The crypto market could face another DIP following a recent revision in March, as the risk of tariff-related uncertainty remains in the second quarter, Nansen analysts say.

As the industry heads towards April, Bitcoin (BTC) and the broader crypto market may be staring at another DIP as uncertainty surrounding tariffs and US trade policy could cause further volatility.

According to Nansen analysts, the market could face another revision in the weeks following April 2nd. In fact, researchers believe there is a 70% chance that another price dip will occur after this day.

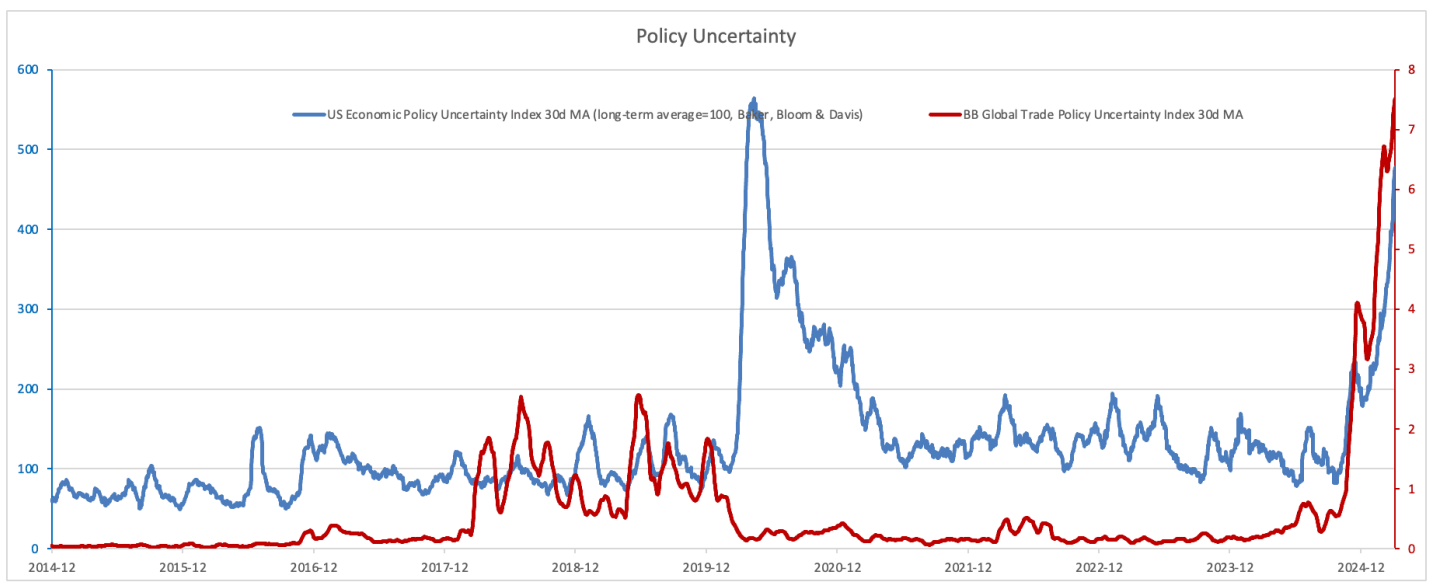

US Economic Policy Uncertainty Index 30D MA vs BB Global Trade Policy Uncertainty Index 30D MA | Source: Nansen

President Donald Trump previously promised to roll out new tariffs on April 2, calling it a critical moment for the economy just weeks after the final round shook the market and caused concerns about a recession.

In a recent interview with Crypto.News, Nansen’s leading research analyst Aurelie Barthere, said that after a brief revision after April 2, he hopes the market will stabilize and pave the path to future growth.

“My main scenario, 70% subjective possibility, has seen another leg of crypto prices drop since April 2nd after reaching the local bottom in mid-March. After this second revision, I’m expecting the remainder of the year (continuation of the BTC bull and revisiting ATH).”

Aurelie Barthere

However, it is not all fate and darkness for the crypto market. Another dip has not been ruled out, but after that fix, it suggests that Bitcoin can rebound, benefiting from a supportive macro environment, including increased adoption of crypto in the US and a lack of recession. Still, Barthere remains cautious about the remaining 30%.

“For the remaining 30%: it’s already at the bottom or whether this is a dead cat bouncing for US stocks and crypto (in the case of a recession that is not my base case, the US is just reducing growth of 3% to 1.5-2%).”

Aurelie Barthere

You might like it too: Bitcoin slips even more 4% after Trump targets Canadian steel, tariff-on-duty aluminum

Uncertainty can last until Q2

The tariff situation is a key driver of market volatility, with the US policy uncertainty index reaching new highs. While the trade debate has become an important source of investor uncertainty, Nansen believes that uncertainty could soon reach a peak.

As Treasury Secretary Becent recently pointed out, many of the US trading partners are already negotiating lowering their own trade barriers, which has helped ease some fears. Even Trump has recently hinted at a potential tariff “exemption” in certain circumstances. However, as Barthere pointed out, these talks could bring long-term growth benefits to the US, but lingering uncertainty could continue into the second quarter.

