“We’re not sooner.” That’s the mantra that resonates across today’s Crypto Twitter. Last week, 35,000 people joined Bitcoin 2025, including Bitcoin enthusiasts, US senators, White House staff, BlackRock analysts and Silk Road founder Ross Ulbricht. Spot prices are quite high $100,000and Bitcoiner is celebrating “becoming mainstream.”

But behind the standing ovation and ETF fuel price charts, there is a quiet truth. Bitcoin is still far from mainstream.

Despite only the record-breaking rally and the embrace of Wall Street, 4% of the world’s population Holds Bitcoin at all. In raw numbers, it’s about 337 million People, half of Snapchat users. Even with Altcoins included, we still know that it’s hundreds of millions of shorts of 659 million.

For every trillion dollar promise, Bitcoin remains the fringe tool of a developing ecosystem.

Bitcoin is still the internet in the late 90s.

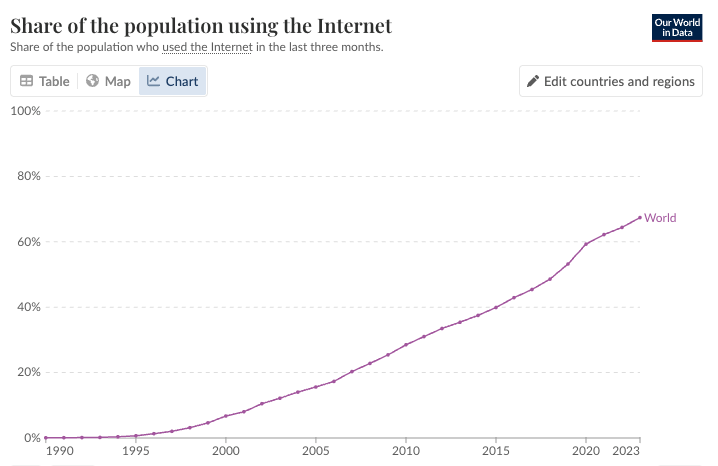

Compare the Bitcoin adoption curve with the early Internet adoption curve.

Bitcoin in 2025 is similar to the internet before email became completely mainstream. It is a place of innovation, but it is far from omnipresent. Using a Bitcoin wallet to read articles like this is similar to owning an AOL account or installing the latest version of Netscape from a CD connected to a computer magazine.

The Las Vegas crowd may feel like a clinician. Statistically, they are still early adopters.

I buy it on Wall Street, but not on Main Street.

Crypto narratives are increasingly dependent on institutional participation. Since SEC’s ETF approval in early 2024, $44 billion We poured it into a spot Bitcoin ETF. Pension funds, asset managers, and family offices allocate all Bitcoin as portfolio hedges.

