The Bitcoin derivatives market remained active early Saturday morning, with Bitcoin hovering between $95,871 and $96,341 in the past hour as of 9 a.m. ET, as traders scrambled to change positions after Bitcoin spent a week below the six-digit threshold for the first time since June.

Futures traders reduce risk as options flow suggests continued volatility

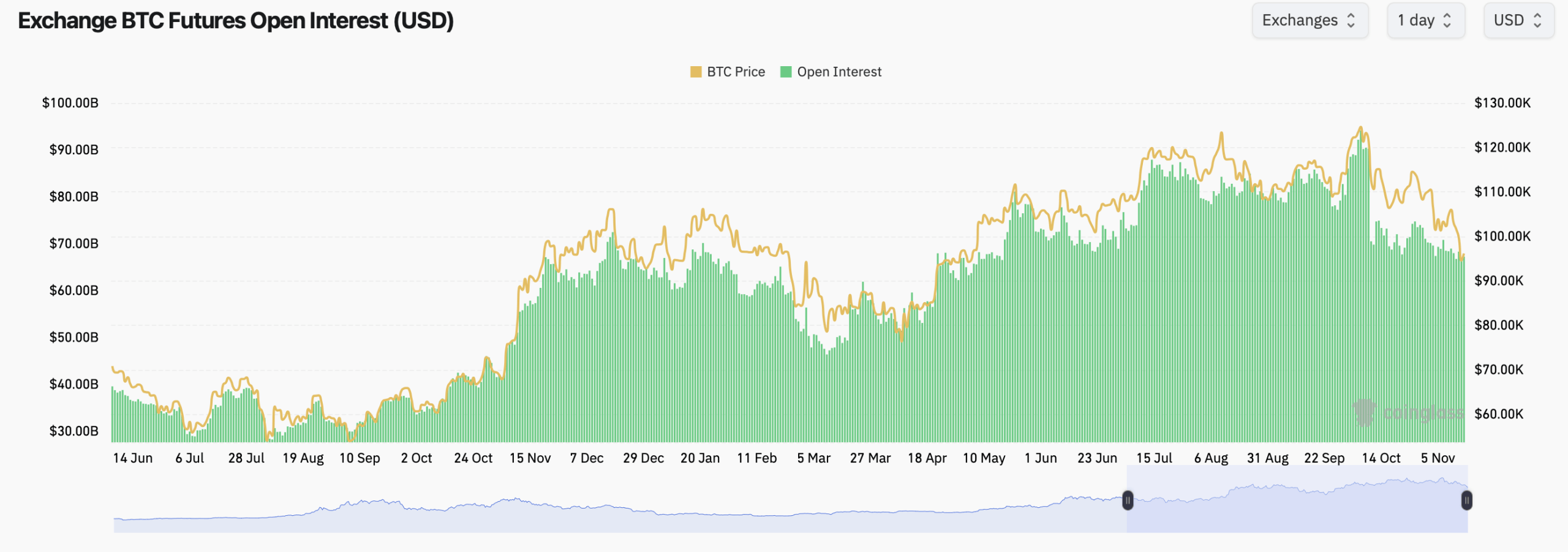

This pullback pushed Bitcoin’s weekly performance down by 5.6%, but today’s modest intraday gain of 1.4% kept sentiment from going into full doom mode. According to statistics from Coinglass.com, open interest (OI) across the futures market totaled 699,010 BTC, or $67.22 billion in value, cooling down from recent highs reflecting a combination of forced deleveraging and voluntary risk-off exits.

CME maintains an iron grip on the institutional investor crowd with a total OI of 143,170 BTC, equivalent to $13.76 billion and a commanding 20.47% share. Despite Bitcoin’s decline, CME posted a modest gain of 0.33% in the past hour and 0.91% in the 24-hour period, indicating that the big players seem to be nibbling rather than panicking.

Bitcoin Futures OI via Coinglass.com on November 15, 2025.

Binance follows closely with 134,130BTC with OI worth $12.89 billion, and its 5.20% daily increase suggests traders are more interested in rotating positions than heading for an exit. OKX, Bybit, Kucoin, and MEXC all added new open interest in the daily window, while Gate and BingX saw notable declines.

BingX in particular recorded an astonishing 10.67% drop in OI in one hour and 15.36% in 24 hours, showing how quickly leverage can evaporate when prices fall. The broader annual OI trend shows that Bitcoin futures are still at historically large levels despite the recent drawdown.

