Bounces in the crypto market were primarily stagnant on Tuesday, with the US government shutting down in Eastern Eastern Time.

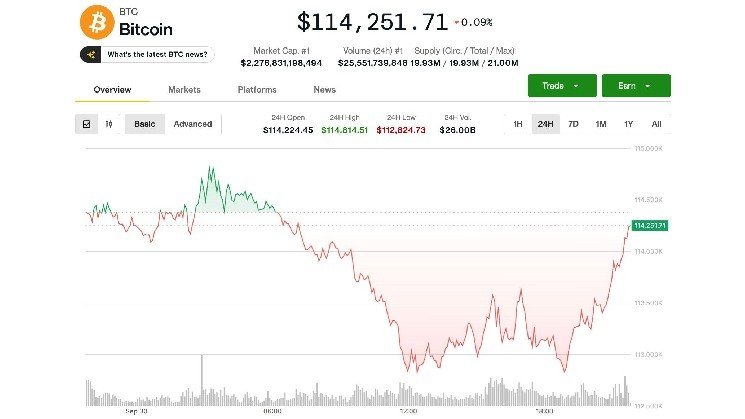

BTC$114,195.26 – After previously sliding about 2% from an overnight high of nearly $115,000, the late afternoon rally rose slightly from 24 hours ago. ETH$4,155.46 It slid 1.3% over the same period, slightly above $4,100.

Most tokens on the Broadmarket benchmark Coindesk 20 index have declined. avax$29.97uniswap (uni) and near$2.6286 Major loss.

In traditional market checks, Gold climbed an additional 0.5% to $3,850, extending the record-breaking run, but the Nasdaq and the S&P 500 Equity Index saw the late rally to move into post-territories.

Most market participants are in standby mode as the US government appears to be heading towards certain closures of uncertain lengths.

Once the government is closed, all non-essential activities based on the administrative sector will cease. This could include ongoing efforts by the Securities and Exchange Commission, Commodity Futures Trading Commission and federal banking regulators to create new rules for the crypto industry.

Shutdowns will not affect the ability of people to submit comments on open rulemaking efforts, but it is unlikely that anyone at these agencies will be tasked with reading feedback. This outage could also affect businesses’ ongoing efforts. Sol209.14 dollars and LTC$106.88Coindesk reported on Tuesday.

Congressional work on laws on crypto market structures will be delayed. The Senate Banking Committee has already postponed the interim planned markup (hearing of discussion of provisions regarding the bill) on the market structure draft from Tuesday until late October. The Senate Agriculture Committee has not made the bill public. However, the Senate Finance Committee is scheduled to hold a hearing Wednesday to look into the issue of crypto taxes.

Shutdown will leave BTC vulnerable, Bitfinex warns

The closure will also halt the release of key economic indicators such as Jobs data and CPI inflation report, which could amplify volatility across asset classes, including Cryptos, Bitfinex analysts warned in the report.

The delay in data could complicate Federal Reserve’s monetary policy decisions, and ripple effects resonate across rate markets, the report states. Global investors have already reduced our exposure, which has led to a trend in accelerating long-term shutdowns, the report says.

“In the case of the market, the immediate risk is not systemic financial instability, but a blind spot for confidence and data,” Bitfinex analysts say of the potential shutdown.

Zooming out, BTC is still in the correction phase since the Fed’s interest rate cuts in September. This turned out to be “buying rumors and selling news events.”

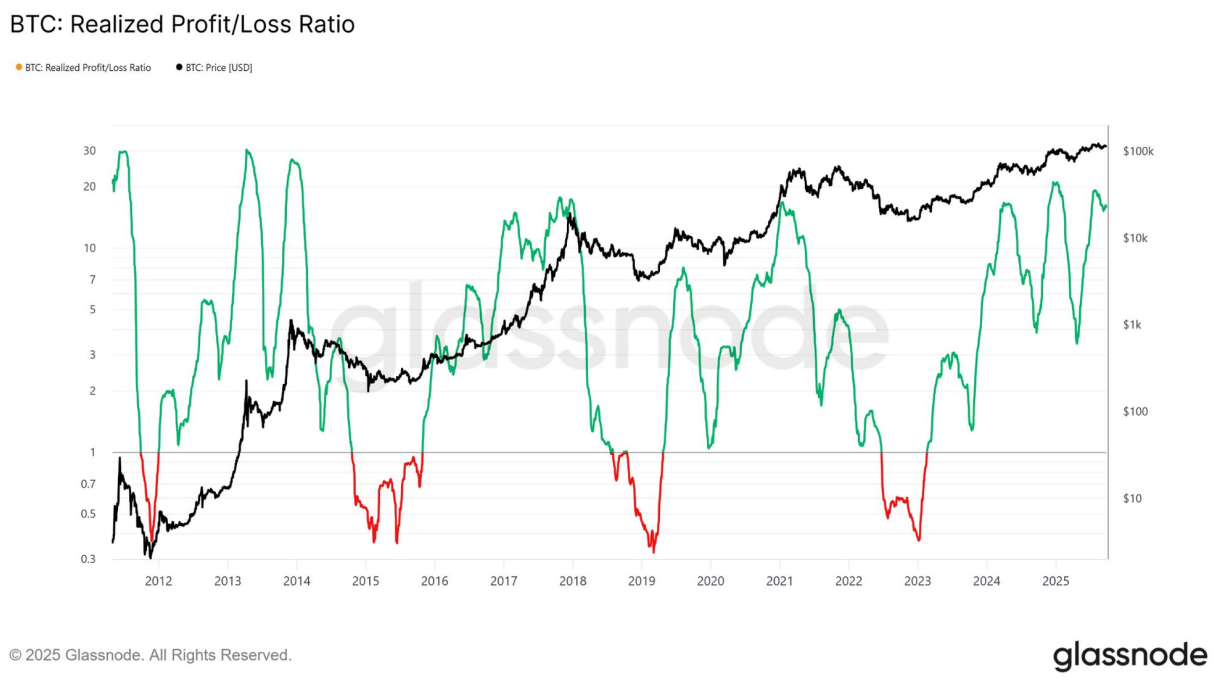

The report notes that unlike previous cycles, this cycle has been unfolding in three different months of surges, each being capped with widespread profits.

Bitcoin shows three different peaks throughout this market cycle. (bitfinex/glassnode)

“At each cyclical peak, more than 90% of the coins that moved were traded on profits. This is a clear signal of widespread distribution,” the analyst wrote.

Bitfinex analysts have just retreated from their third peak and are seeing the probability of further leaning towards integration.

“Deep political polarization, rising fiscal deficits and a fragile global economy leave shock-sensitive markets behind,” they added.