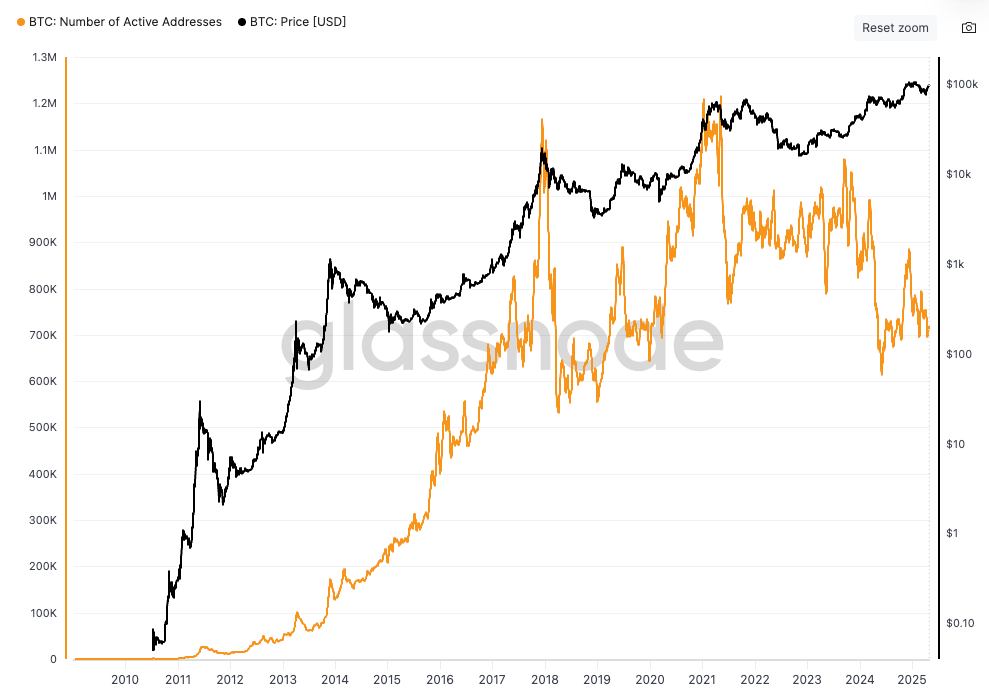

However, no Bitcoin’s everyday utility has occurred. Daily active address fell nearby 700,000after pressing the peak of 1.1 million 2021. TradfiMoney justified BTC as an asset class, but has not been translated into a wider transactional use. Celebrated by Bitcoin’s rebel roots, Ross Ulbricht’s existence juxtaposed Bitcoin as a political tool and contrasted as an institutional commodity.

What’s still holding back Bitcoin?

Despite growing visibility, Bitcoin faces a major obstacle to the road to mass adoption.

- Silent UX: Wallet setup or managing seed phrases is not intuitive. One mistake can mean permanent loss.

- High entry friction: Micro-Onramps is best for underserved users, but fees, regulatory checks, and slower transactions weaken the experience.

- Unknown regulations: Although ETFs have brought legitimacy, they fragment global policies around wallets, mining and commerce, creating confusion and risk.

- Low cultural flow: Even in a digital-first society, Bitcoin is seen as a more speculative asset than a tool for payments and savings.

There are building blocks

Several initiatives lay the foundation for a wider utility.

“Bitcoin is no longer a niche,” said Dovile Silenskyte, an analyst at Wisdomtree in January. That may be true in the capital market, but that has not yet been reflected in how people use their money. Over $100,000 per BTC, the price of one coin exceeds the net worth of an average American household (excluding home equity). As Bitcoin becomes more collectible, the risk is lower unless there is a wide range of access in the Layer 2 solution and its orbital direction.

Reality Check Agenda in the Bitcoin Era

Bitcoin supporters need to recover to convert hype into actual financial inclusion.

- First use case: Emphasise real-world examples, not just ETF influx and celebrity support, such as Argentina’s freelance income and East African lightning transfers.

- Meaning indicators: Recruitment is not measured by market capitalization. Track metrics such as active wallet use, lightning fluidity, merchant integration and more.

- Edge Design: The most important users live in an unstable economy with insufficient bank access. Bitcoin promises are being tested here, not Vegas glass.

- Policy Clarity: Regulation consistency is more important than political theatres. Frameworks like European mica and targeted mining incentives could encourage adoption.

Work begins after the fireworks

The moment of Bitcoin’s breakout may have arrived at headlines and hedge funds, but the true test is ahead. Just as internet promises in the 1990s didn’t come to fruition until the 2000s brought mobile phones, broadband and user-friendly apps, the global impact of Bitcoin will vary based on what comes rear Hype.

Although total wallets continue to rise, lightning bolt use, active wallets, and daily chain traders have not been able to regain the highest ever high. Prices will rise, but on-chain usage is not the case. When the battle wins, we are satisfied and cannot claim victory.

The Las Vegas Summit was a celebration. However, the revolution will not be aired in payments, savings, remittances, and financial sovereignty. It will be built. Quietly. Bricks made of bricks.