IREN announced that it will add the index to the MSCI USA Index, a leading benchmark tracking the performance of large- and mid-cap U.S. stocks, by the end of February.

This inclusion is expected to increase IREN’s visibility among institutional investors and index-tracking funds, which could support the company’s long-term pricing and capital raising plans.

Many ETFs and funds track MSCI, and new additions typically trigger automatic purchases by companies tracking the benchmark, so it’s unlikely to go unnoticed.

This could cause stock prices to rise in the short term. It also increases the stock’s visibility among institutional investors, which could support the company’s long-term pricing and capital raising plans.

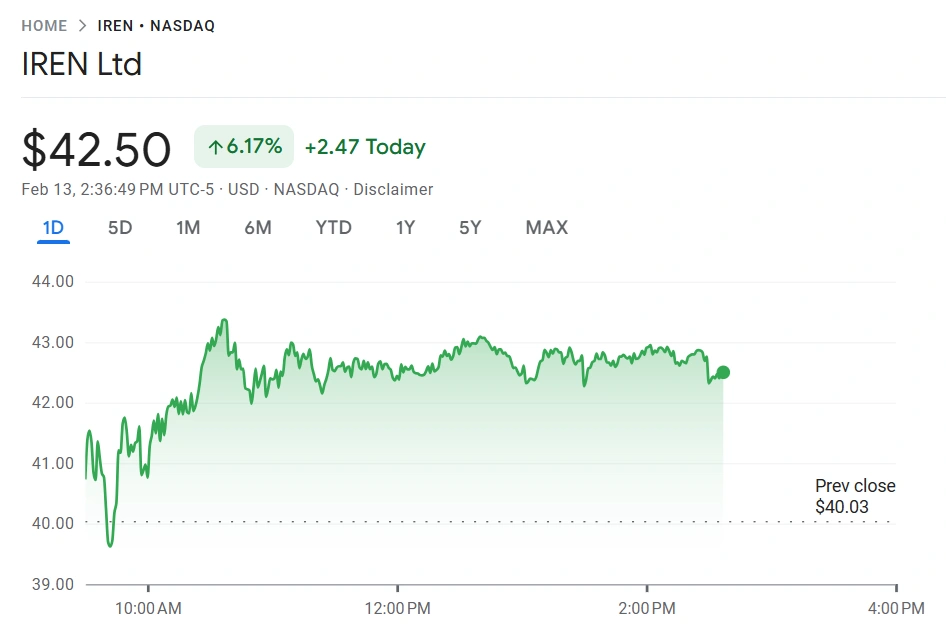

IREN’s stock price has been in the green since announcing its participation in MSCI. Source: Google Finance

Why joining MSCI is important to IREN

Daniel Roberts, co-founder and co-CEO of IREN, said the privilege of being added to the MSCI USA index reflects the scale and liquidity the company has built in its business.

“We believe this milestone will expand institutions’ access to IREN as we continue to execute on our AI cloud strategy,” he said.

of announcement It comes as IREN continues to transform from a purely focused company. $BTC We provide mining to dual-purpose players that provide mining services and AI cloud services.

Notably, the company is currently investing more in AI-centric rather than AI-centric assets. $BTC Mining work. In fact, the company’s current spending on equipment and data centers far exceeds what it had planned for Bitcoin mining, and has reportedly continued since its IPO.

IREN stock reaction to this announcement

Since the announcement, IREN stock is in the green zone, indicating a positive recovery of about 7%. But stocks still struggle between institutional optimism and volatility.

The earnings concerns stem from IREN’s weaker-than-expected quarterly results, with sales falling to $184.7 million and losses widening. Wall Street is divided on this performance, with some analysts focusing on near-term earnings pressures, while others point to longer-term upside.

Many will continue to monitor the stock until February 27, when it is scheduled to be included in MSCI, which is expected to attract institutional investors and ETFs that track the index.

IREN’s deal with Microsoft

Airen safe The company ended 2025 with about 3 gigawatts in the pipeline, compared to just 200 megawatts in its five-year, $9.7 billion deal with Microsoft.

Investors have been expecting a similar deal since the deal was revealed and initially expressed disappointment that the company did not announce a new deal.

Fortunately, CEO Daniel Roberts reassured investors that the company is negotiating multiple deals, including multibillion-dollar deals, as an indication that the long-term AI thesis remains intact.

Iren also secured a 1.6 GW data center campus in Oklahoma.

IREN positions itself as the solution to one of the major bottlenecks affecting technology giants today: energy. The company boasts the ability to support multiple large transactions thanks to its 1.4 gigawatt Sweetwater 1 facility, which is scheduled to be energized in April.

It has also secured a new 1.6 GW data center campus in Oklahoma, and the data center power schedule will be enhanced in 2028, bringing Airen’s total secure grid-connected power to 4.5 GW.

As AI infrastructure continues to expand and energy demand increases, IREN is expected to win more contracts similar to the one with Microsoft. The company has already turned 200 megawatts into $1.94 billion in annual recurring revenue, and if it can achieve the same percentage with 4.5 gigawatts (4,500 megawatts), it could increase its annual recurring revenue to billions of dollars.

That’s one reason Roberts called IREN’s projected annual recurring revenue of $3.4 billion by the end of 2026 “in the early stages of profitability relative to the size of its secure power portfolio.”