The January FOMC meeting featured two dovish dissents, reflecting deep rifts at the Federal Reserve.

Policymakers generally support the current stance, but several officials expressed support for “two-sided language” on future interest rate movements, suggesting another rate hike could happen if inflation remains above target.

Fed minutes reveal hawkish opinion divided over Bitcoin’s struggles

Recent macroeconomic indicators support Fed Chairman Jerome Powell’s cautiously optimistic outlook.

Growth has picked up surprisingly well, inflation appears to be on the decline, and the job market is showing signs of stabilization.

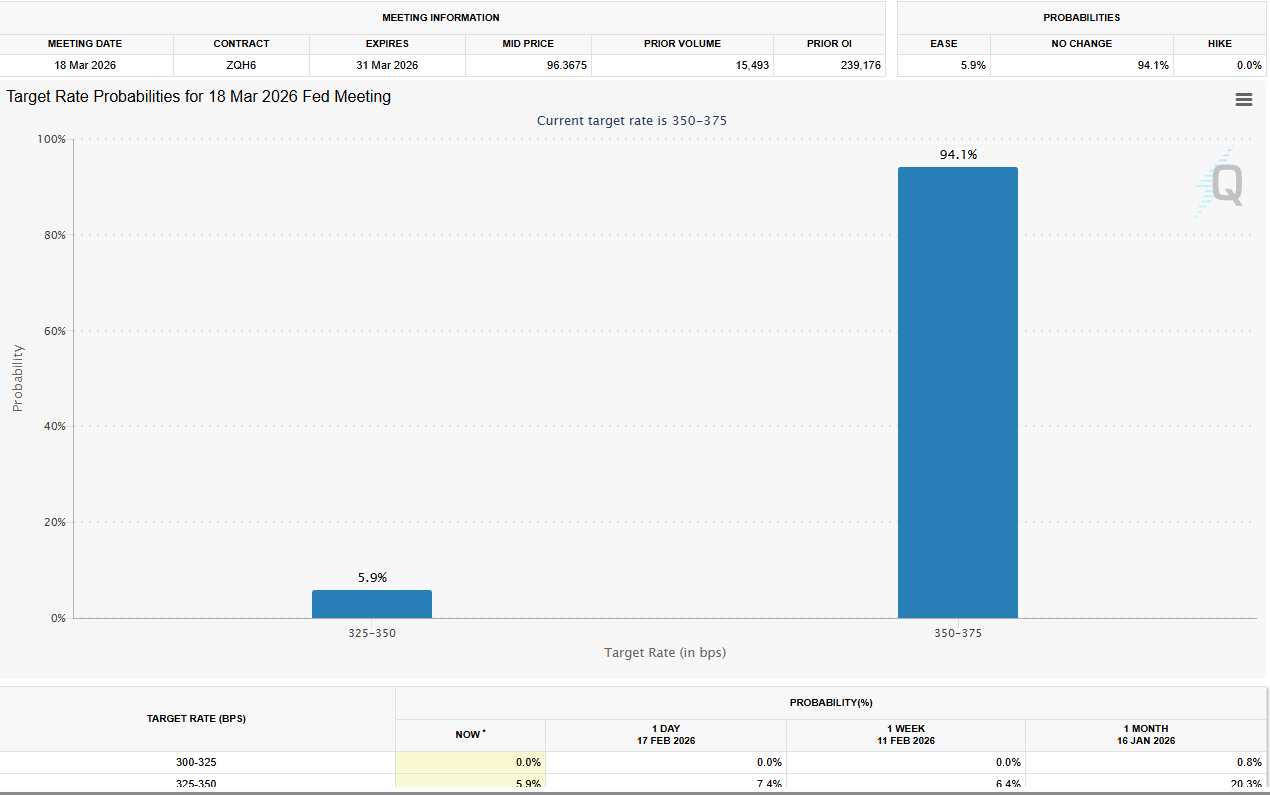

These developments have raised expectations for a rate cut in 2026, but last week’s better-than-expected employment data has effectively made a March rate cut unexpected.

Possibility of interest rate cuts. Source: CME FedWatch Tool

The minutes also revealed sensitive discussions within the Fed about inflation and productivity.

- Several officials have warned that defusing inflation may proceed more slowly than expected.

- Some said further rate cuts could be justified if inflation fell as expected, but others warned that cutting rates too much could increase inflationary pressures.

- Productivity gains were highlighted as a potential factor in curbing future inflation.

Market vulnerabilities were also a focus, with several participants citing risks to private credit and the broader financial system.

Analysts suggest that these concerns, combined with the Fed’s hawkish tone, will continue to put Bitcoin under downward pressure while safe-haven bonds and the dollar are bought.

Bitcoin (BTC) price performance. Source: TradingView

“The minutes show that the Fed, while still divided, is paying attention to both inflation risks and growth momentum,” said a senior market strategist. “Bitcoin’s underperformance partly reflects risk-off sentiment and the continued strength of the dollar.”

Investors will be watching for further comments from Fed officials as markets digest the minutes and weigh the balance between hawkish caution and dovish optimism in shaping the trajectory of monetary policy in 2026.

The article Bitcoin falls, dollar and bonds rise on hawkish Fed minutes appeared first on BeInCrypto.