Bitcoin fell to $108,000 on Thursday, falling 3.6% in 24 hours and nearly 7% a week, according to Coingecko data.

The decline caused widespread losses across the crypto market, bringing Ethereum down 8% to $3,887, bringing the four-week loss of ether to 23%.

The sale saw a surge in liquidation, wiping out more than $1.1 billion in transactions over 24 hours. Most of it was a long bet that would go up over $1 billion and prices would rise.

Dogecoin fell 7.6%, trading close to $0.23, while Solana fell 7.7% to $197.52. Both tokens have fallen 21% over the past seven days, ranking them as the worst performance of the week in the top 100.

Pullback also lined up with weaknesses in US stocks. The industrial averages for the S&P 500, Nasdaq and Dow Jones all ended in red on Thursday.

Long term holders dumped Bitcoin while the ETF was silent

Bitcoin’s latest rally, with a postform-high $117,000, has been reversed to what analysts describe as the classic “buy rumors and sell news” pattern. GlassNode analysts said Thursday that Bitcoin is now “indicating signs of fatigue” as demand for ETFs stalled and long-term investors began to stand up to profits.

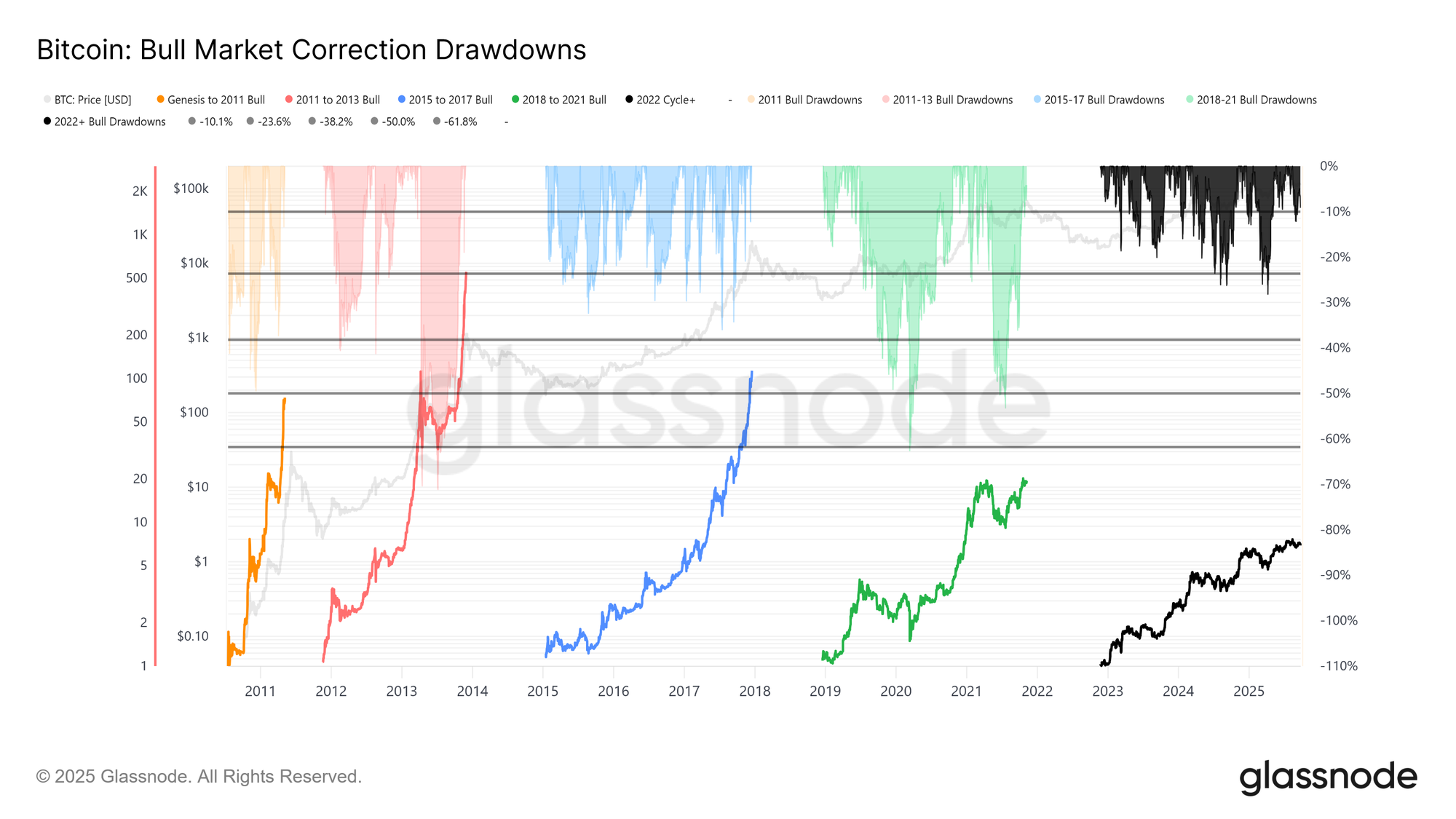

The current decline fell from $124,000 to $113,700, equaling an 8% decline. This is milder than the 28% drawdown of this cycle and the 60% drop seen in previous ones. However, analysts also note that Bitcoin’s volatility has been shrinking over time, resembling the slow climbs seen between 2015 and 2017.

Source: GlassNode

The cycle lasted about 1-030 days, but was shy about the 1-060-day period seen in the last two. Capital’s deployment has moved in three waves since November 2022, increasing CAP to $1.06 trillion, according to on-chain data. Currently, capital inflows are $678 billion, almost $2383 billion in the last cycle.

