will open a way to increase the price that matches the high goals of some market analysts.

BTC miners get $ 16 million in profits

In other news, another top encryption analyst, ALI Martinez, reported that the miner recently used Bitcoin’s impressive price rally, and the price reached $ 94,000 and realized nearly $ 16 million.

This emphasizes that profit spikes are strategically profitable at this high price level. However, it is worth noting that Bitcoin maintains a strong strength despite the sales pressure, which is promoted by various factors, including strong influx to the spot ETF.

At the time of writing, the value of the BTC is $ 94,393, with a decline in price 0.76%.

Chart of TradingView, the main image of Investopedia

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.