Bitcoin Bull Market continues to balance with a wide range of prices in the last three months. Despite the appropriate price rebound in April, premiere cryptocurrency still lacks positive market factors and has not expressed its strong intention to resume bull rally. However, encryption analyst AXEL Adler JR. emphasized promising development that shows the possibility of a major rise in Bitcoin.

Bitcoin long -term holders are trying to stop sales pressure.

In a recent post about X, Adler Jr. has shared important updates in the Bitcoin long -term holder (LTH), which can be quite positive for a wider BTC market.

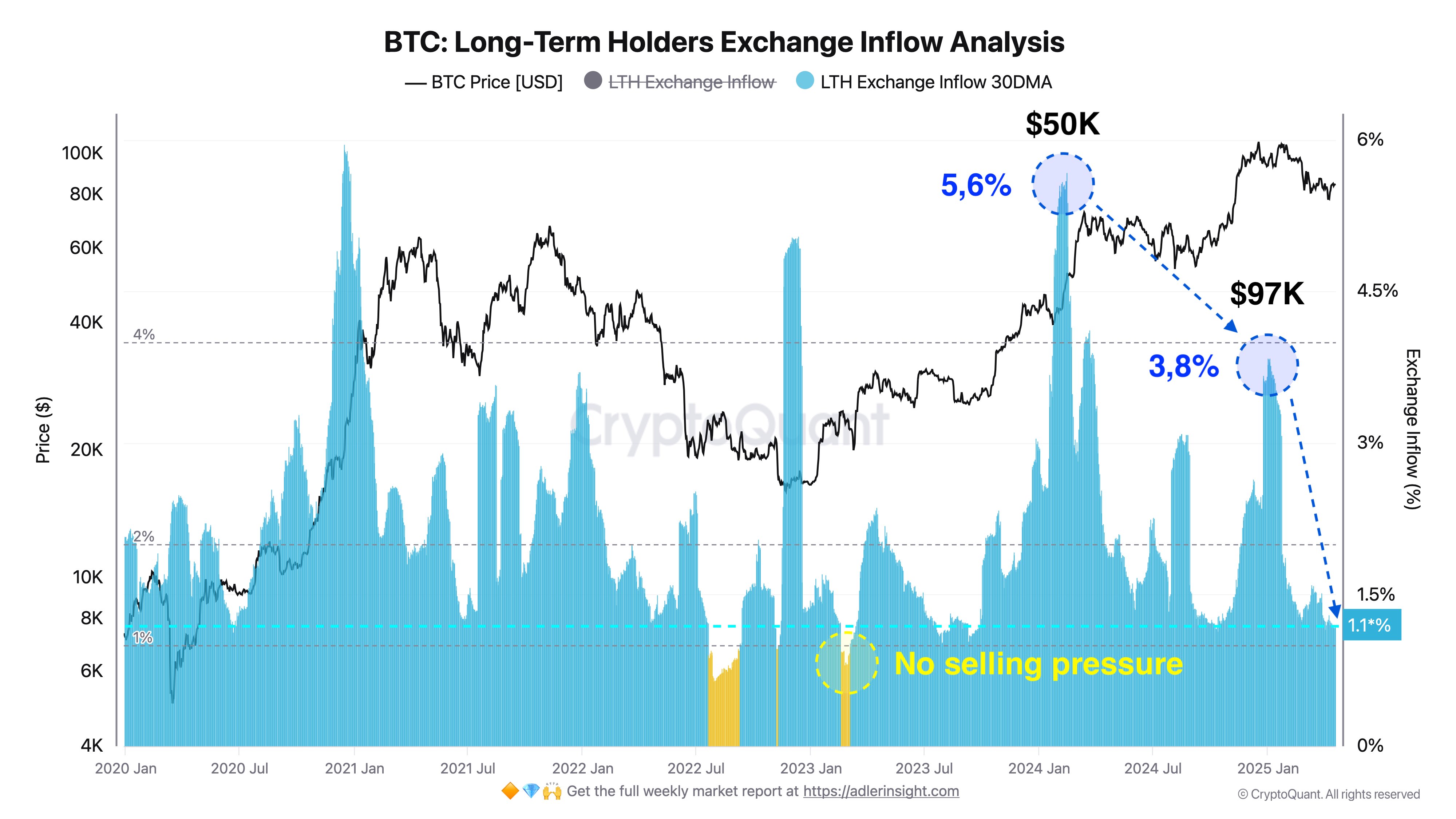

The famous analyst reported that the low -end pressure of long -term holders, that is, LTH holdings, recorded the lowest point at 1.1%last year. This development indicates that Bitcoin LTH is now choosing to maintain assets rather than gaining profit.

Adler explains that additional reductions to 1.0%of these LTH Exchange will signal the absence of the total sales pressure. In particular, this development can create a strong optimistic momentum in the BTC market by encouraging new market entry and continuous accumulation.

Importantly, Alder emphasized that the majority of Bitcoin LTH has entered the market with an average of $ 25,000. Since then, Cryptoquant recorded the highest sales pressure of $ 50,000 in early 2024 and 3.8%from $ 97,000 in early 2025.

According to ADLER, these two cases indicate the first profits of long -term holders to terminate the market. Therefore, there will be little selling pressure from this cohort of BTC investors. Long -term holders are currently controlling 77.5%of Bitcoin in circulation, supporting buildings.

BTC price outline

At the time of writing, Bitcoin increased 0.36% last day and traded at $ 85,226 last week with a loss of 0.02%. BTC only reflects continuous market integration because BTC continues to have difficulty in achieving persuasive price repayment beyond $ 86,000.

On the other hand, the performance of the asset in monthly chat is now reflected in the profit of 1.97%, and the market correction is suspended, showing a potential trend reversal. Nevertheless, BTC needs a strong market catalyst to ignite sustainable price rally. With the market cap of $ 1.67, Bitcoin is ranked as the largest digital asset that controls 62.9%of the encryption market.

The main image of Adobe Stock, the chart of TradingView

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.