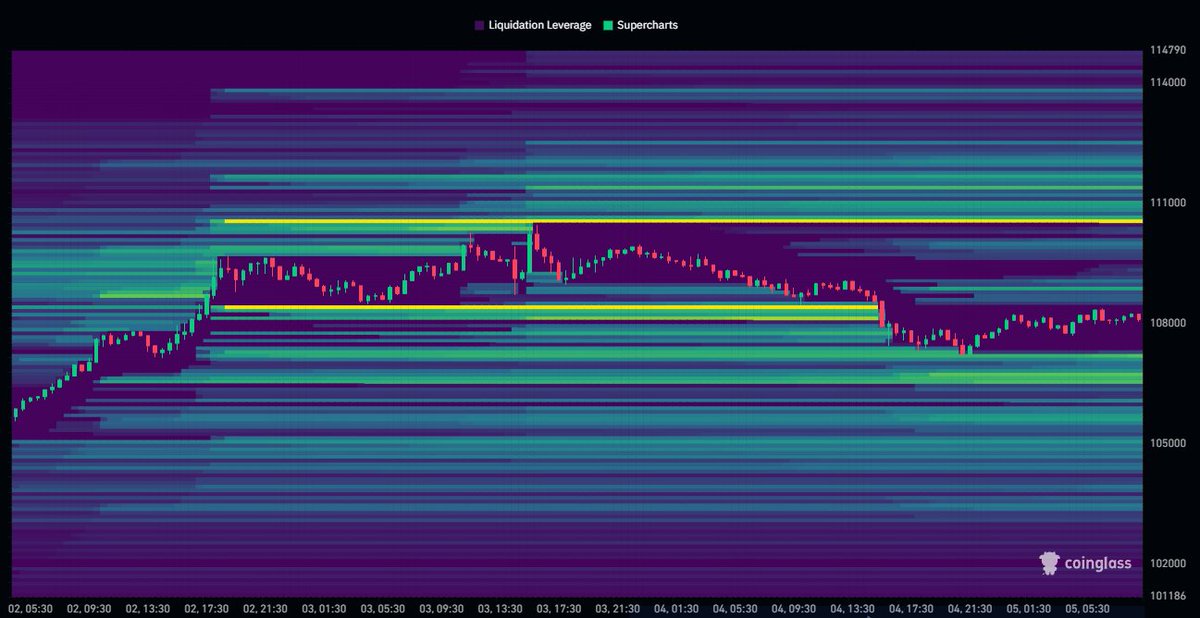

Bitcoin (BTC) prices increase slightly over the last 24 hours and continue to move about $ 108,000. Flagship Cryptocurrency is steadily maintained within a wide range of integrated range between $ 100,000 and $ 110,000, reflecting the uncertainty of the market. In the current market state, the popular trading experts in X users’ name DAAN CRYPTO have emphasized the main fluid clusters that can play an important role in forming Bitcoin’s short -term price measures.

Implied Bitcoin Battle Front: $ 107,000 and $ 110,500

In the X post on July 5, DAAN CRYPTO shares important insights to Bitcoin’s potential price measures compared to the liquidity level. The data from COINGLASS explains that the famous analysts have clearly cleared the leverage location centered on the $ 108,000 area due to the price activity of Friday. Following this development, investors’ interest is now concentrated in the new liquidity area, forming about $ 107,000 and $ 110,500.

Among the emphasized areas, $ 107,000 appears to be used as immediate support, and some traders defend their positions that have recently survived in liquidation. Therefore, BTC is likely to experience a short -term rebound when testing this level again. However, if the price drops to less than $ 107,000, the price will be forced to force the price to $ 100,000, depending on the recent range of bounds.

On the other hand, $ 110,500 is emerging as a short -term resistance for potential sales pressure or short items to accumulate if Bitcoin attempts another escape. Successful prices above this level remove a number of short positions, causing short pressure, allowing Bitcoin to move quickly to an unknown price of $ 111,970.

Overall, the BTC market seems to be stabilizing within $ 107,000- $ 110.5,000 zone since Friday’s rapid liquidation sweep. Next to this, the price movement usually sets the stage of rapid breakout or failure.

Bitcoin exchange leverage reaches the new best

In other developments, encryption data shows that the estimated leverage ratio of all exchanges reaches up to 0.27 per year, and Bitcoin trader is showing high market appetite. Compared to the Exchange BTC reserves, the metrics, which track public interest, are increasingly risky as the traders are expected to change the price, and the borrowing capital is placed more and more.

Premier cryptocurrency, meanwhile, continues to trade about $ 108,232, reflecting 0.70%and 6.41%of market profits, respectively, respectively. Bitcoin, which has a market cap of $ 2.15 trillion, maintains 64.6%of its market dominance as the world’s largest virtual asset.

PEXELS’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.