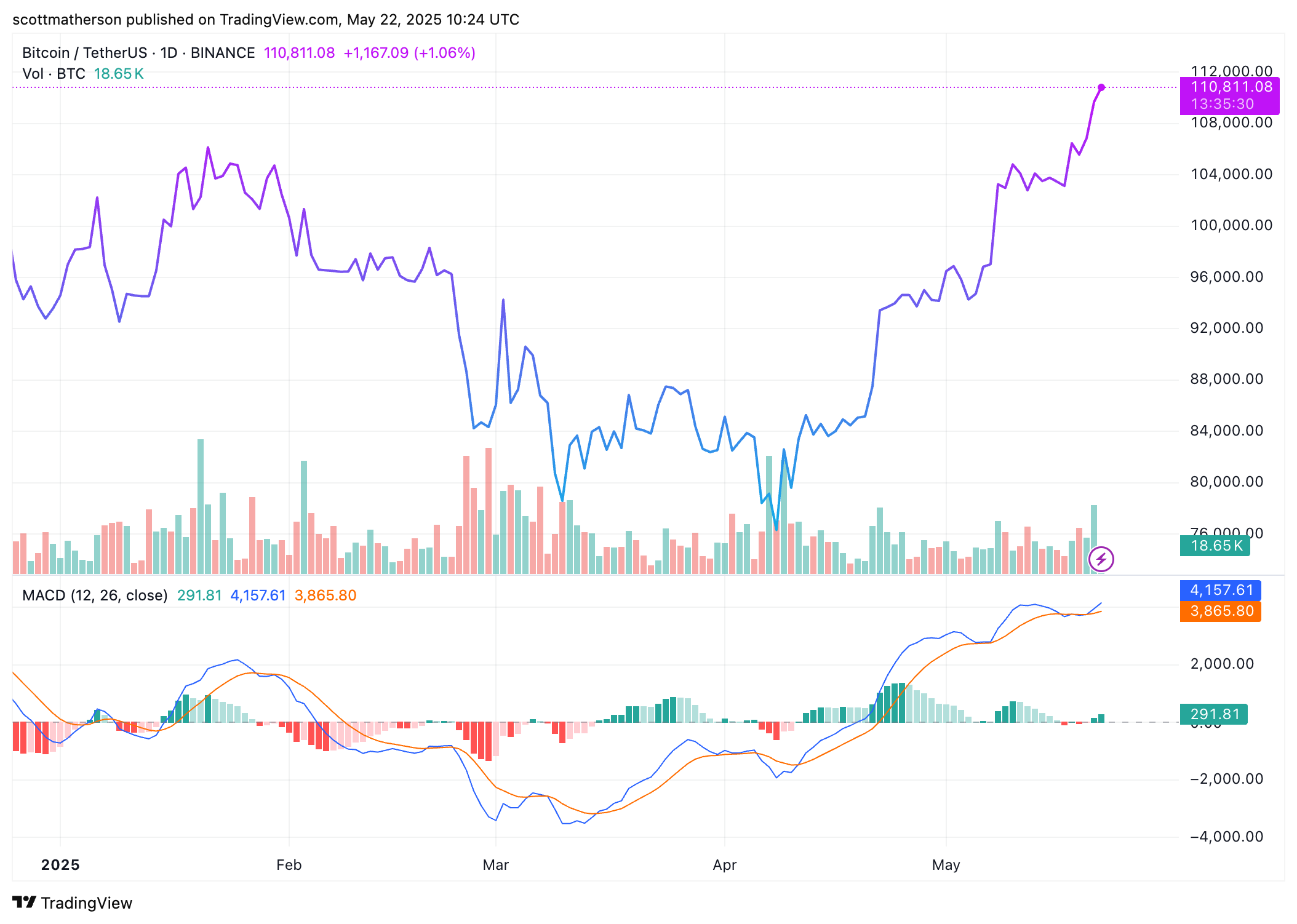

Bitcoin price action over the last 24 hours has been remarkable. After consolidating for several days, the market broke beyond the resistance zone, which turned to $105,503 support early in the week, and began a steep climb on past trading days. This pushed Bitcoin To the greatest new level ever, And it shows no signs of slowing down.

Interestingly, technical analysis shows that the meeting is off Golden Cross Approach Between the 50-200-day moving average, FX_Professor provided a different view on the very famous Golden Cross.

Analysts challenge Golden Cross hype as a late signal

recently Analysis published in TradingViewFX_Professor discussed another view of Bitcoin’s Golden Cross. Most market commentators interpreted this crossover with a simple moving average of over 200 days as a strong bullish confirmation, but analysts dismissed it as a delay indicator. Analysts described it as an afterparty where retail investors arrive late at the scene.

Instead of waiting for the gold Flash green from the crossFX_Professor pointed out that the pregaiter pressure zone is a real signal of value. In the case of Bitcoin pricing measures over the past few months, analysts pointed to the $74,394 and $79,000 region as accumulation and early positioning zones before the Golden Cross became visible. So, by the time the cross appeared recently, Bitcoin price action had already risen significantly.

Golden Cross is often used by traders as a signal to enter long positions, as it suggests that the price of an asset is likely to continue to rise. However, this analysis follows the trend among experienced traders who view golden crosses as a slower confirmation rather than a rally trigger.

Early entry zones and structures are even more important, analysts say

According to FX_Professor, metrics like EMA and SMA can be useful, but never come before understanding price structure, trendlines and real-time pressure zones. He shared a snapshot of his own Bitcoin price chart combining custom EMA with a signature parallelogram method to detect where price tensions began to build. The entries that appear on the chart are those that are formed as early as April when it comes to Bitcoin. Bouncing off about $74,000 in supportlong before the crossover was confirmed.

I’m currently pushing bitcoin Heading towards the next target zone At nearly $113,000, the analyst’s strategy continues to validate itself in real time. Nevertheless, Golden Cross confirmation is still bullish for Bitcoin price action to move forward, even if price increases are already at peak levels.

At the time of writing, Bitcoin is trading at $110,734. This is a small pullback starting at $111,544, registered just three hours ago. Bitcoin prices are still up 3.1% in the last 24 hours, allowing a new all-time high before the end of each week.

Getty Images Featured Images, Charts on tradingView.com