“I think we are experiencing corrections within the crypto bull market. Why do we consider this a bull market: 1) the ongoing advancement in crypto regulations and cryptosystems in the US, and 2) the actual growth in the US has slowed, but it has not flashed the “recession.” Of course, this is my only major scenario and I will continue to watch the data and markets of indications that this is the correct reading. ”

Aurelie Barthere

As stated, he added that there is a “50/50 chance that has passed the peak of trade policy uncertainty,” and that the true impact of these tariff negotiations may not be entirely clear until mid-year. “We believe this peak uncertainty is still likely between April and June, particularly with the start of discussion on our tax cut package,” she wrote in her research report.

Nansen’s research shows that uncertainty could lead to another short-term correction in both Bitcoin and US stocks.

There is no evidence of a recession

Still, there is a reason for optimism. The report says technology shows signs of encouragement. “DIP is being purchased for BTC and US stocks,” Barthere added that Spot Bitcoin ETF recorded “a seven-day net inflow winning streak, the first to peak crypto prices.”

Either way, it is clear that the market is cautious. Many people question whether the code bull’s run is still strong or if we are approaching peak. If history is any indication, then times of economic uncertainty often line up with market slump, making investors even more cautious.

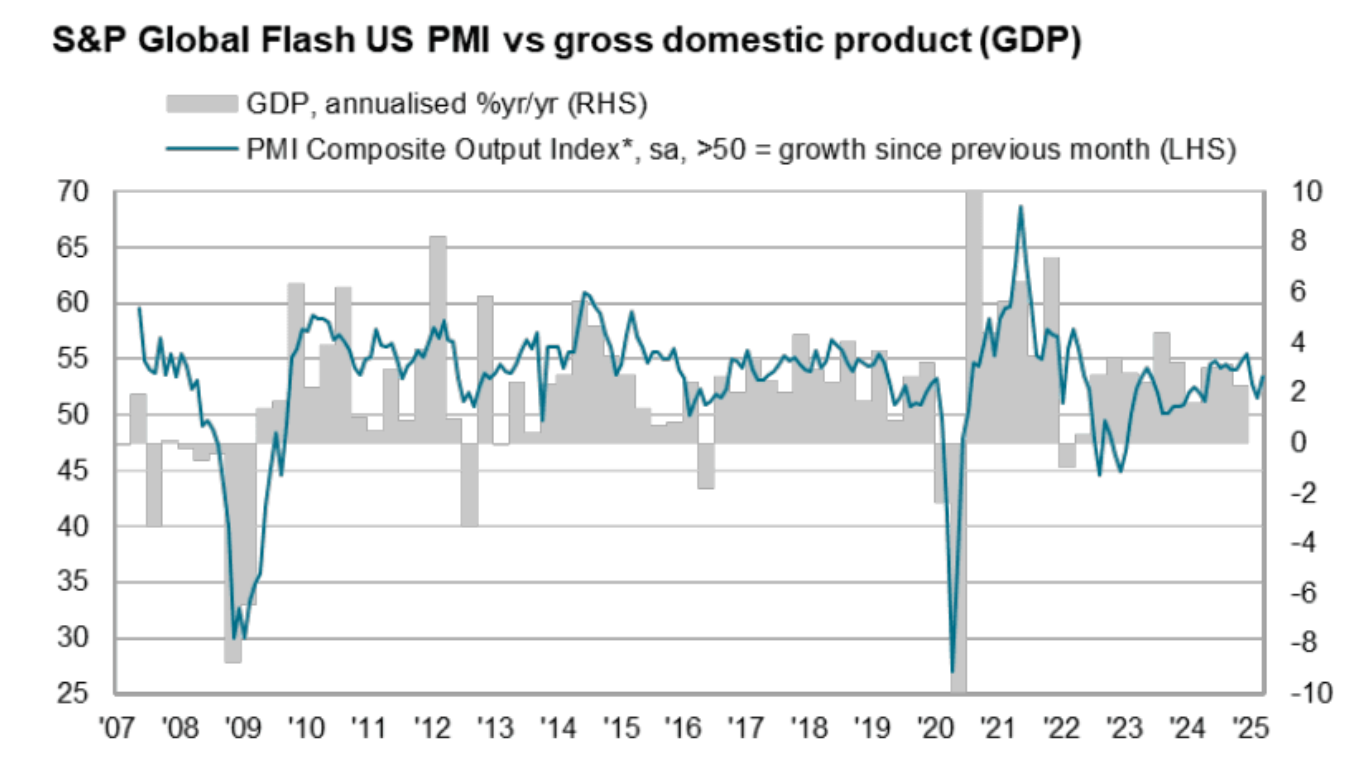

S&P Global Flash US PMI vs domestic products | Source: Nansen

After market sentiment was extremely terrified last week, some investment banks eased these concerns as they increased the odds of a US recession to 40% this year. The latest US March Flash PMI report shows a highest score of 53.5 in three months, suggesting an annual growth rate of 1.9%. However, due to weak data in January and February, overall quarterly growth is low at 1.5%.

Barthere has emphasized that so far there is no harsh evidence of a recession, as “mostly the weakness in the data is on sentiment indicators, and difficult economic data is maintained.” She added, “There is no evidence of a recession at this stage, so there is no evidence that we have moved to the bear market.”

The coming months may increase, but Nansen’s report suggests that the entire bull market is still playing. As barthere puts it, the market “is likely to see corrections, but then bottomed out for the rest of the year and headed towards a new high.”

read more: Crypto sells flat markets as inflation cools, and Trump’s tariffs cause uncertainty