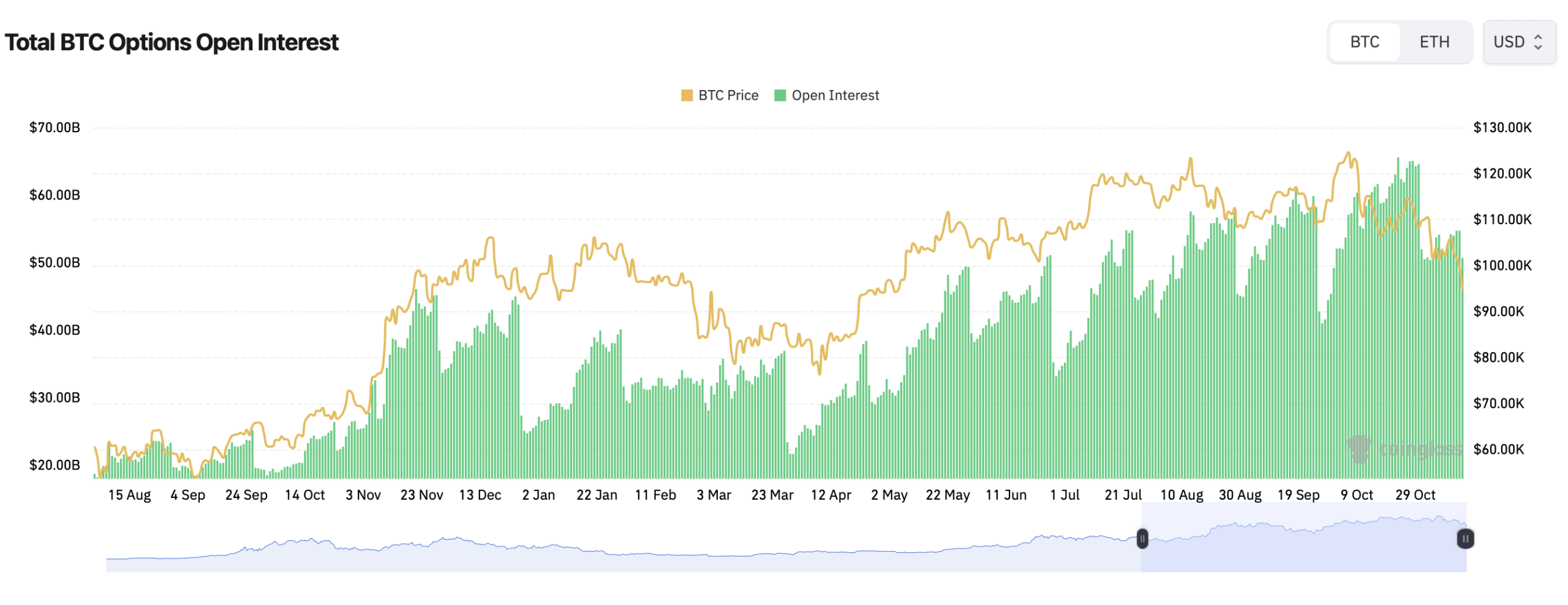

Markets often reflect a past cleansing phase that preceded a sharp pullback, or a deeper correction phase, depending on which side you ask. The options market is playing out quite differently this weekend, with a much more optimistic outlook. Calls accounted for the majority of the open interest with 279,653 BTC (60.24% of the total), overwhelming the put OI with 184,559 BTC.

November 15, 2025, Bitcoin Options OI via coinglass.com.

In the past 24 hours, call volume was 23,214 BTC and put volume was 18,217 BTC. This confirms that traders continue to lean toward upside exposure even though the price is testing the mid-$90,000 area. Deribit’s main contracts center on $85,000 puts and $140,000 to $200,000 calls, reflecting both protective hedging and long-term bullish speculation. The November 28, 2025 expiration date has sparked meaningful action, especially with the $90,000 strike, and traders appear to be wary of further declines.

Also read: Bitcoin Price Monitoring: Bottom or Breather? The Importance of Charts

Under market indecision, maximum pain levels were underlined in neon at several major venues. For Deribit, the maximum pain zone is roughly between $100,000 and $105,000, leading to a monster notional ballooning around the December 26, 2025 expiry. Binance’s maximum pain curve has gotten even hotter, approaching the $110,000 to $150,000 range thanks to more aggressive upside expectations dominating the books.

OKX’s max pain stats are close to the spot, with max pain in the $97,000 to $105,000 range. Together, these paint a picture of a market that wants to keep Bitcoin locked in a narrow range, which is a bit of a frustrating development for both breakout chasers and breakout chasers. Despite this week’s bumps, the call’s continued dominance suggests that traders aren’t ready to abandon the narrative of a massive fourth-quarter rally.

While futures markets may be reducing risk, options markets continue to exude a confident tone, with traders still leaning toward strength over prolonged weakness this year, even as they anticipate volatility. With the maximum pain levels concentrated around the current price, Bitcoin is likely to remain in this narrow range until an external catalyst forces the next decisive move. For now, derivatives traders are keeping an eye on the upside and bracing for the fallout in case Bitcoin goes against the mood again.

Frequently asked questions ❓

- What is the total Bitcoin futures open interest today? Open interest in Bitcoin futures stands at approximately $67.22 billion across major exchanges.

- Are traders leaning toward calls or puts in the Bitcoin options market?Calls account for about 60% of open interest, indicating a bullish trend.

- Where are the maximum pain levels for Bitcoin options concentrated?Maximum pain is approximately between $95,000 and $105,000, depending on the exchange.

- • Which exchanges are leading Bitcoin derivatives activity?CME, Binance, OKX, Bybit, and Deribit dominate futures and options flows today.