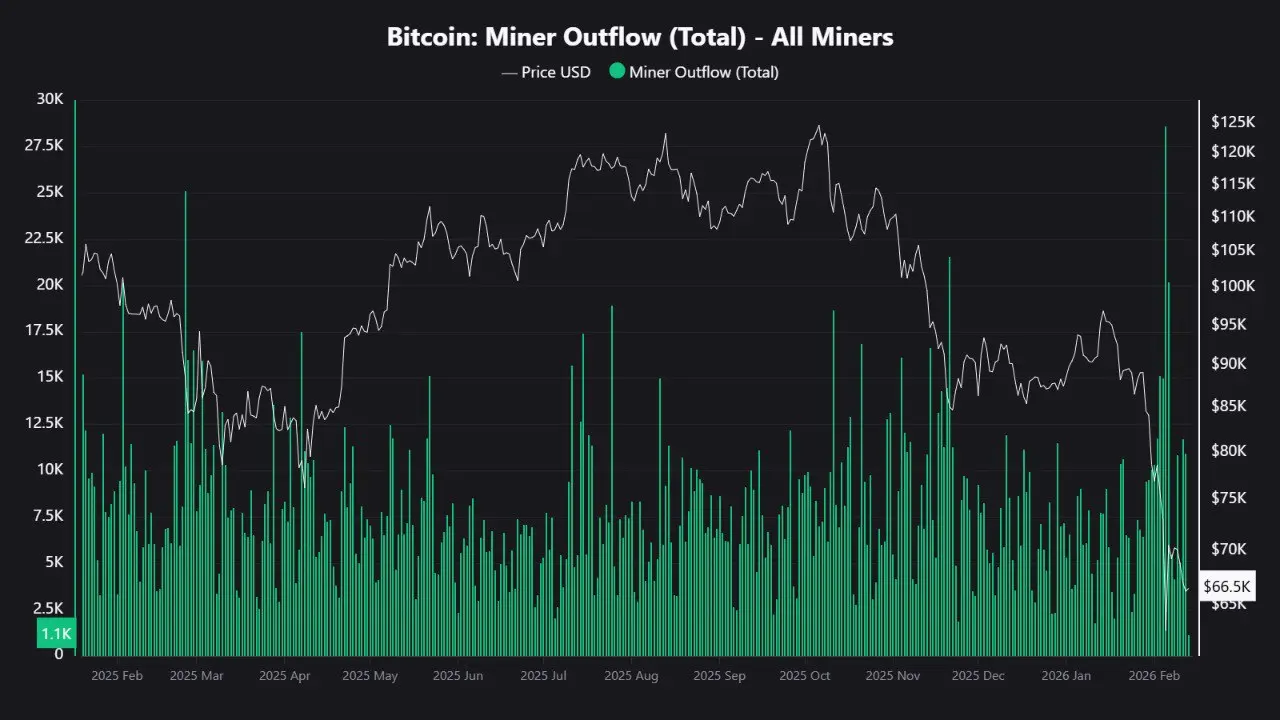

Bitcoin miner outflows surge to 48,000 $BTC But huge outflows do not mean miners capitulate, according to January disclosures from major companies. $BTC mining company.

According to on-chain data, Bitcoin miners moved 48,774 Bitcoins worth $3.2 billion from wallets between February 5th and 6th. However, trades do not automatically reflect miner surrender or immediate spot market sales. This data includes transfers to exchanges, internal wallet movements, and transfers to other entities. Therefore, the miner exodus does not mean that Bitcoin miners are releasing their assets to the public market as the crypto winter continues.

Wallet linked to Bitcoin miner moves $48,000 $BTCworth $3.2 billion in two days

Source: CryptoQuant Bitcoin Miner Outflow (Total) All Miners

February 5th, Bitcoin miner leaked spiked up to 28,605 $BTC The value is $1.8 billion. This value represents one of the most significant daily transactions related to miner wallet addresses since November 2024. Wallets linked to miners also recorded an additional 20,169. $BTC According to on-chain data, $1.4 billion worth of outflows occurred on February 6th, and a similar outflow spiked on November 12th, 2024.

The spike on February 5th and 6th coincided with Bitcoin’s recent price decline, with assets reaching $62,000 before recovering to $66,000. Whale trading amid market volatility has garnered a lot of attention and could signal potential selling pressure.

Despite on-chain data showing that addresses linked to miners moved large amounts of Bitcoin over a two-day period, the listed mining company’s corporate documents do not show any strong selling pressure from miners. Eight miners have reported a total of 2,377 production, including CleanSpark, Bitdeer, Hive Digital Technologies, BitFuFu, Canaan, LM Funding America, Cango, and DMG Blockchain Solutions. $BTC It is listed in the financial statements for that month. However, this number is significantly lower than the numbers recorded on February 5th and 6th.

During the same period, mining companies did not sell large amounts of Bitcoin. total number of $BTC CleanSpark, Cango, and DMG’s sales matched only a portion of the minor spills registered on February 5th or 6th. CleanSpark reported mining 573 $BTC and sales 158.63 $BTC During January, Kango mined 496.35 $BTC Disclose sale of 550.03 $BTC.

LM funding mined 7.8 $BTC He also reported that he did not sell any Bitcoin. Other companies like BitDeer, BitFuFu, and Canaan did not. disclose of $BTC However, based on projections, it will be difficult to reconcile the outflows recorded on February 5 and 6 with the company’s records.

Bitcoin miners are facing pressure from: $BTC price is below production cost

The news comes at a difficult time for miners. According to data According to Checkonchain, Bitcoin’s price floor fell below the difficulty regression model representing Bitcoin’s average production cost on January 26 and has remained below since then. The data shows how much it costs to produce 1. $BTC is $79,242,000, but $BTC At the time of publishing this article, it is trading at $66,485,000.

The Royal Government of Bhutan $BTC Transfer 100 and sell it off $BTC It was sent to QCP Capital’s WBTC merchant deposit address (bc1qt) on Thursday, according to blockchain analysis firm Arcam. Cryptopolitan reported The motive for the transaction remains unclear. This suggests that the government is potentially working on liquidity management or preparing to sell into a liquid market. The Royal Government of Bhutan is actively implementing state-led initiatives. $BTC Mining activity is increasing, and the economy may loosen due to increased selling pressure.

Bitcoin has fallen sharply since hitting a yearly high of $97,860 on January 14, according to data from CoinMarketCap. The crypto asset has since fallen more than 30% amid intense selling pressure.