Bitcoin Miner attacked gold in July, earning its highest revenue since half of April 2024. In fact, mining revenues in July were about 19.42% higher than in June.

Bitcoin Miner is pleased with the July stairwell

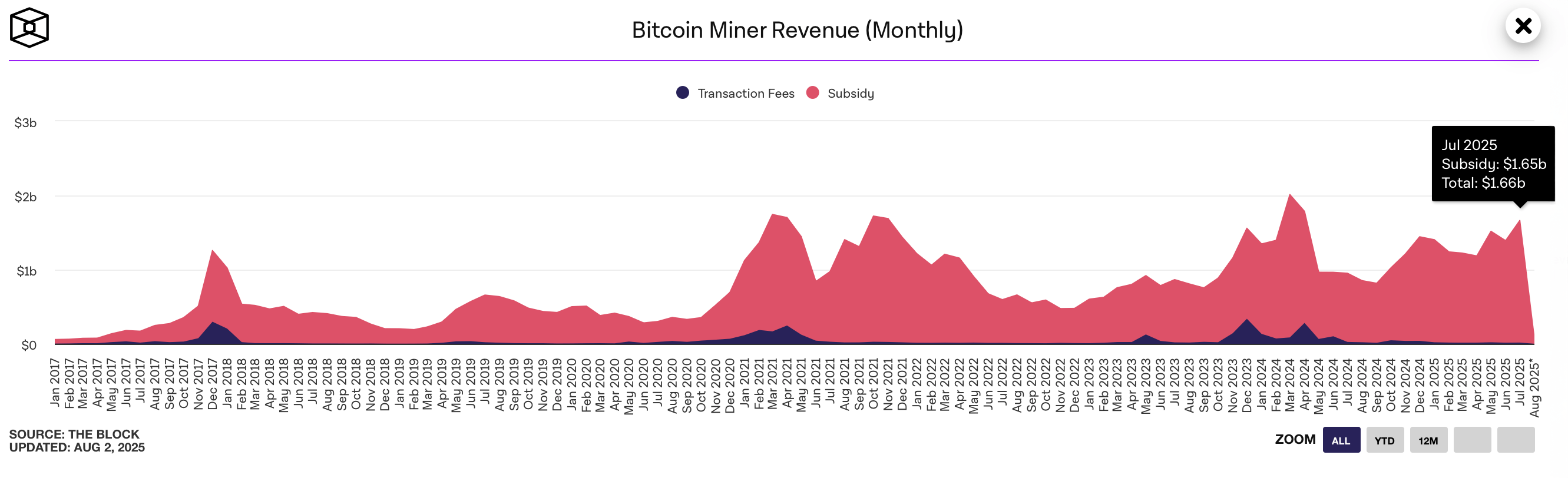

Bitcoin price action gave miners much needed boost last month, closing July as the highest payday since April 20, 2024. At the time, it cost a lot more than a year ago at $1.79 billion. According to data from TheBlock.co, in July this year, they pulled in $1.666 billion in total revenue from fees and block compensation.

Source: Bitcoin Miner Revenue (Monthly) from TheBlock.co.

In June 2025, miners were transported at $13.9 billion, resulting in a total of $270 million jump, or 19.42% in revenue. Of the $1.66 billion won in July 2025, just $16.43 million came from Onchain Fees. This year, fee revenue has been significantly reduced. For context, in April 2024, when miners brought in $17.9 billion, of which $281.47 million came from fees alone.

Hashpris (estimated revenue from 1 petahash per second (pH/s) of hash power) remained neatly in July and opened in August at a bit of a dip. On July 2nd, the 1 value was $58.40, but that figure reduced from 2.81% to $56.76. This means you’ll get $56,760 from $58,400 just a month ago, and get $56,760 with a full exhaush per second (Eh/s).

This revenue flooding has tightened the miner’s screws. The total hashrate peaked at 943 EH/s on July 26th, but relaxed to 900.29 EH/s a week later. As of 8:30am on Saturday, the block time averaged 10 minutes and 16 seconds. If this pace continues, miners may consider decreasing difficulty when the next adjustment hits on August 9, 2025.