After a week, the price of Bitcoin seems to finally stabilize and build optimistic momentum. On Friday, March 14, the flagship Cryptocurrency showed the driving force by steadily climbing the chart and crossing the $ 85,000.

Interestingly, the BTC Open Interest (OI) has been moving in a similar direction to the last few days. As the open interest increases, the urgent questions that require a quick answer are -Bitcoin Bull goes on track?

The BTC Open Interest increases to $ 27.9 billion. What does it mean?

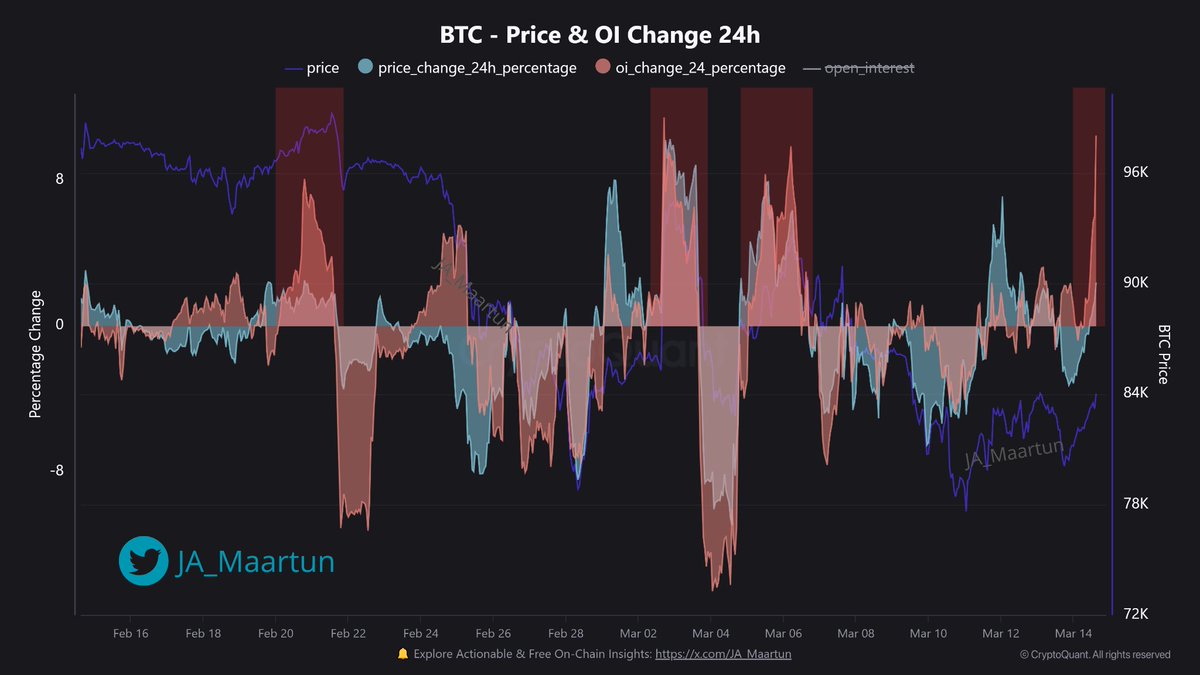

In a new post on the X platform, MAARTUNN’s pseudonym encryption community analyst revealed that Bitcoin’s public interest is increasing. Due to the context and public interest metric traces the total amount poured into BTC derivatives at a given time.

According to Cryptoquant’s data, Bitcoin OI has risen to $ 27.9 billion, witnessing a notable rise on Friday. MAARTUNN mentioned that this important movement has shown more than 13% of jumps (more than $ 3.3 billion) at the most recent lows.

Source: @JA_Maartun

In general, the increase in Bitcoin revealing interest suggests that investors are opening new positions in the futures and options markets. It means that investors are pouring money into BTC derivatives at the time. On the contrary, the drop in OI value indicates that derivatives are leaving their position or being liquidated in the market.

Greater open interest can be a healthy optimistic sign of Pryptocurrency. Especially if historical priorities pass. When fresh capital flows into the market, it suggests speculation of investors’ emotions (typically trust) or bitcoin price trajectory.

As more investors flood in the derivatives market and bet on the price of the BTC, open interest rising can increase volatility in the bitcoin market. As volatility increases, there is a signal that flagship cryptocurrency can soon experience large -scale price fluctuations.

What is the price of Bitcoin?

The price of the BTC seems to have been prepared for a big move due to a rise. The charter market engineer, Tony Severino, shared the market leader that the market leader could achieve about $ 95,000 over the next few days.

Source: @tonythebullBTCA cryptocurrency expert pointed out that the projection has been able to recover the 200 -day MAR because it depends on the price of Bitcoin. If the price of the BTC ends decisively over this MA, you can run to 50 days MA around the mid -90,000 dollars.

At the time of this article, Bitcoin’s price was about $ 84,500, up almost 5% over the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Chart of TradingView, the main image created by Dall-E

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.