This wave doesn’t all come at once. Every time more than 90% of the coins that moved were profiting, it was the top. The code has just left the third spike like that. Long-term holders sell 3.4 million btc, already selling more BTC than in past cycles.

The ETF flow, which helped absorb that supply at the beginning of the year, fell off the cliff. Around the FOMC, long-term holders were lowering at a rate of 122,000 BTC per month, while net ETF inflows fell to near zero from 2,600 btc/day. It created a weak environment as sales pressure rose and new demand dried up.

Futures and options revealed market vulnerabilities

The spot market first collapsed. When Bitcoin fell, trading volume exploded, and thin order books were unable to handle the flow. It pushed the price up to under $113,000, causing a sharp flash of futures. Open interest fell from $44.8 billion to $42.7 billion, with stacked traders forced to leave, expanding the fall.

Coinglass’ HeatMaps showed major liquidation clusters ranging from $114,000 to $112,000, clearing leveraged longs. This created a short-term floor near $111,800. Here, the cost base for short-term holders belongs.

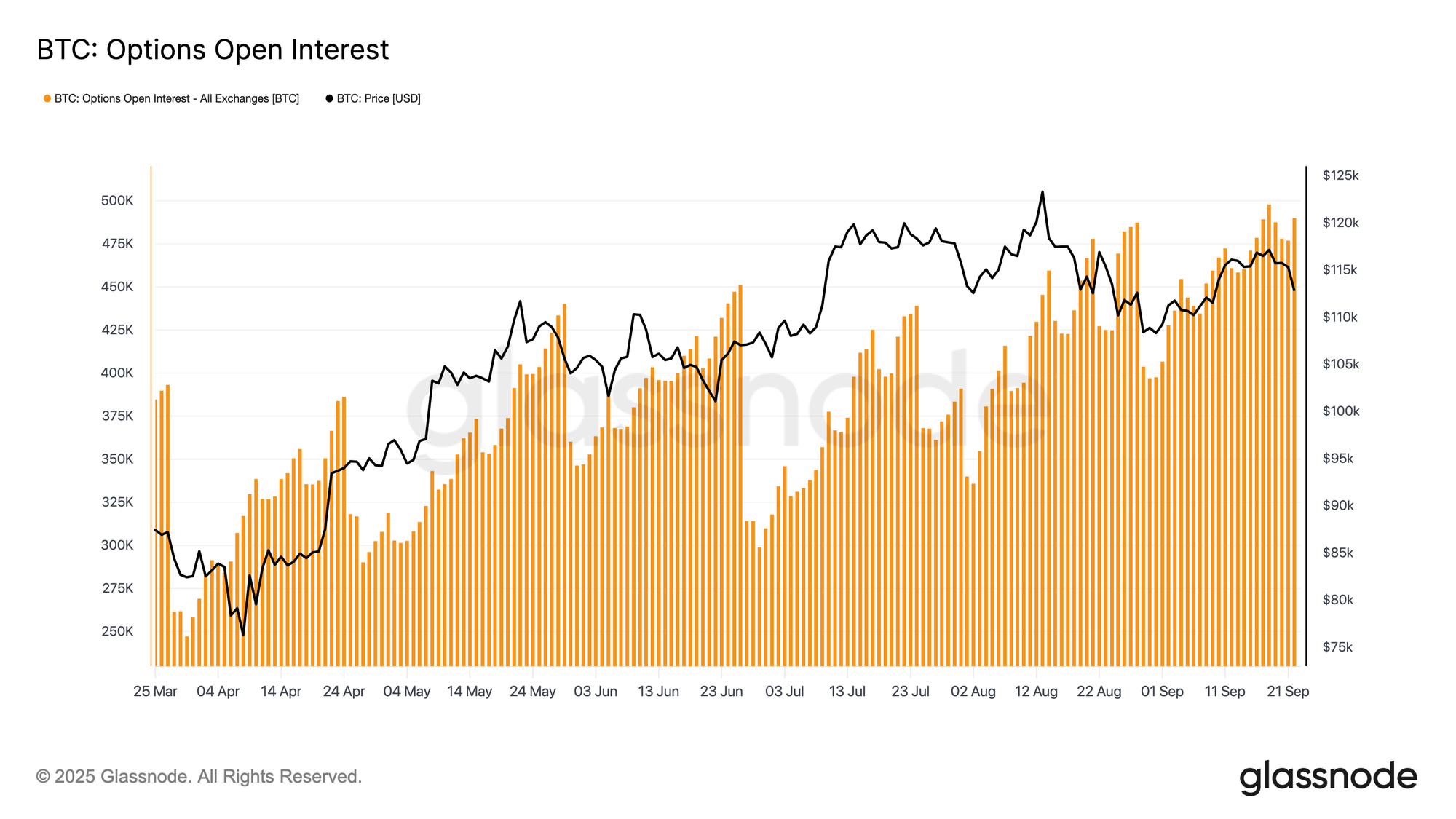

However, prices remain unstable. The risk level still hovering around $117,000, and without a stronger purchase, the price could be even greater. In the options market, volatility surged before FOMC, and it cooled when rate reductions were confirmed.

That didn’t last. Sunday’s futures accident reignited horrifying trading. A week of implicit volatility jumped, and pressure spread to long contracts. On Friday, the 1W skew was spiked from 1.5% to 17%, indicating that traders scrambled for downside protection.

That rush was real. Two days later, the largest liquidation since 2021 appeared on the market. The put/call volume ratio has since dropped as traders cashed out puts and moved them to cheaper calls. Still, skew data shows that the market is still leaning towards more puts, keeping protection expensive and inexpensive.

Total options open interest is still close to record highs. Most of them will be reset after expiration on Friday morning. Until then, dealers have been pinned to the peak gamma zone and forced to hedge all the small movements.