Bitcoin takes on around $81,966 to $82,126, directing a market valuation of $1.62 trillion and daily trading volume of $19.42 billion, oscillates between $81,287 and $83,340 in a downward trajectory visible at multiple intervals.

Bitcoin

The Bitcoin hour chart depicts a vivid portrait of decline, retreating from the recent Zen from $87,481. The scary barrier to resistance is close to $83,000, but immediate support is close to $81,000. BTC’s trading activities support this pessimistic attitude as sellers determine market dynamics. Speculators may explore short positions during weaker gatherings and place protective stops above recent peaks. A critical leap of over $84,000 with amplified activity could suggest a trend rejuvenation.

BTC/USD 1H chart via BitStamp on March 31, 2025.

Zoom into the 4-hour view and Bitcoin carves patterns of peak and trough reduction, amplifying negative emotions. Resistance continues solidly between $85,000 and $86,000, but support nearly $81,500 faces repeated trials. This collapse under the floor could increase downward momentum, but conquering $86,000 could infuse a temporary bullish phase. Observation of activity spikes remains important for detecting inflection points.

BTC/USD 4H chart via BitStamp on March 31, 2025.

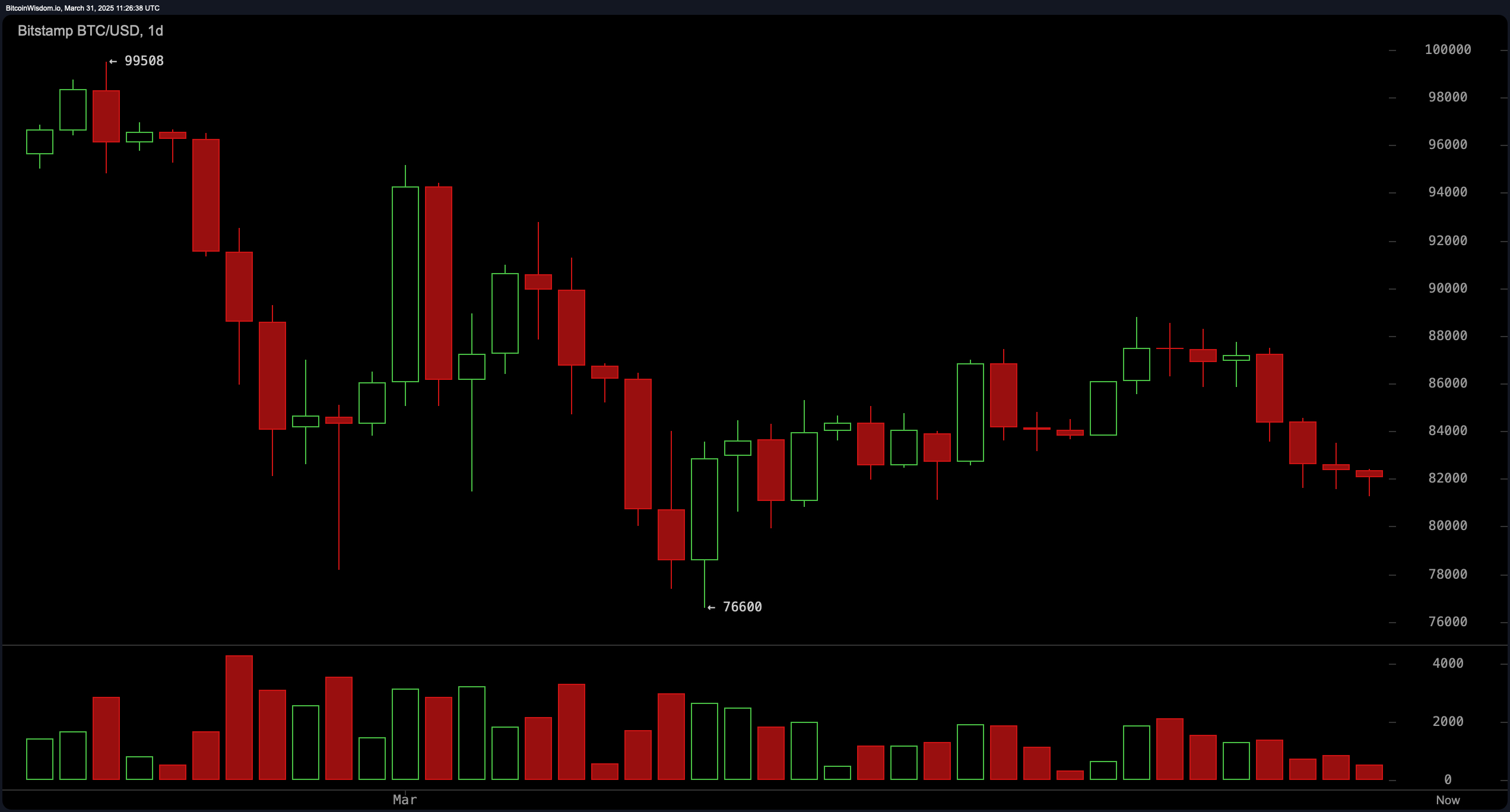

Bitcoin’s daily lens reveals an expansion descent hemmed with horrifying resistance of nearly $90,000 and critical support of nearly $76,600. Buyers remain prominently absent, thwarting attempts to reverse the slide. Careful investors may adopt a cautious attitude, scrutinizing $76,600 in durability or prepare for a deeper loss. Only the emphasised close of over $90,000 will confuse the bearish story.

BTC/USD 1D chart via BitStamp on March 31, 2025.

A technical oscillator draws a mosaic of conflicting signals. The relative strength index (RSI-43), probability theory (49), CCI (-32), ADX (23), and Awesome Oscillator (656) collectively reflect equilibrium. Momentum (-3,954) remains in negative terrain, while MACD (-831) suggests a potential long opportunity. Ambiguity has become widespread, and participants are eager to find clues for clearer directions.

Moving Average (MAS) flashes evenly pessimistic signals. It is on sale via EMAS and SMAS (10-200 periods, with 10th period EMA at $85,196 and 200th period SMA at $85,809. The bear will retain control at the price remaining under all major averages, unless a strong violation occurs that exceeds the pivotal resistance.

Fibonacci’s retracement highlights important thresholds. On daily scale, Bitcoin falls below the 50.0% mark ($88,054) and reveals its vulnerability to additional losses unless it recovers the 61.8% level ($85,350). On the four-hour chart, resistance converges near $85,728 (50.0%), with a price dancing at around $84,517 (61.8%) in the one-hour frame. A critical violation above these markers can tell you a change in momentum. Failure to hold $83,711 will lead to further erosion.

In short, bears blow powerfully at every interval. Active traders may support strategic short positions in the absence of a clear inverted signal, but vigilant observations of activity and resistance thresholds reveal potential turning points.

Bull Verdict:

If Bitcoin surpasses major resistance levels, particularly $85,000 on the 4-hour chart and $90,000 on the daily chart, bullish momentum could regain control as it is supported by strong volumes. A successful violation is likely to mark the end of the current downward trend, encouraging buyers to re-enter the market and could push prices up to previous highs. The positive signal and increased momentum from the MACD will further strengthen the bullish outlook.

Bear Verdict:

A consistent failure to break through Bitcoin’s resistance combines sales signals from all major moving averages with bear pressure visible across all time frames to support a bearish outlook. If the price loses support at $82,685 and falls below $81,287, there will be an additional downside, with $76,600 serving as the next important level. Weak buying pressure and ongoing negative momentum suggest that traders will continue to support short positions in anticipation of further declines.