Bitcoin has shown some resilience as the stock market drops due to US tariffs on most trading partners. Unchained experts explain why.

US stocks have seen some of their worst performances over the years. However, Bitcoin (BTC) has shown relative resilience. This is great news for institutional investments, explains Joe Burnett, director of market research at Crypto Financial Firms Unchained.

Trump’s tariffs are here, US stocks are crashing, and China is retaliating.

Now may be one of the best times to build meaningful Bitcoin locations.

It’s not financial advice. pic.twitter.com/rf9z01wrhm

– Joe Burnett, MSBA (@iicapital) April 4th,

On April 4, the Dow Jones industrial average drove over 2,200 points, adding to the 1,679 points decline on Thursday. This was the worst two-day performance in history, and many stock investors were worried about the weekend.

You might like it too: Traders Holding Bitcoin despite Market Panic: Binance

At the same time, Bitcoin showed relative resilience and began to begin recovering, actually recording a 2.2% increase in the last 24 hours. Burnett suggested that this is a recurring pattern since 2020, when Bitcoin prices led to a market recovery.

Recalling in March 2020, Bitcoin quickly ran out of stock and first recovered (before US stocks).

Due to Bitcoin’s high volatility, Burnett said that first asset investors often sell when liquidity is dry. However, because selloffs are usually fast and aggressive, Bitcoin often runs out of stocks.

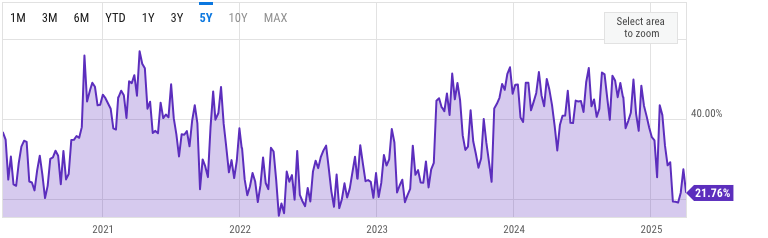

This could also indicate that the stock is approaching the bottom. Supporting this view is the AAII Investor Sentiment Survey. This fell to 19.11% on March 13th, the lowest level since the pandemic. This extreme negative outlook could mean that the stock is set to inverted.

Still, Burnett warned that this does not guarantee that Bitcoin is out of danger.

Of course, if stocks continue to fall aggressively over the next few weeks, it’s reasonable to expect Bitcoin to experience another leg too.

You might like it too: Bitcoin prices could rise as US bond yields, fear and greedy indicators drop