Bitcoin has seen the market’s great cooling since it recorded more than $ 111,000. According to COINMARKETCAP’s data, Bitcoin has decreased 4.36% over the last seven days to less than $ 104,000.

In order to establish optimistic propulsion, the prominent encryption analyst in X -user name DAAN CRYPTO mentioned that Premiere cryptocurrency must finish more than $ 106,000, representing the pivotal price area of the current price structure.

Bitcoin price -disadvantages in the integration range?

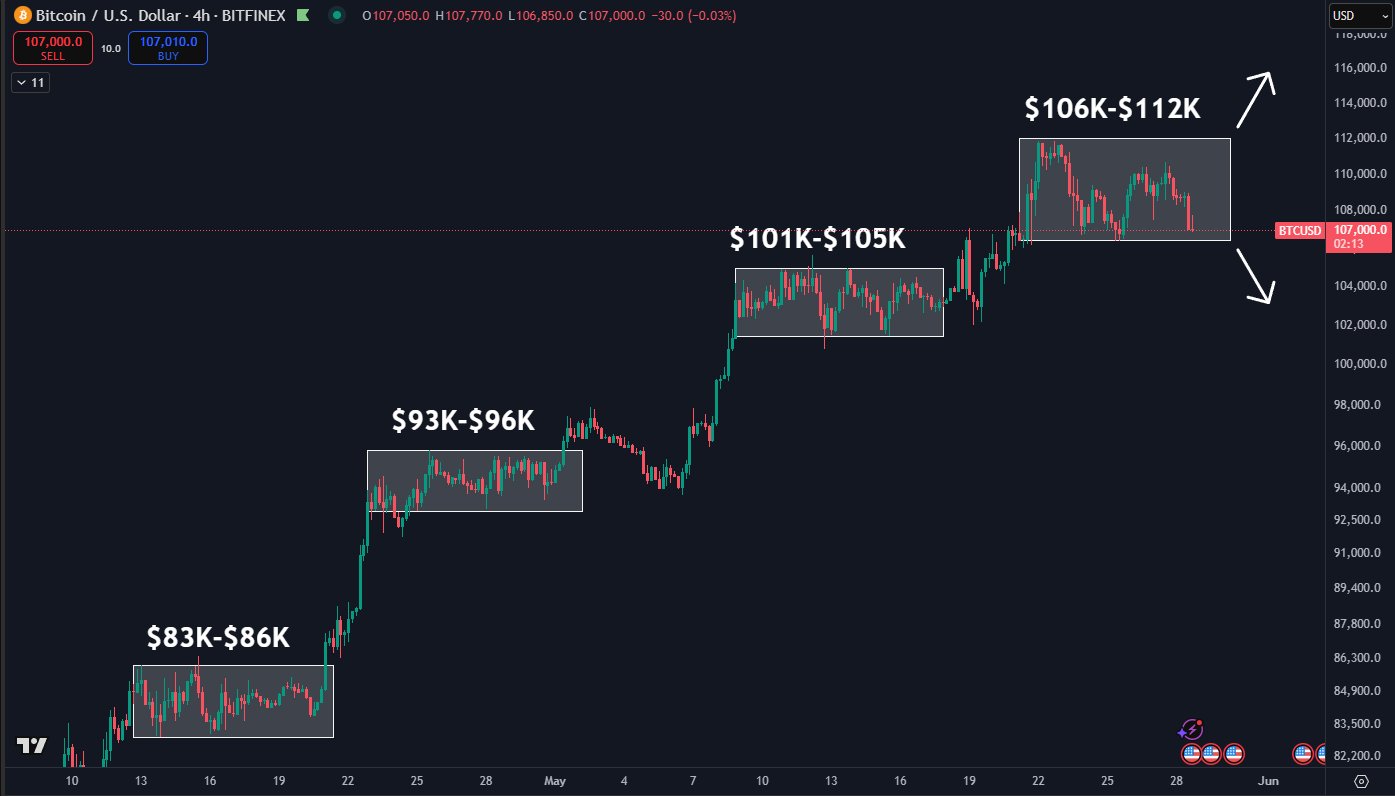

After the Crypto Bull Market began in April, Bitcoin showed a specific price pattern marked by the estimated $ 10,000 price soaring, and showed integration within a specific price range for about 7-10 days before another rally occurred.

As the new ATH, the most recent $ 111,970, the BTC price has settled on the range of $ 106,000 and $ 112,000 to prepare for another potential rise. However, according to a report that the US trade negotiations faced walls, the recent negative market response to factors, including macroeconomic pressure, forced the price to reduce the price below the integrated area to $ 103,867.

According to the DAAN CRYPTO of the X Post on May 30, Bitcoin Bulls must find a price range of more than $ 106,000 to set the intention to stop the current fall and maintain the current rise.

In particular, the potential rejection at this price level indicates that Bitcoin may have the highest market of $ 111,970, and that additional price modifications are required for several weeks. The potential for this weak development is especially high, especially considering that Bitcoin Spot ETF has registered a negative net inflow on May 29 and registered for the first time on the 10th.

Certain market analysts agreed to the potential of overwhelming weakness, which accurately expresses the price targets of about 100,000 to $ 102,000, and other market analysts believe that premium cryptocurrency can establish a major price conflict that matches the encryption market cycle.

Bitcoin price outline

At the time of writing, Bitcoin is traded at $ 103,539, which reflects 2.60%losses last day. On the other hand, the daily trading volume of assets decreases by 2.24%, indicating that sales pressure in the market is slightly reduced during the current decrease.

According to data from Sentora, a Blockchain analytics company, Bitcoin is now down, so the decrease of more than 1.2 million people is decreasing. However, there is strong evidence that if the price resumes the $ 100,000 area, it will support the market rebound.

PEXELS’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.