Cryptocurrency prices have steadily appreciated throughout the Easter weekend, surpassing $88,000 on Monday, bringing the dollar to its lowest level in three years.

BTC is rising sharply while the dollar continues to free fall

His threat to fire President Donald Trump’s aggressive tariffs and Federal Reserve Chairman Jerome Powell have shouted traditional markets and foreign investors weakened the greenback, but Bitcoin (BTC) and physical gold appear to have emerged as safe shelters.

Market Metric Overview

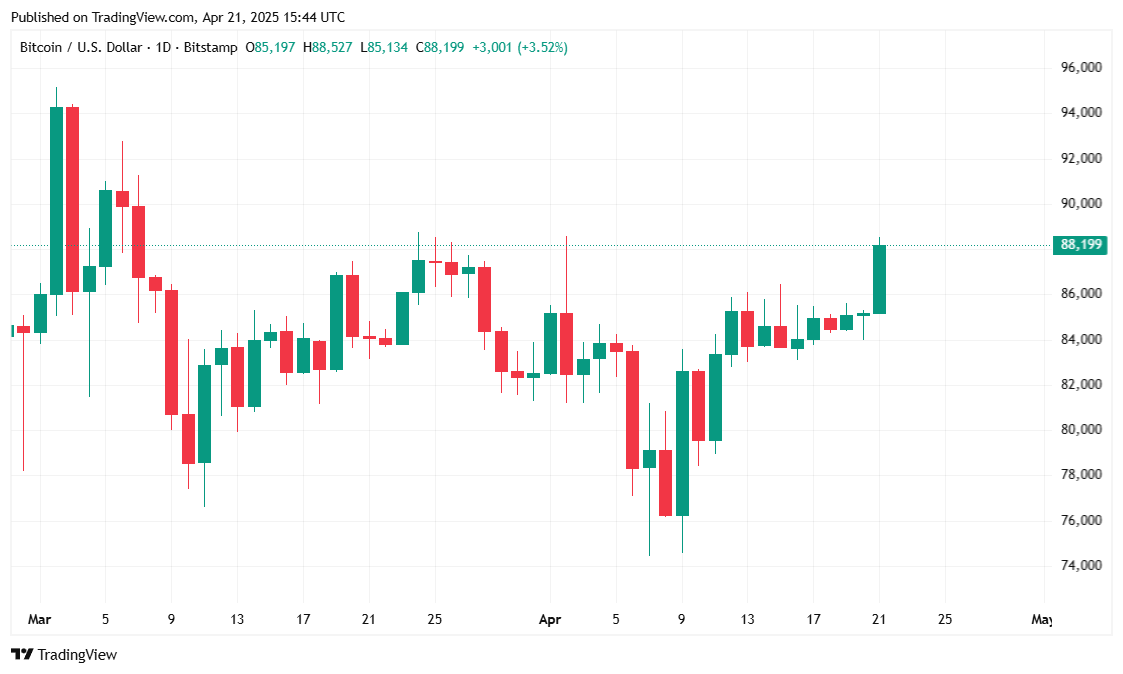

Bitcoin started the week at a strong pace, rising 4.48% over the last 24 hours to $88,260.09 when reported. Digital assets traded between $84,281.02 to $88,460.10 as investors sentiment continued to improve. Over the past seven days, BTC has won 5.08%, supported by stable purchases and broader market optimism.

(BTC Price/Trade View)

