BITCOIN has recently caused a range of bound exercises, with prices rose from $ 83,000 to $ 86,000. Interestingly, Burak Kesmeci, a popular encryption analyst, has confirmed the important price level of short -term measures.

Support of 82,800, where is the resistance -Bitcoin at 92,000?

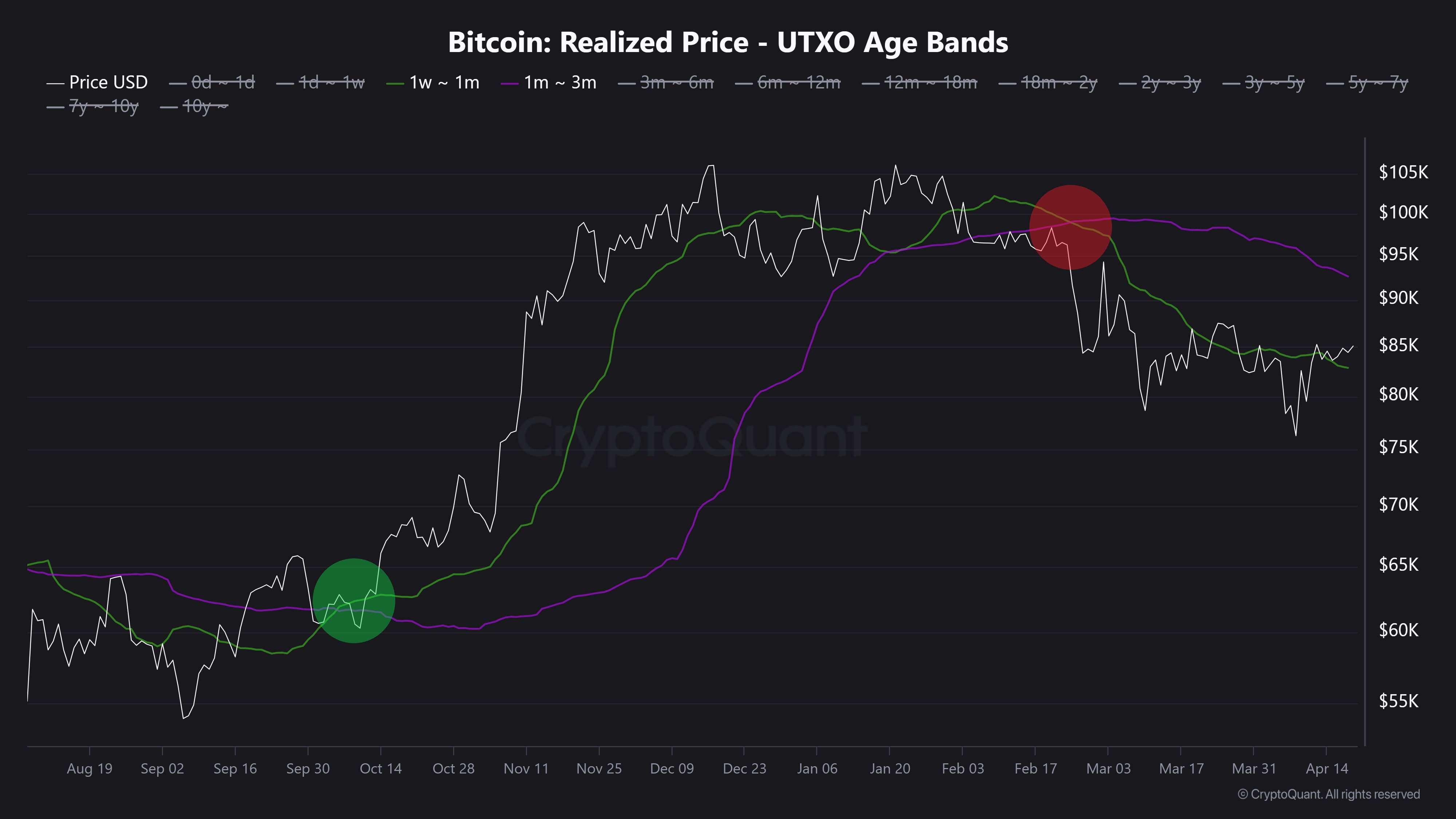

In X’s new post, Kesmeci shared an interesting chain analysis of Bitcoin Market. Using short -term investor costs, analysts have confirmed two major prices, which are important for Bitcoin’s next major movement..

First, Burak Kesmeci focuses on the average cost of new traders over the past 1-4 weeks, which can be the most responsive to price fluctuations. The price of these traders is currently $ 82,800, and many buyers are still gaining profit and form short -term support that indicates that they can defend this level into a psychological layer.

Kesmeci also emphasizes the price of $ 92,000, which records the average cost of BTC holders for 1-3 months. This price range has emerged as an important resistance area because investors may be able to escape the market once they are out of the market. In addition, the price level of $ 92,000 is represented by a variety of technical indicators.

The interaction between these two levels is important. Historically, the short-term strength of BTC tends to begin when the recent cost standards of investors exceed the cost of 1-3 BTC holders than 1-4 weeks (1-4 weeks). These shift signals have increased their trust and willingness to purchase at a higher level, which often fuels wider rally with fuel.

But in the current market, there is a dynamic thing. Currently, BITCOIN is trading about 85,000 people, which is less than $ 92,000 in 1-3 months compared to the average of $ 82,800 of 1-4 weeks. In addition, over the past two months, the level of standards has been hesitant or reduced to reflect the aggressive purchase of new participants.

In particular, Kesmeci says that BTC must surge more than $ 92,000 to confirm the strong optimal driving force for the price reversal.

Bitcoin ETFS Off -Road 1,725 BTC

In other news, ALI Martinez said that Bitcoin ETF had withdrawn of 1,725 Bitcoin with $ 149.2 million last week. This development shows high levels of negative feelings among institutional investors and adds market uncertainty to the BTC market.

Meanwhile, Bitcoin is trading at $ 85,249 last day with a price fluctuation of 0.89%. Premier Cryptocurrency also reflects 0.58% loss in the weekly chart and 1.06% in monthly charts.

Functional image of Adobe Stock, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.