Bitcoin’s price has risen less than $ 100,000 in the initial blues marked with a crash in the roller coaster for the last seven days. Flagship Cryptocurrency has been revived up to $ 108,000 over the last few days.

This recent resurrection is not particularly reflected in the blockchain, and the latest on -chain data suggests that the trader is not willing to bet on the price of Bitcoin. The popular market analysis platform has now had a potential impact on this scenario.

Reduction of financing rate increases short -term positioning: glass nodes reflect

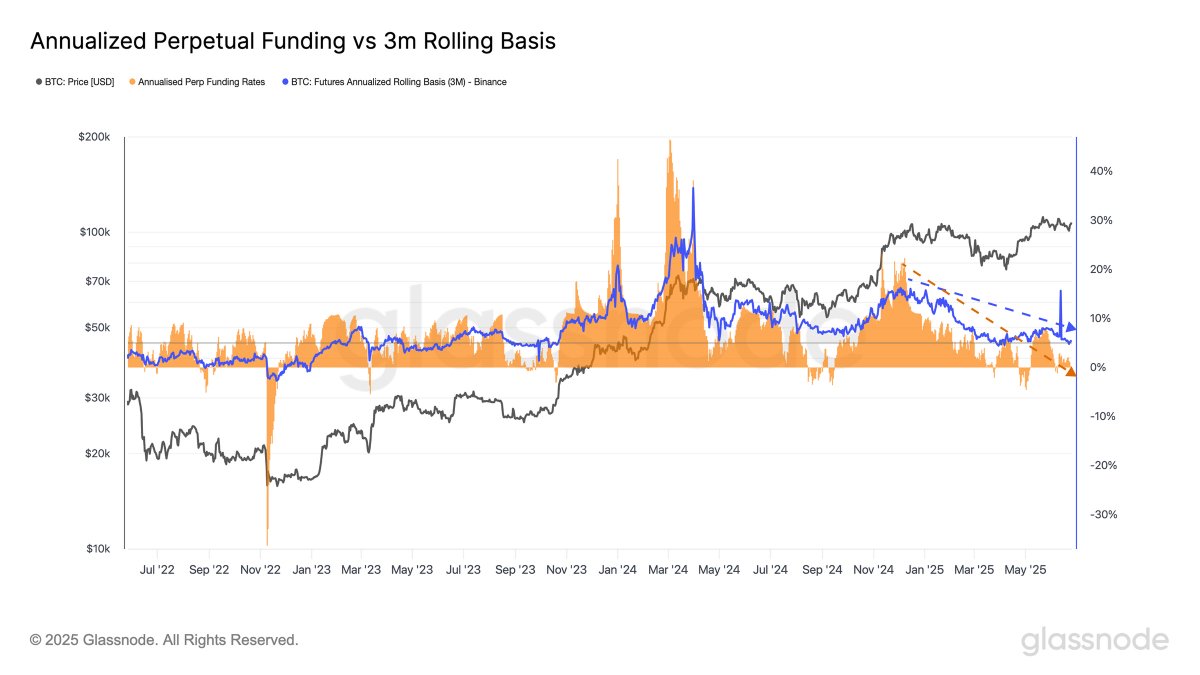

In the June 27 posts on the X platform, GlassNode, a whole chain analysis company, appears to have been trained in the decline in Bitcoin’s funds for the past few months. The related indicators here are “annual perp financing fees” and “binance 3 months (3m) future annual rolling -based” metrics.

The annual perp financing fee is a major indicator of regular payments between long and short traders in the Perpetual Future Market. This indicator provides timely insight into emotions and leverage in the Cryptocurrency derivative market.

If the rate of financing is high or positive, it means that long -range traders pay short positions to traders. In general, this direction of this periodic payment suggests strong strong feelings in the market. Meanwhile, the negative value of the metrics means that a short trader pays money to a long trader.

On the other hand, the annual rolling base of 3 months (3m) is to buy cryptocurrency in the spot market to estimate the annual returns and sell encryption futures contracts that expire in three months. In general, futures contracts are traded at a higher price than spot assets. This is the difference that the trader can use for profit.

Source: @glassnode on X

As can be seen in the chart above, the annual funding rate and three -month (3m) annual rolling base have decreased since November. GlassNode said, “Despite high gift activities, the appetite for long exposure is faded, which increases attention and reflects more neutral or short -term positioning.

In essence, the reduction of financing rate and three -month rolling standards indicate that short traders are continuously crowded with derivatives. There was a careful approach to the market from the traders, but it was a silver lining that the institutional trend and macroeconomic climate in the US -based Bitcoin exchange trading funds were improved.

Therefore, even if the rate of financing continues to fall, the market can see short pressure even if the macroeconomic environment and the inflow of institutional capital are steadily maintained. This potential scenario is supported by the fact that the market tends to move in the opposite direction of the crowd.

Bitcoin price at a glance

At the time of this article, the price of BTC is about $ 107,180 and has not shown a big movement for the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Istock’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.