Cryptocurrency fell to $108,000 after the “minimum” exemption ended on Friday, bringing core inflation to 2.9%.

BTC buckle under double pressure to increase inflation and trade tensions

Both Crypto and the stock market bleed on Friday, with core inflation of 2.9% and the “minimum” exemption waiver waives on goods under $800 expired earlier than planned. Bitcoin has sunk to the lowest level in the news since July.

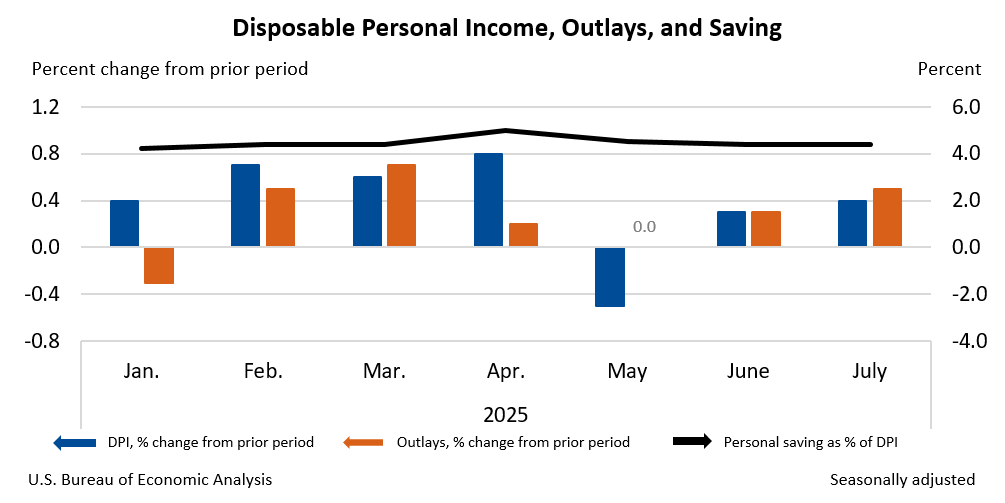

The US Agency for Economic Analysis (BEA) has released price index data for monthly personal consumption expenditures (PCE) and measures of inflation supported by the Federal Reserve. The core figure was in line with analysts’ expectations, but it was also the highest inflation rate since February 2025.

(Core inflation in July was 2.9%, which is in line with expectations, the highest level since February 2025/US Bureau of Economic Analysis)

To add shaming to the injury, it is an obscure trade rule that allowed President Donald Trump to enter US tax exemption on Friday after signing an executive order to move the expiration date on August 29, rather than later in 2027.

