Bitcoin (BTC) mining is the next sector that feels the impact of the US-China tariff war. Miners are seeking workarounds as ASIC and mining rig status remains unknown.

Bitcoin mining has responded to the US-China tariff war as the situation of the machine and its components remains unknown. The competitive mining of the SHA-256 still relies on Bitmain machines, which are shipped to locations or use rental mining facilities overseas.

The tariff war has flapped up just as Bitmain announced new shipments of some of the most powerful ASIC rigs. The S21, the most powerful Bitcoin mining machine at the moment, is now shipping this month.

Antminer S21E HYD spot sale.

#BTC #Mining Cost-Effective Options✅288t

✅4896W

✅17j/t

💲12/t onlySales will begin on April 15th at 9am EST

ship Available from April to May it.twitter.com/jmgq0uaekw– Bitmain (@bitmaintech) April 15, 2025

A 90-day tariff bounty period could lead to increased shipping demand for ASICs. Miners can also double their US facilities and may purchase as many hashrates as possible before a shipping failure occurs.

Customs duties may be in a hurry to ship ASICs to the US

The biggest question is whether the promised electronics and mining equipment will be shipped. US tariffs affect not only China, but Malaysia, Thailand and Vietnam.

Some of the mining startups using components of these countries scrambled to ship as much as possible before customs duties are enforced.

“We have started chartering freight planes from Malaysia and Thailand to ship to the US before the original deadline. ” said Vishnmackenchery, director of global logistics and services for compass mining.

Based on the latest classification, ASIC miners do not fall under exempt electronics. Additionally, if the trade war is not resolved by the end of the trade war, it may be shipped with exorbitant tariffs. Compass Mining is one of the companies supporting impact due to limited replies for exemptions based on the current US tariff system and classification.

🚨Customer Duties & Bitcoin Mining Hardware 🚨

Following the White House’s April 11, 2025 update on tariff exceptions under EO 14257, let’s dive into the impact of imported ASIC miners into the US

In 2018, US Customs and Border Protection (CBP) was classified…

– Compass Mining🧭 (@compass_mining) April 15, 2025

Another mining equipment distributor, Luxor Technology, plans to continue providing information to its users, but hints at it Customs It may be that you’re coming to a new device. Like other electronics, not all supply chains pass through China, with fewer tariffs on some machines and components.

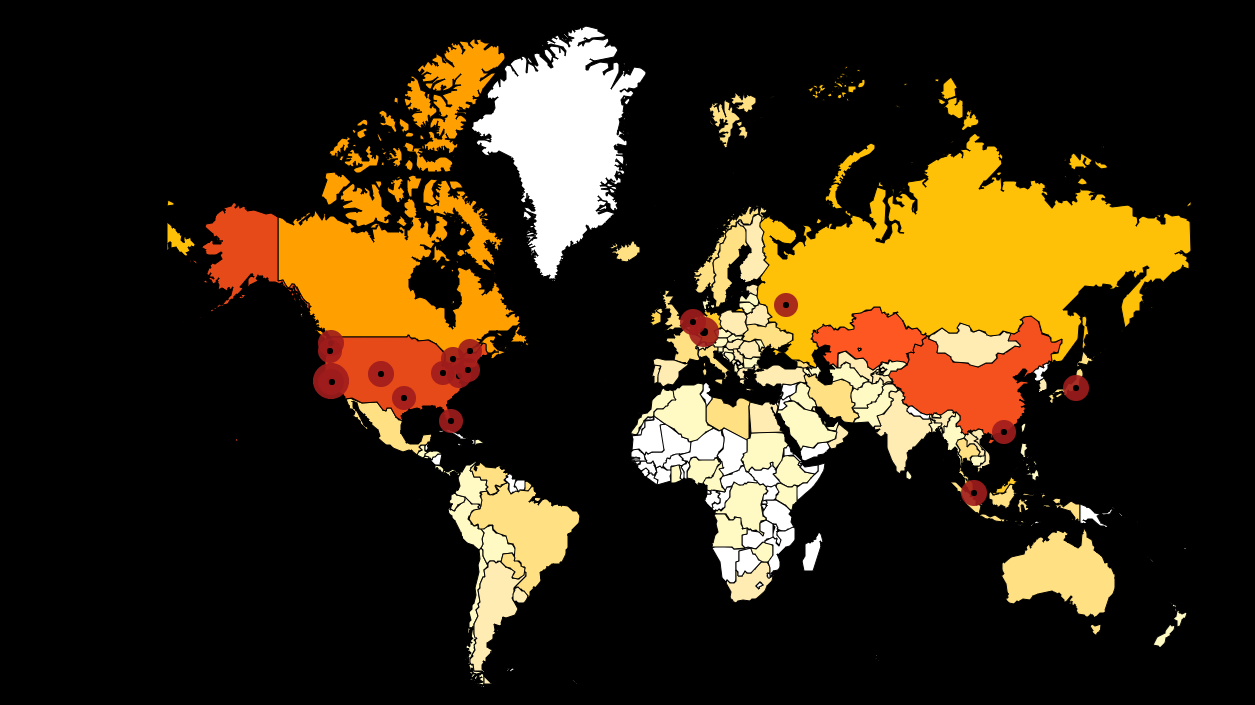

The US continues to control hashrates

Until recently, all mining ASICs from China were still taxed at 25% on their entry into the US. Traders have circumvented this requirement by shipping from other countries. Now, these areas also collide with mutual tariffs, ensuring miners find new potential routes for rigs and supplies. Indonesia, Malaysia and Thailand may be the most important markets affected.

Today, the US continues to be one of the leading countries with raw hashrates. Top mining companies like Mara Holdings are expanding hashrates and building new facilities.

The US continues to be both leaders, both hosting local mining data centers, as well as pool aggregators. |Source: Chain Breaking News

The threat of tariffs could benefit existing mining companies, particularly those that change equipment and are trapped at higher hashrates. US-based stocks Mining What happened in the past day, China-based Canaan Mining (CAN) reduced its price by 7.2% to $0.26.

Feindryusa, the largest mining pool in the United States, currently produces more than 31% of blocks due to an influx of overseas miners, but also adds native hashrates. Bitcoin Network is still experiencing peak hashrates 890 EH/s.