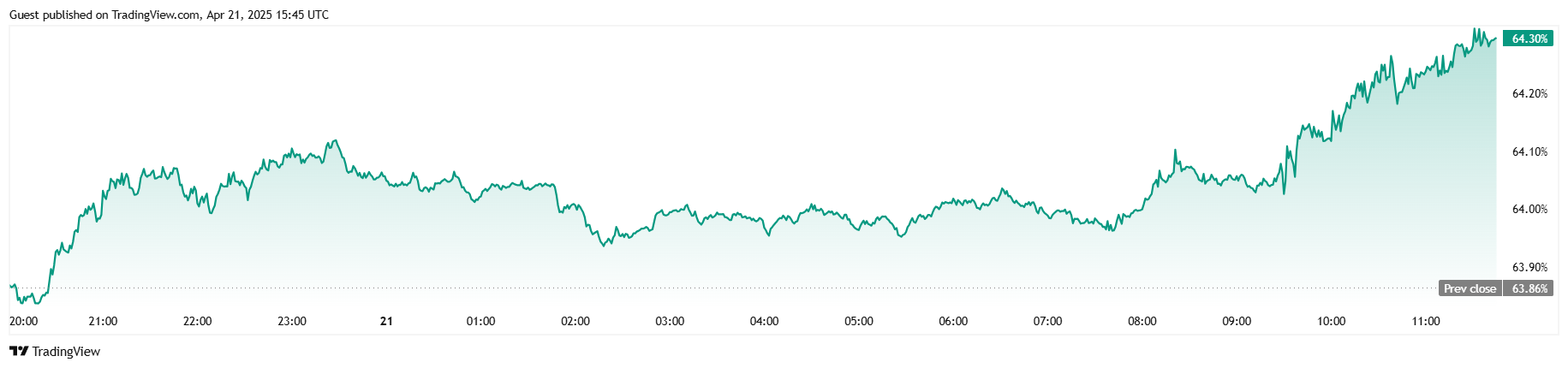

Trading volume surged to $344.1 billion, an increase of 133.17% compared to the previous day. This is a jump due to a typical post-week surge. Bitcoin’s market capitalization also rose 4.15% to $1.74 trillion. Meanwhile, BTC’s dominance rose to 64.30%, earning 0.67%, strengthening Bitcoin’s leadership role in the crypto market.

(BTC dominance/trade view)

Coinglass data shows a significant increase in open interest in Bitcoin futures. Despite the surge, the overall liquidation remained minimal at $460,490, with $276,400 from the shorts and $184,090 from the longs. The relatively low liquidation volume emphasizes the orderly nature of the market even as prices and trading activities rise.

Trump’s tough talk tank dollar

Trump touted lower than expected inflation numbers released by the Bureau of Labor Statistics on April 10, calling Powell “the main loser” on Monday, and did not cut interest rates to help slow the US economy.

“There could be little inflation, but as long as you’re too late, you’re a loser, a major loser, and you’re going to have a slower economy,” Trump posted to The Truth Society. “Europe has already “down” seven times. Powell was always “late,” the president added.

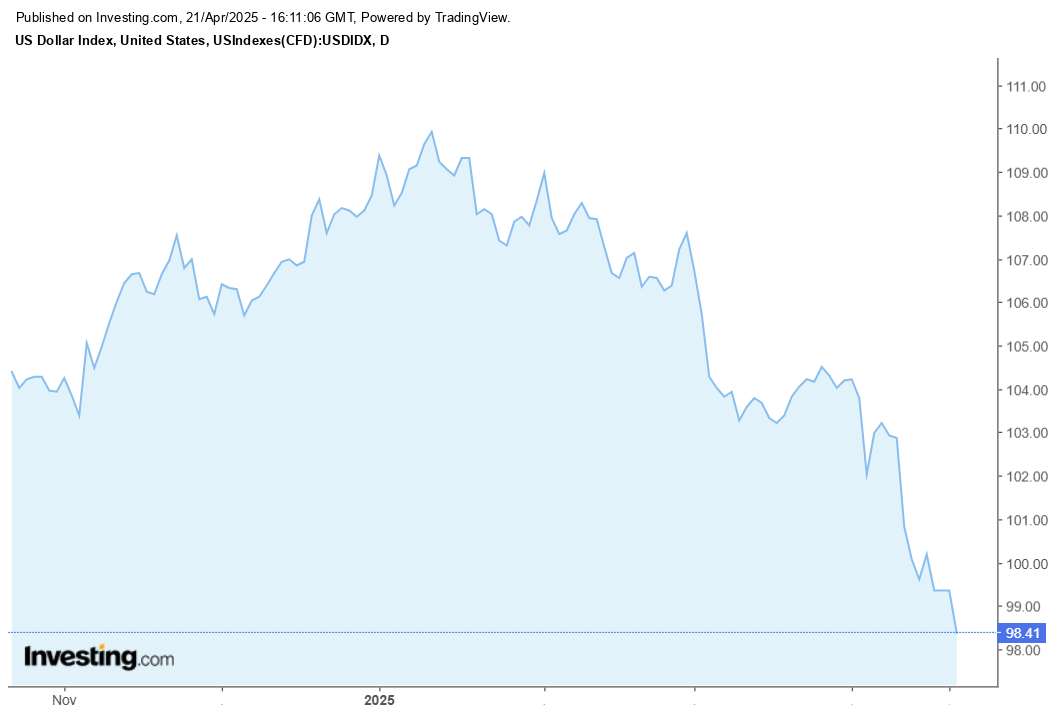

Last week, Trump threatened to fire Powell, focusing on the issue of FRED independence. The president’s harsh trade policy and his shot at Powell led to the escape of foreign investors, sending the US Dollar Index (DXY) to three years’ low, gold, all-time high, and Bitcoin to $88,000.

(The US dollar index, which tracks the dollar’s strength against a basket of foreign currency, fell to its lowest in three years on Monday / Investing.com)

If the trend continues, greenback risks giving away global control to cryptocurrencies, specifically designed as an antidote to reckless Fiat policies.