Market Metric Overview

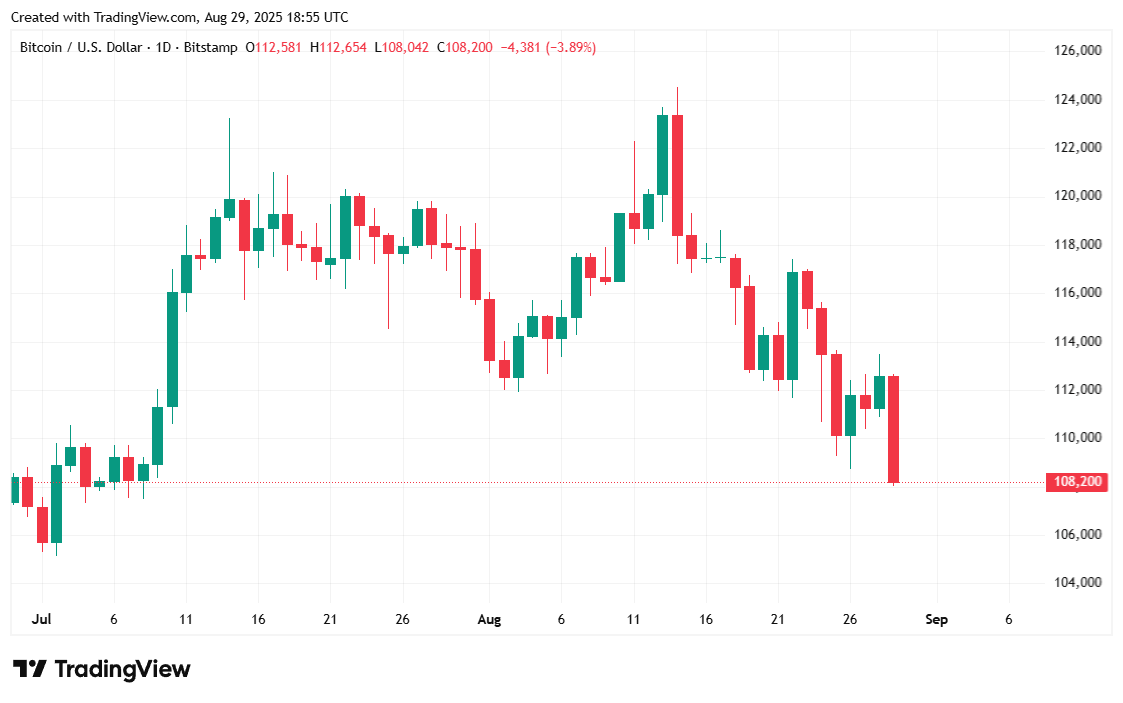

Bitcoin fell by $108,186.53 on reporting, a 3.79% decrease that day and a 7.38% weekly, according to CoinmarketCap. Digital assets are traded between $108,098.62 and $112,619.05 over 24 hours.

(Bitcoin Price/Trading View)

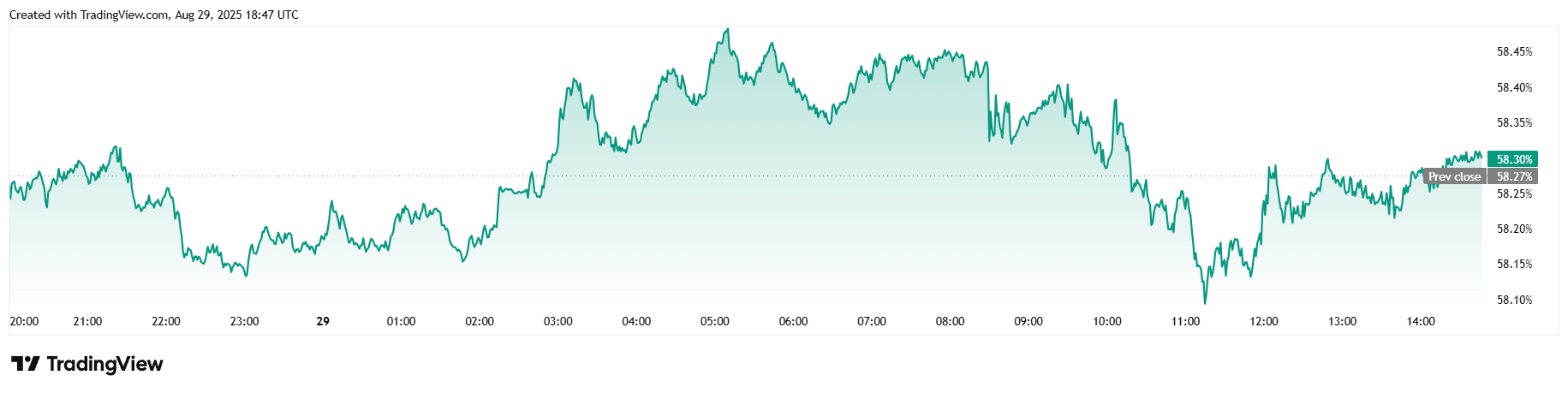

The 24-hour trading volume rose 15.84% to $72.777 billion, but market capitalization fell 3.72% to $2.15 trillion, along with the price decline. However, Bitcoin’s dominance rose slightly, up 0.09% to 58.30%, according to CoinMarketCap data.

(Bitcoin control/trade view)

Open interest on total Bitcoin futures fell 1.17% in 24 hours to $8.028 billion, while Bitcoin liquidation in Coinglass rose to $13,362 million over the same period. Of that total, $121.61 million was a long liquidation, and a significantly lower $12.01 million came from shorts.